Best options trading service

Why Options Traders Join

- 12 Years CAGR of 122.7%

- Comprehensive Trading Plan

- Backtested Strategies

- Excellent Value For Money

- The Most Active Trading Forum

- Honesty, Integrity, Transparency

- Best Options Analysis

- Valuable and Helpful Community

Become a Better Trader!

You want to learn to trade options? No matter your experience level, we can help you to become a better trader.

We are an options trading service that uses diversified options trading strategies for steady and consistent gains.

You will have access to exclusive forum with hundreds of experienced traders.

We provide a comprehensive trading plan and teach members how to make money in any market.

Learn more

What We Offer

- Real (not Hypothetical) Trades

- Best Options Education

- Risk Management

- Implied Volatility Trading

- Actionable Trade Ideas

- Steady and Consistent Gains

- Complete Portfolio Approach

- Non correlated trading strategies

Is Our Options Trading Service For You?

SteadyOptions is a trading ideas generator rather than an option alert service. If you are using it as a pure trading alert service, you are not taking advantage of all the wealth of knowledge and research we offer to our members.

We provide options traders the best research and analysis using the best options tools.

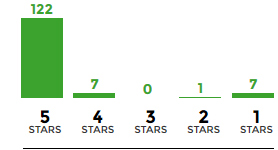

highest rated options trading service

Investimonials

Honest Reviews of All Things Financial

Avg. Rating

Avg. Rating

Views

Views Reviews

Reviews- 143

Six Unique Options Strategies

Steady Options

Anchor Trades

Simple Spreads

Steady Collars

SteadyVol

SteadyYields

Recent Articles

Articles

-

- 0 comments

- 1,043 views

-

- Added by Mark Wolfinger

-

- 0 comments

- 1,424 views

-

- Added by Kim

-

- 0 comments

- 1,707 views

-

- Added by Yowster

-

- 0 comments

- 913 views

-

- Added by TrustyJules

-

- 0 comments

- 1,932 views

-

- Added by TrustyJules

-

- 0 comments

- 6,441 views

-

- Added by Kim

-

- 0 comments

- 9,999 views

-

- Added by Chris Young

-

- 0 comments

- 11,627 views

-

- Added by Chris Young

-

- 0 comments

- 12,062 views

-

- Added by Chris Young

-

- 0 comments

- 10,104 views

-

- Added by Kim