Couple of weeks ago, the CML published an article The Volatility Option Trade After Earnings in PayPal Holdings Inc.

The setup was:

"The week following PayPal Holdings Inc (NASDAQ:PYPL) has had one fairly consistent pattern -- volatility. If we take a myopic view after looking at the last three-years and focus on the last six-months, that pattern is yet more decisive. Irrespective of whether the earnings move was large or small, if we tested waiting one-day after earnings and then holding a long out of the money (40 delta) strangle for one-week (using two-week options), the results were quite strong. This trade opens one-day after earnings were announced to try to find a stock that moves a lot after the earnings announcement."

If we bought the out-of-the-money strangle in PayPal Holdings Inc (NASDAQ:PYPL) over the last three-years but only held it after earnings we get these results:

|

PYPL Long out-of-the-money strangle |

|||

| % Wins: | 64% | ||

| Wins: 7 | Losses: 4 | ||

| % Return: | 174% | ||

The backtest also defines very clear rules for the trade:

* Open the long out-of-the-money (40 delta) strangle one-calendar day after earnings.

* Close the strangle 7 calendar days after earnings.

* Use the options closest to 14 days from expiration (but more than 7 days).

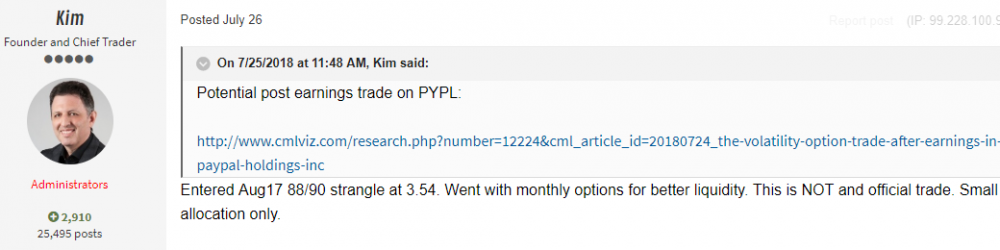

On July 25, I posted the link to the PYPL potential trade on the forum:

On the next day I posted my entry:

Please note that this trade didn't make it into the official model portfolio due to higher potential risk - hence I mentioned "small allocation only".

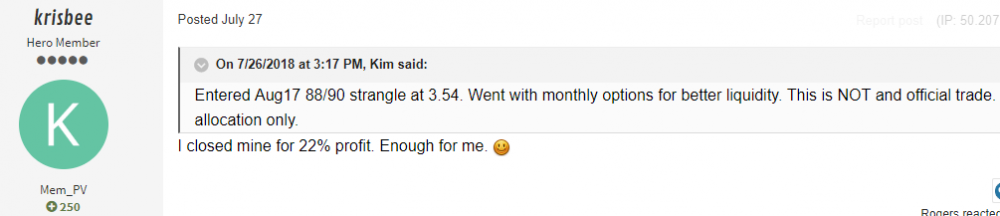

The next day, some of the members started posting their exit prices:

I was out a day later for 27% gain:

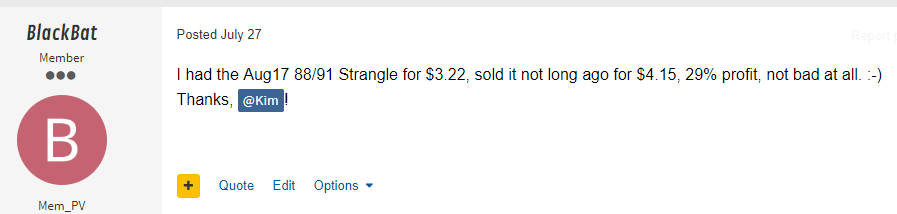

Some members did even better:

And finally an interesting comment from another member:

Those are real trades, from real traders, posted in real time.

Attention tastytrade: Buying premium does work - you just need to know how to do it.

This is how people profit from the option market. It's not guessing or speculation. Take a reasonable idea or hypothesis, use a rationale system to help overcome cognitive biases, and test it. Tap the link below to learn more:

Tap Here to See the Tools at Work

When you combine the best options trading community with the best backtester, the results are unbeatable.

Related articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now