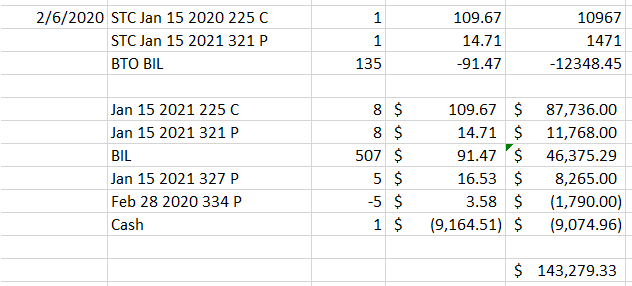

This is how the Anchor portfolio looked like on Feb.6 2020, two weeks before the start of the decline:

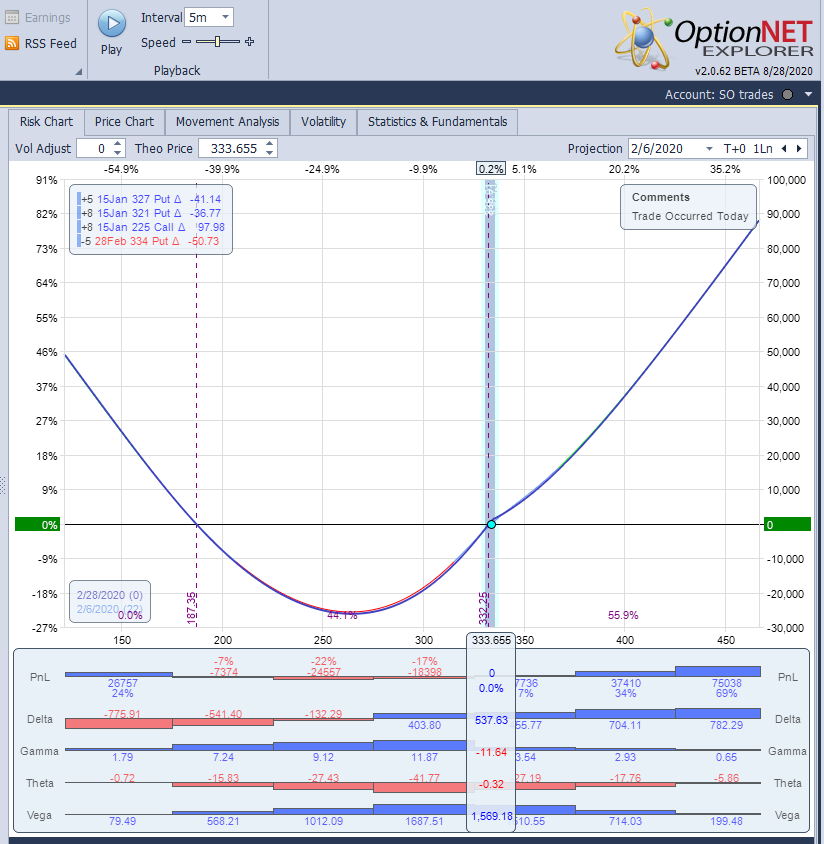

SPY was at 334, total portfolio value around $143k. This is how the P/L chart looked like:

With 8 SPY contracts, this translates to x1.85 leverage. This setup obviously should perform very well on the upside (the portfolio should easily outperform SPY on any upside move), but the downside doesn't look that great on this P/L chart.

Lets see how things developed.

Feb.28 2020, SPY at 290 (down 13%), Anchor down $15k (~10%):

With SPY down 13%, the Anchor portfolio was down only 10%. This is normal and expected. The strategy is not designed to provide a total protection, especially in smaller declines.

It is worth mentioning that the puts are typically 5% OTM when opened. It’s entirely possible for Anchor to be up 7%, then the market drops, and we end up down 12% peak to trough (or even a bit more). The Downside of Anchor discusses it in more details.

