Here is how their methodology works:

In theory, if you knew exactly what price a stock would be immediately before earnings, you could purchase the corresponding straddle a number of days beforehand. To test this, we looked at the past 4 earnings cycles in 5 different stocks. We recorded the closing price of each stock immediately before the earnings announcement. We then went back 14 days and purchased the straddle using the strikes recorded on the close prior to earnings. We closed those positions immediately before earnings were to be reported.

Study Parameters:

- TSLA, LNKD, NFLX, AAPL, GOOG

- Past 4 earnings cycles

- 14 days prior to earnings - purchased future ATM straddle

- Sold positions on the close before earnings

The results:

Future ATM straddle produced average ROC of -19%.

As an example:

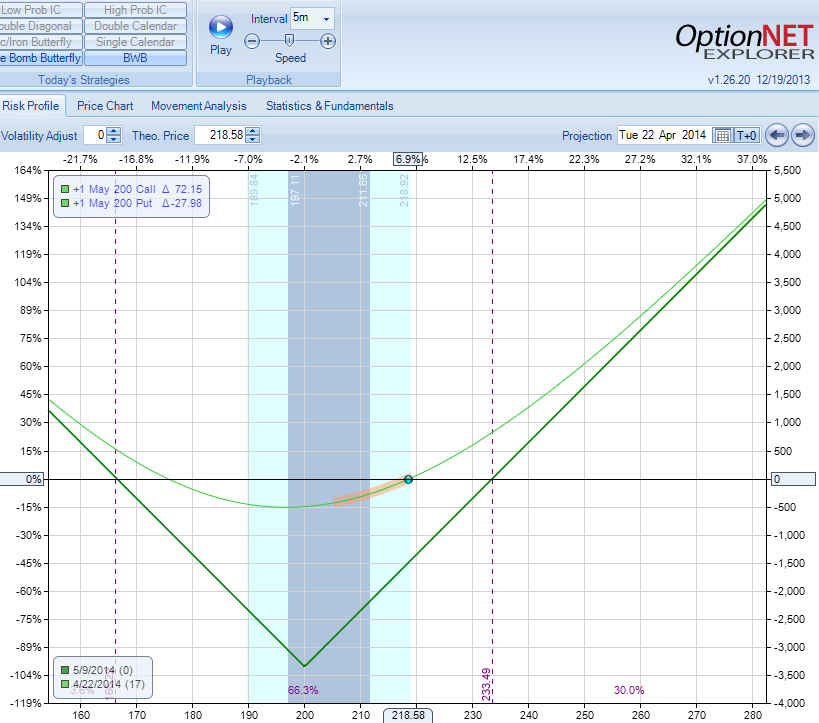

In the previous cycle, TSLA was trading around $219 two weeks before earnings. The stock closed around $201 a day before earnings. According to tastytrade methodology, they would buy the 200 straddle 2 weeks before earnings. They claim that this is the best case scenario for buying pre-earnings straddles.

My Rebuttal

Wait a minute.. This is a straddle, not a calendar. For a calendar, the stock has to trade as close to the strike as possible to realize the maximum gain. For a straddle, it's exactly the opposite:

When you buy a straddle, you want the stock to move away from your strike, not towards the strike. You LOSE the maximum amount of money if the stock moves to the strike.

In case of TSLA, if you wanted to trade pre-earnings straddle 2 weeks before earnings when the stock was at $219, you would purchase the 220 straddle, not 200 straddle. If you do that, you start delta neutral and have some gamma gains when the stock moves to $200. But if you start with 200 straddle, your initial setup is delta positive, while you know that the stock will move against you.

It still does not guarantee that the straddle will be profitable. You need to select the best timing (usually 5-7 days, not 14 days) and select the stocks carefully (some stocks are better candidates than others). But using tastytrade methodology would GUARANTEE that the strategy will lose money 90% of the time. It almost feels like they deliberately used those parameters to reach the conclusion they wanted.

As a side note, the five stocks they selected for the study are among the worst possible candidates for this strategy. It almost feels like they selected the worst possible parameters in terms of strike, timing and stocks, in order to reach the conclusion they wanted to reach.

At SteadyOptions, buying pre-earnings straddles is one of our key strategies. It works very well for us. Check out our performance page for full results. As you can see from our results, "Buying Premium Prior To Earnings" is still alive and kicking. Not exactly "Nail In The Coffin".

Comment: the segment has been removed from tastytrade website, which shows that they realized how absurd it was. We linked to the YouTube video which is still there.

Of course the devil is in the details. There are many moving parts to this strategy:

- When to enter?

- Which stocks to use?

- How to manage the position?

- When to take profits?

And much more. But overall, this strategy has been working very well for us. If you want to learn more how to use it (and many other profitable strategies):

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

Related Articles:

How We Trade Straddle Option Strategy

Can We Profit From Volatility Expansion into Earnings

Long Straddle: A Guaranteed Win?

Why We Sell Our Straddles Before Earnings

Long Straddle: A Guaranteed Win?

How We Made 23% On QIHU Straddle In 4 Hours

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now