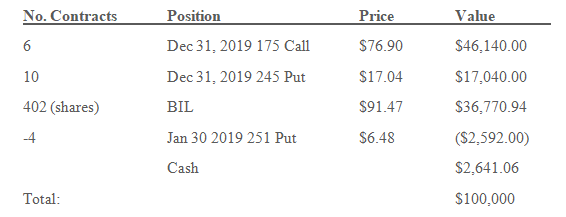

The new tracking account was opened on January 2, 2019 when SPY was right at $249.00 with a balance of $100,000. In the tracking account, trading commissions were ignored. The initial portfolio looked like:

Six contracts of the 175 calls gave us control over $105,000 of SPY, and we held $36,000 of BIL. This gave us about 140% leverage on the account, a moderate amount, but enough that we should not lag when the market increased.

I have a couple of comments on our initial portfolio. First, our initial hedge was only 1.6% out of the money. During the year we changed that to 5%, allowing for a loss in the event of a small market decline but trading it off for a higher upside. Second, during the year we also “split” the hedge of the short puts and the long portfolio. The short put hedge stayed at the money, as one of the bigger risks to the portfolio is a large spread between the short put that is sold during the week and the actual put hedging it.

For instance, in the above portfolio there is more than $6.00 of downside risk between the short put and its hedge. (It is more than six dollars due to the delta of the hedge compared to the delta of the short position – in other words, the short position is more sensitive to down movements than the long hedge). To offset this risk, we kept the portion of the hedge against the short puts higher.

Almost immediately after opening the position and continuing throughout the year, the market took off upwards, moving over 2.5% up in the first week alone. In fact, the market moved up so quickly, we ended up having to roll the long hedge after the first month, rolling to the January 20 258 Puts when SPY hit 270. It was at this roll that we adopted the five percent out of the money hedge.

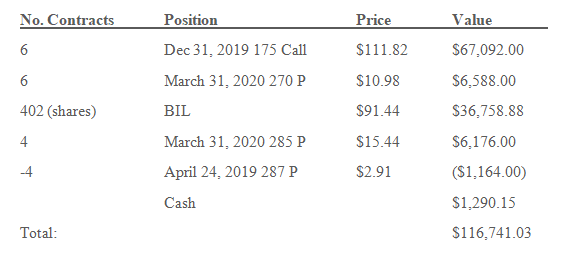

The market kept moving up, resulting in us having to roll the long hedge again on April 2, 2019 when SPY hit 285. At this point we “split” the hedge and our portfolio looked like:

With SPY trading at 285, the six contracts at five percent out of the money, hedging the actual long portion of the portfolio were purchased at a strike of 270. The four contracts hedging the short puts that are sold to generate income were purchased at a strike of 285 – the then current value of SPY.

The market did not stop its rise, leading to another roll of the hedge on November 1, 2019. That makes three rolls up of the long hedge during one calendar year – a record number for Anchor and one that we would expect to act as a drag on the account. However, due to the leverage employed, any drag was minimal.

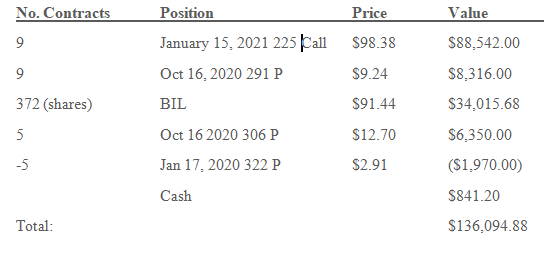

December 30, 2019 came around, necessitating a roll of the long call position. Due to portfolio gains, the strategy also had to purchase some additional long puts to continue to hedge the entire position. After this roll, with SPY at $320.74, the portfolio looked like:

Over the full year, SPY went from $249.00 to $320.74, a gain of 28.8% (31.2% including dividends). Over that same period, Leveraged Anchor increased from $100,000 to $136,094.88 – a gain of 36.1%. The final number for 2019 is 38.4% gain. In other words, the strategy outperformed the S&P 500 by 7.2%. Individual accounts will be less, as there are trading costs and commissions, but even if an individual trader’s commissions ran two percent (an extremely high number), performance is still superb.

In reviewing the strategy, several points emerge:

-

Adding forty percent of leverage resulted in outperforming the market by twenty five percent. This means the three rolls of the hedge during the year bled the account by about fifteen percent, which is to be expected. Another way of looking at this is, had we not been hedged, the performance would be higher, but if a trader did that, the trader would be significantly increasing risk;

-

Given the outperformance, it may be worth rolling the hedge more frequently to reduce risks from downturns;

-

Given the outperformance, it may be worth rolling the hedge of the short puts more frequently to reduce the risk from small short term pull backs and whipsawing; and

- For large accounts, diversifying into other instruments on other market indexes (small caps and international) should be explored.

Thoughts and opinions on rolling the hedge more frequently, or on any other concerns or ideas for the strategy are always appreciated, as we are always looking to improve the strategy further.

Thanks everyone for a great year, and let’s hope next year performs just as well.

Christopher Welsh is a licensed investment advisor and president of LorintineCapital, LP. He provides investment advice to clients all over the United States and around the world. Christopher has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™. Working with a CFP® professional represents the highest standard of financial planning advice. Christopher has a J.D. from the SMU Dedman School of Law, a Bachelor of Science in Computer Science, and a Bachelor of Science in Economics. Christopher is a regular contributor to the Steady Options Anchor Trades and Lorintine CapitalBlog.

Related articles:

- Anchor Trades Portfolio Launched

- Defining The Anchor Strategy

- Market Thoughts And Anchor Update

- Leveraged Anchor Is Boosting Performance

- Anchor Trades Strategy Performance

- Revisiting Anchor (Thanks To ORATS Wheel)

- Revisiting Anchor Part 2

- Leveraged Anchor Update

- Leveraged Anchor Implementation

- Leveraged Anchor: A Three Month Review

- Anchor Maximum Drawdown Analysis

- Why Doesn't Anchor Roll The Long Calls?

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.