It's time to take advantage of volatility. Fear, uncertainty, doubt, unclear news headlines -- these are all trade-able events, at anytime, without concern for earnings. Today we look at exactly what has worked. Across the board for several technology companies, and specifically today, we look at Alibaba (BABA). Please check your Trade Machine for AAPL, NVDA, and others. Now is our time.

Take well bounded risk, small, and direction-less, and let a tweet, a news headline, an Apple headline, a day of pessimism or a day of optimism, whatever -- move the market, as it has so often in this new volatility regime.

The Short-term Option Volatility Trade in Alibaba Group Holding

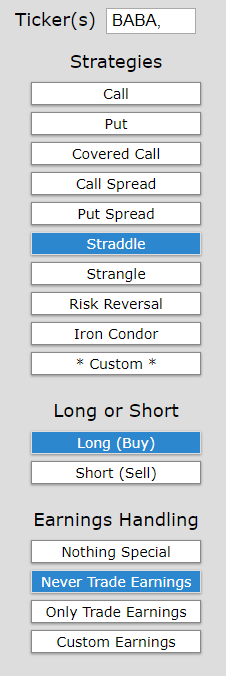

We will examine the outcome of going long a short-term at-the-money (50 delta) straddle, in options that are the closest to five-days from expiration. But we have a rule -- it's a stop and a limit of 10%, and, we back-test re-opening the position immediately, as opposed to waiting for 5-days later.

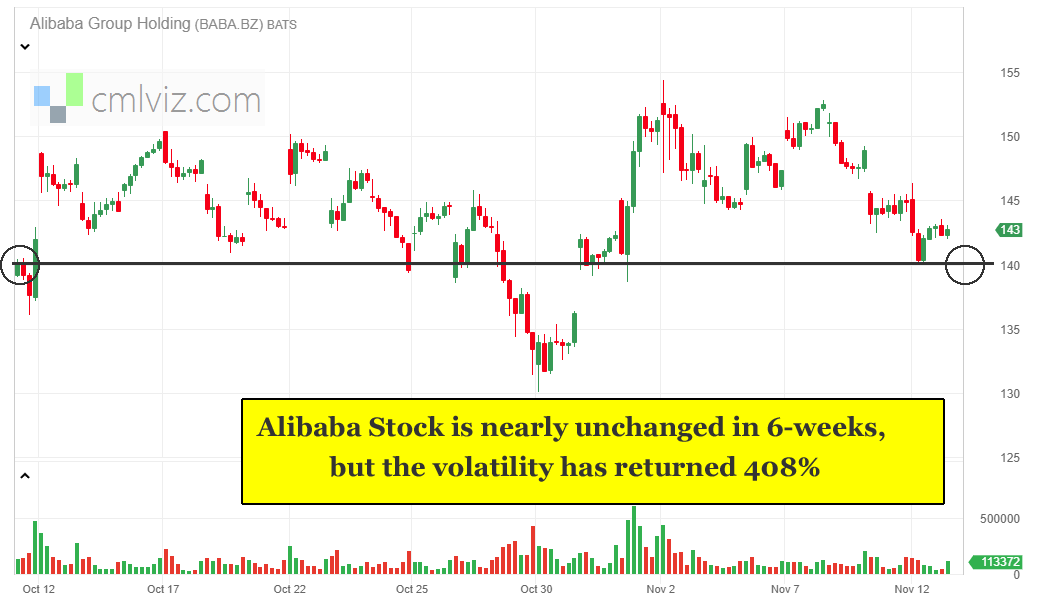

Here is the stock chart for Alibaba since October 1st -- focus on the volatility, not the direction -- these are daily candles.

So we see the wild gyrations -- let's not worry about direction, let's try to find a back-test that benefits from that volatility. Here it is, first, we enter the long straddle.

Second, we set a very specific type of stop and limit:

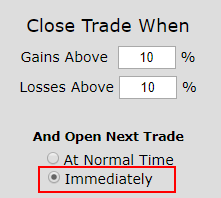

At the end of each day, the back-tester checks to see if the long straddle is up or down 10%. If it is, it closes the position, and re-opens at the same time, another long straddle, but this one now re-adjusted for what is the newest at-the-money strike price.

We have a full blown tutorial write up on this type of stop/limit behavior in the Discover Tab: Stops & Limits Roll Timing What does "open again at normal time" vs "immediately" mean?

The Results

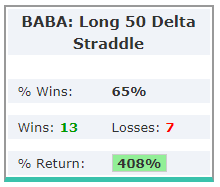

We back-tested this only over the last six-weeks. We are hyper focusing not on a long drawn out pattern, but rather this time, right now, this period of volatility.

The mechanics of the TradeMachine® are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that this has triggered a trade 20 times in the last six-weeks. This is a fast moving, re-adjusting straddle. The idea is simple:

Take well bounded risk, small, and direction-less, and let a tweet, a news headline, an Apple headline, a day of pessimism or a day of optimism, whatever -- move the market, as it has so often in this new volatility regime.

Setting Expectations

Since we use end of day open and closes, while this strategy has an overall return of 408%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 23.4%.

➡ The average percent return per winning trade was 49.2%.

➡ The percent return per losing trade was -24.6%.

Not only are we seeing a high winning percentage, but also that the average win is twice as large as the average loss. Further, this trade takes no stock direction risk at all.

WHAT HAPPENED

This is why you have a Trade Machine membership. We can ride the evergreen patterns, and we have, for years. But when the market shifts, we need a minimum amount of data to adjust, and succeed. This is how people profit from the option market.

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

Related articles:

- The Incredible Option Trade In VXX

- The Volatility Option Trade In Apple

- Earnings Momentum Trade In Oracle

- Post Earnings Option Trade In Facebook

- Option Trade After Earnings In AutoZone

- Pre-Earnings Momentum Trade In Netflix

- Microsoft Pre-Earnings Momentum Trade

- Post Earnings Trade In FedEx

- Pre Earnings Pattern In Apple

- Earnings Momentum Trading In Google

- PANW Broke The Golden Rule

- How To Profit From PayPal Volatility

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now