IWM performed the worse, followed by EFA. This is in contrast to the prior year when SPY was not the best performing and "Regular" Anchor lagged Diversified. In any given year, if SPY is the best performing index, Regular Anchor will perform better than Diversified. Given that I'm pretty bad at picking which index will do best each year, I prefer the Diversified approach.

All four indexes performed exactly as expected given the market conditions -- but that does not mean we're satisfied with the results obtained. IWM in particular had a "bad" year, which means we've spent quite some time digging into the results.

For several years now, I've said the worst possible outcome for Anchor is a small drawdown (0%-7.5% or so) right after opening the position, then trading in a sawtooth pattern on the year, followed by finishing almost exactly 5% down from the opening of the positions.

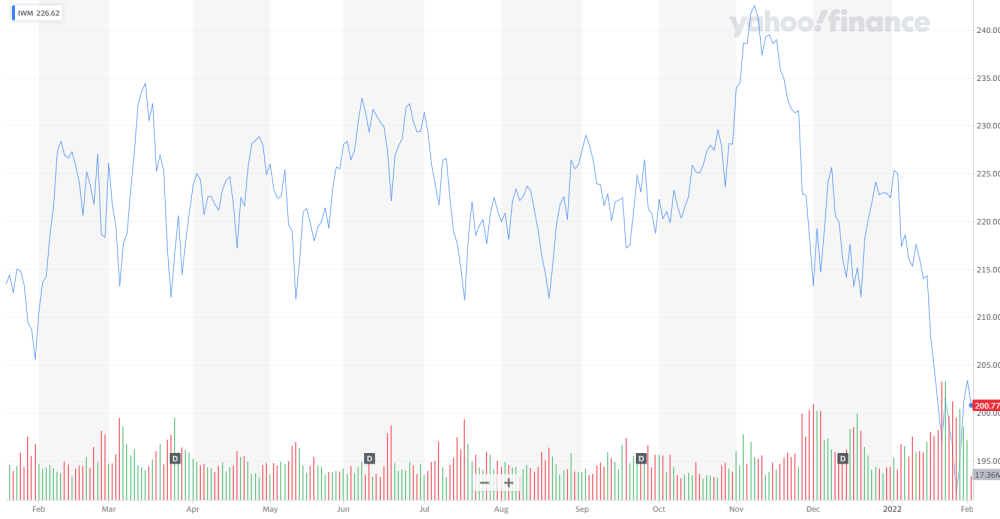

IWM Chart:

We rolled (and or many new members entered) IWM in March, when IWM was in the 225-230 range. Immediately thereafter it dropped to the 210-215 range and stayed there almost all year. This has the effect of us rolling the shorts on the diagonals for essentially zero credits almost all year, which means the hedge does not get paid for. If the hedge costs 8% and we start the hedge at 5% out of the money, there's a theoretical loss of 13% (or even a bit more) depending on if there were small losses here and there on the diagonal, if we paid a bit more for the hedge, on volatility, and a few other factors.

If the drop in December had been bigger (15%-20%), our hedge would have kicked into full gear, as it was, delta didn't get above 70.

In other words, we got, virtually "perfectly," the worst case scenario on IWM. So the question becomes, "how do we improve?"

For the last six months, I've been trading the same strategy on BTC, which has similar volatilities to IWM (at least in the last year), and we ran into the exact same problem with the diagonal paying for things. We learned, through live experience and testing, that on higher volatility instruments you need to roll the diagonal down much more frequently then you roll down to increase your calls (as happens in crashes).

This is not a "magic bullet" if the market drops 3%-4% and stays there for several months, when do we roll down? But it should help.

Other members have suggested implementing an iron condor/vertical spread trade on top of the long positions, particularly in the higher volatility instruments such as IWM. I have extensively tested this, it is a losing strategy over time, particularly if you do at a 1:1 ratio (e.g. if you are long 2 calls doing 2 vertical spreads). This is because sooner or later you WILL miss out on a big move up or down -- which is where Anchor really shines. Sure, particularly on IWM, a wide vertical spread or iron condor will win 90% of the time. But making $1.00 90% of the time and missing out on $50 the other 10% of the time doesn't make much sense long term.

If you have good "feelings" about the market (I'll reserve my opinions on that), and you think its going to stay flat, trend down, or whatever, and believe your momentum/fundamental analysis, you certainly can implement the strategy -- but if you do, I wouldn't go above a 2:1 ratio -- of course it's each investor's own call.

In other announcements, Soteria Fund officially started trading in October. We had to rename Anchor to Soteria, as opposed to getting into a trademark fight (me as a lawyer and another IP lawyer thought we could win the lawsuit, but it seems dumb to get into a lawsuit over a name for the launch of a fund - investors tend to run from that type of thing). The Soteria Fund is open to US and non-US investors, but such investors do have to be qualified clients (net worth over $2.1m). If you have questions about the fund, would like to join, or know someone who might, it is open and I'm happy to discuss it.

Other than the above, we're quite happy with Anchor and look forward to another great year. Feel free to post questions, comments, criticisms, or concerns.

*Yes, I'm still working on updating the FAQ.

Related articles:

- Anchor Trades Portfolio Launched

- Defining The Anchor Strategy

- Leveraged Anchor Is Boosting Performance

- Leveraged Anchor Update

- Leveraged Anchor Implementation

- Leveraged Anchor: A Three Month Review

- Anchor Maximum Drawdown Analysis

- A More Diversified Anchor Strategy

- Anchor Analysis and Options

- Diversified Leveraged Anchor Performance

- The Downside Of Anchor

- Leveraged Anchor 2020 Year In Review

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.