.thumb.jpg.8b700cb7c2ed5bf77285e823b1303084.jpg)

IDEA

The idea is quite simple -- trying to take advantage of a pattern in short-term bullishness just before earnings, and then getting out of the way so no actual earnings risk is taken. Now we can see it in Oracle Corporation.

The Short-term Option Swing Trade Ahead of Earnings in Oracle Corporation

We will examine the outcome of going long a weekly call option in Oracle Corporation just three calendar days before earnings and selling the call the day of the actual news. Since Oracle reports earnings after the market closes, examining a pattern that goes right up to the close of that day still does not take earnings risk.

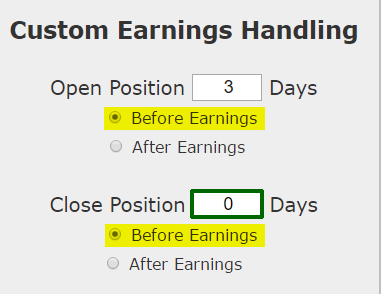

This is construct of the trade, noting that the short-term trade closes before earnings and therefore does not take a position on the earnings result.

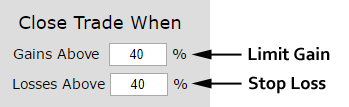

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

DISCOVERY

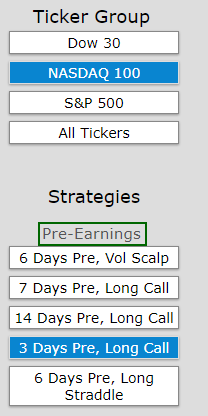

We found this pattern using the scanner in Trade Machine Pro. We looked at the NASDAQ 100 and then the 3-day pre-earnings long call scan:

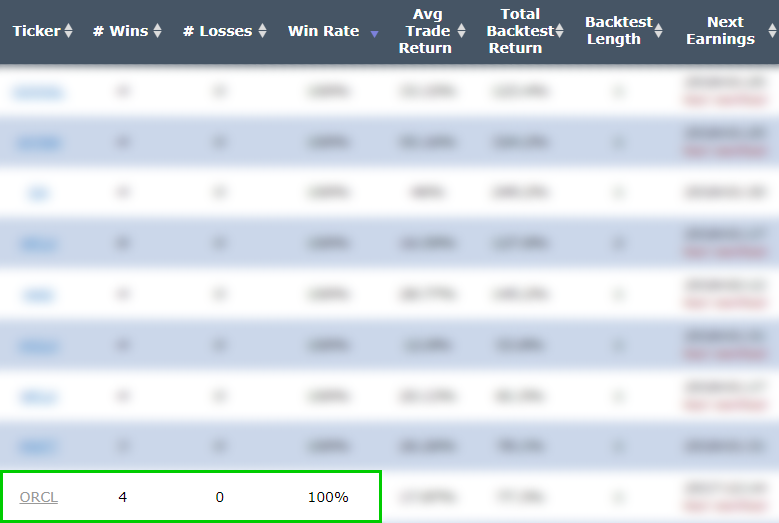

And here are the results:

There are only seven companies in the NASDAQ 100 that have seen this pattern win at least four times in a row, and Oracle is one of those.

RESULTS

Below we present the back-test stats over the last two-years in Oracle Corporation:

| ORCL: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 8 | Losses: 0 | ||

| % Return: | 290% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine™ are that it uses end of day prices for every back-test entry and exit (every trigger).

We see a 290% return, testing this over the last 8 earnings dates in Oracle Corporation. That's a total of just 32 days (4-day holding period for each earnings date, over 8 earnings dates).

The trade will lose sometimes, and since it is such a short-term position, it can lose from news that moves the whole market that has nothing to do with Oracle Corporation, but over the recent history, this bullish option trade has won ahead of earnings.

Setting Expectations

While this strategy has an overall return of 290%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 40.4% over just 4 trading days.

Looking at More Recent History

We did a multi-year back-test above, now we can look at just the last year:

| ORCL: Long 40 Delta Call | |||

| % Wins: | 100% | ||

| Wins: 4 | Losses: 0 | ||

| % Return: | 123% | ||

Tap Here to See the Back-test

We're now looking at 123% returns, on 4 winning trades and 0 losing trades.

➡ The average percent return over the last year per trade was 30% over just 4 trading days.

WHAT HAPPENED

Bull markets tend to create optimism, whether it's deserved or not. To see how to test this for any stock we welcome you to watch this quick demonstration video:

Tap Here to See the Tools at Work

Risk Disclosure

You should read the Characteristics and Risks of Standardized Options.

Past performance is not an indication of future results.

Trading futures and options involves the risk of loss. Please consider carefully whether futures or options are appropriate to your financial situation. Only risk capital should be used when trading futures or options. Investors could lose more than their initial investment.

Past results are not necessarily indicative of future results. The risk of loss in trading can be substantial, carefully consider the inherent risks of such an investment in light of your financial condition.

Please note that the executions and other statistics in this article are hypothetical, and do not reflect the impact, if any, of certain market factors such as liquidity and slippage.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now