In this article, I will try to help you understand Options Greeks and use them to your advantage.

The Basics

First, a quick reminder for those less familiar with the Options Greeks.

The Delta is the rate of change of the price of the option with respect to its underlying price. The delta of an option ranges in value from 0 to 1 for calls (0 to -1 for puts) and reflects the increase or decrease in the price of the option in response to a 1 point movement of the underlying asset price. In dollar terms, the delta is from $0 to +$100 for calls ($0 to -$100 for puts).

Delta can be viewed as a percentage probability an option will wind up in-the-money at expiration. Therefore, an at-the-money option would have a .50 Delta or 50% chance of being in-the-money at expiration. Deep-in-the-money options will have a much larger Delta or much higher probability of expiring in-the-money.

The Theta is a measurement of the option's time decay. The theta measures the rate at which options lose their value, specifically the time value, as the expiration draws nearer. Generally expressed as a negative number, the theta of an option reflects the amount by which the option's value will decrease every day. When you buy options, the theta is your enemy. When you sell them, the theta is your friend.

Option sellers use theta to their advantage, collecting time decay every day. The same is true of credit spreads, which are really selling strategies. Calendar spreads involve buying a longer-dated option and selling a nearer-dated option, taking advantage of the fact that options expire faster as they approach expiration.

The Vega is a measure of the impact of changes in the Implied Volatility on the option price. Specifically, the vega of an option expresses the change in the price of the option for every 1% change in the Implied Volatility. Options tend to be more expensive when volatility is higher. When you buy options, the vega is your friend. When you sell them, the vega is your enemy.

Short premium positions like Iron Condors or Butterflies will be negatively impacted by an increase in implied volatility, which generally occurs with downside market moves. When entering Iron Condors or Butterflies, it makes sense to start with a slightly short delta bias. If the market stays flat or goes up, the short premium will come in and our position benefits. However, if the market goes down, the short vega position will go against us - this is where the short delta hedge will help.

The Gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price. When you buy options, the gamma is your friend. When you sell them, the gamma is your enemy.

Selling options with close expiration will give you higher positive theta per day but higher negative gamma. That means that a sharp move of the underlying will cause much higher loss. So if the underlying doesn't move, then theta will kick off and you will just earn money with every passing day. But if it does move, the loss will become very large very quickly. You should never ignore negative gamma.

Example

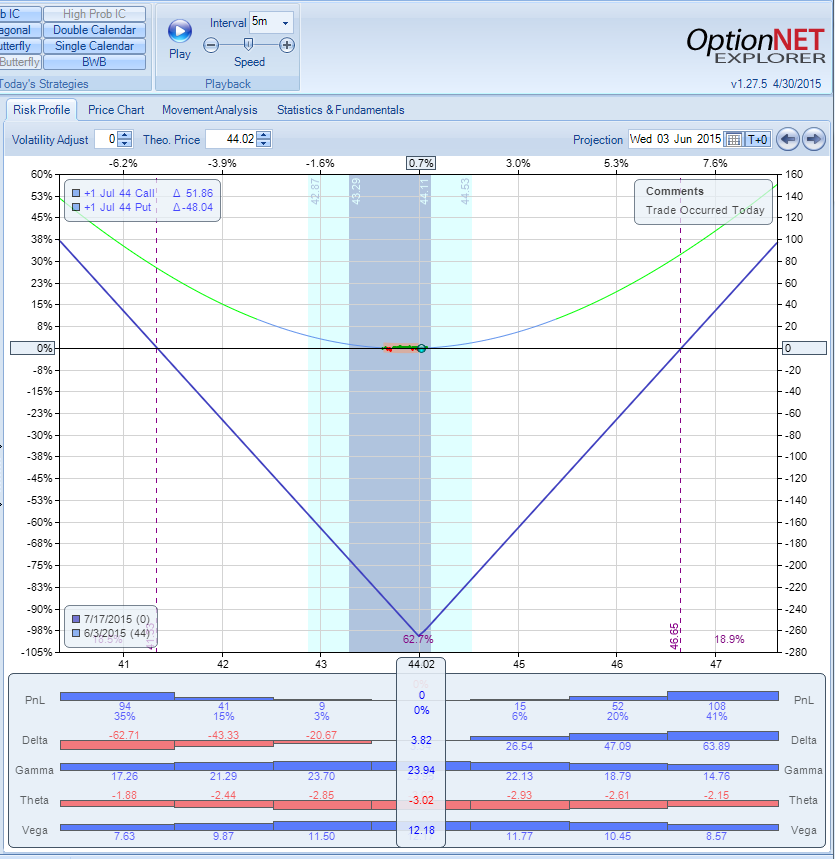

Lets analyze the Greeks using one of our recent trades as an example:

Buy to open 4 ORCL July 17 2015 44 put

Buy to open 4 ORCL July 17 2015 44 call

Price: $2.66 debit

This trade is called a straddle option strategy. It is a neutral strategy in options trading that involves the simultaneously buying of a put and a call on the same underlying, strike and expiration. A straddle is vega positive, gamma positive and theta negative trade. That means that all other factors equal, the straddle will lose money every day due to the time decay, and the loss will accelerate as we get closer to expiration.

With the stock sitting at $44, the trade is almost delta neutral. Lets see how other Greeks impact this trade.

The theta is your worst enemy as we get closer to expiration. This trade had 44 days to expiration, so the negative theta is relatively small ($3 or 1% of the straddle price). As we get closer to expiration, the negative theta becomes larger and the impact on the trade is more severe.

The gamma is your best friend as we get closer to expiration. That means that the stock move will benefit the trade more as time passes.

The vega is your friend. If you buy options when IV is low and it goes higher, the trade starts making money even if the stock doesn't move. This is the thesis behind our pre-earnings straddles.

Make them Work For You

If you expect a big move, go with closer expiration. But if the move doesn't materialize, you will start losing money much faster, unless the IV starts to rise. It basically becomes a "theta against gamma" fight. When you expect an increase in IV (before earnings for example), it's a "theta against vega" fight, and the large gamma is the added bonus.

When you are net "short" options, the opposite is true. For example, Iron Condor is a vega negative and theta positive trade. That means that it benefits from the decline in Implied Volatility (IV) and the time decay. If you initiate the trade when IV is high and IV is declining during the life of the trade, the trade wins twice: from the declining IV and the time passage.

However, it is also gamma negative and the gamma accelerates as we get closer to expiration. This is the reason why I don't like holding the Iron Condor trades till expiration. Any big move of the underlying will cause big losses due to a large negative gamma.

The gamma risk is often overlooked by many Condor traders. Many traders initiate the Iron Condor trades only 3-4 weeks before expiration to take advantage of a large and accelerating positive theta. They hold those trades till expiration, completely ignoring the large negative gamma and are very surprised when a big move accelerates the losses. Don't make that mistake.

One possible strategy is to combine vega positive and theta positive trades with vega positive and theta negative ones. This is what we do at SteadyOptions. A Calendar spread is an example of vega positive theta positive trade. When combined with a straddle trades which are vega positive theta negative, a balance portfolio can be created.

Conclusion: when you trade options, use the Greek option trading strategies to your advantage. When they fight, you should win. Like in a real life, always know who is your friend and who is your enemy.

The following videos will help you understand options Greeks:

Related articles:

- Options Trading Greeks: Theta For Time Decay

- Options Trading Greeks: Delta For Direction

- Options Trading Greeks: Gamma For Speed

- Options Trading Greeks: Vega For Volatility

We invite you to join us and learn how we trade our Greek options trading strategies. We discuss all our trades including the Greeks on our options trading forum.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now