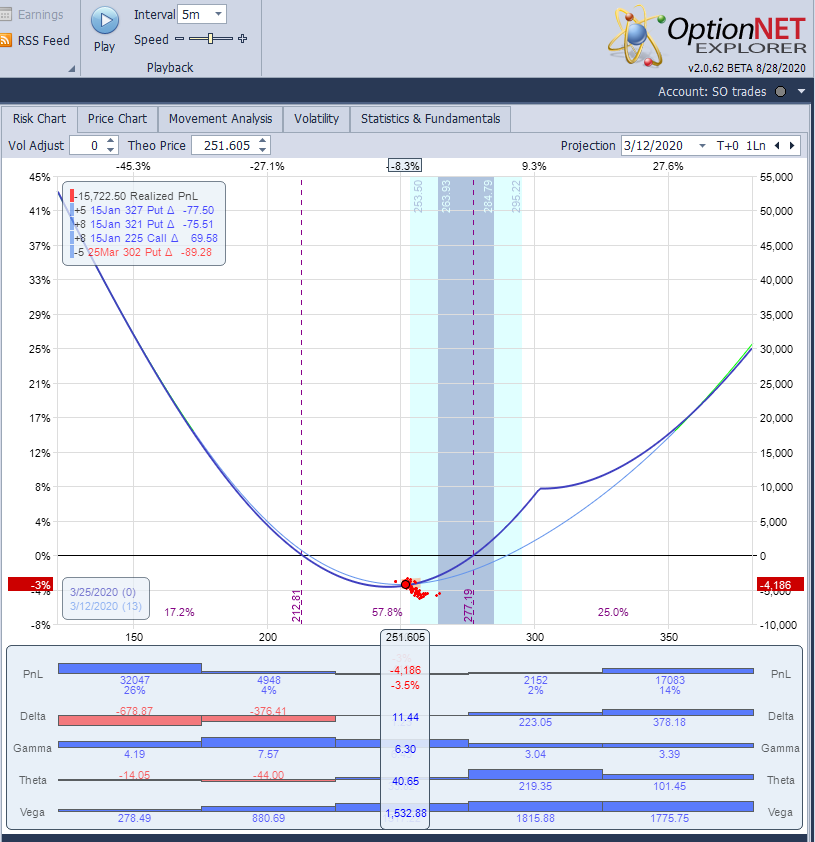

Two weeks later, March 12, SPY at 251 (down 25%), Anchor down only $4k (~3%):

Now you can see how the protection kicks in after a bigger decline.

Fast forward to March 19 2020, SPY at 234 (down 30%), Anchor UP $5k (~3%):

Now, this is pretty amazing. How this was possible?

Few factors contributed to this major outperformance:

-

We used deep ITM calls instead of the stock. As the underlying declines, the delta of the calls decreases and they lose less value. In this case SPY declined $100, while the calls declined only $68.

-

We have more long puts than short puts, so the gains of the long puts far outpace the losses of the short puts.

- During market crashes, IV jumps to the roof (in this case, VIX jumped from 16 to 80+). This caused the long puts to increase in value much more than expected. In addition, we got much more premium from the short puts when rolling.

The bottom line: in the last 30 months, the strategy produced 36.6% CAGR, significantly outperforming the S&P 500, but at the same time provided a full protection during the market crash. To me, this is as close as it gets to the holly grail of investing.

Related articles

- Leveraged Anchor 2020 Year In Review

- Anchor Trades Portfolio Launched

- Defining The Anchor Strategy

- Market Thoughts And Anchor Update

- Leveraged Anchor Is Boosting Performance

- Anchor Trades Strategy Performance

- Revisiting Anchor (Thanks To ORATS Wheel)

- Revisiting Anchor Part 2

- Leveraged Anchor Update

- Leveraged Anchor Implementation

- A More Diversified Anchor Strategy

- Anchor Maximum Drawdown Analysis

- Why Doesn't Anchor Roll The Long Calls?

- The Downside of Anchor

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now