There are many potential ways to manage a short put trade, so in this article I’ll share some backtested research to look at the differences between a few methodologies.

In SMPW, we benchmark our performance against an ETF that attempts to replicate a popular index, CBOE S&P 500 PutWrite Index (PUT). PUT uses a simple approach of selling front month S&P 500 puts and holding them until expiration. 33 years of historical data is available on CBOE’s website to see the results of this straightforward approach. I like to think of PUT as a broad measure of the “beta” of put writing, similar to an index like the Russell 2000 for US Small Cap stocks.

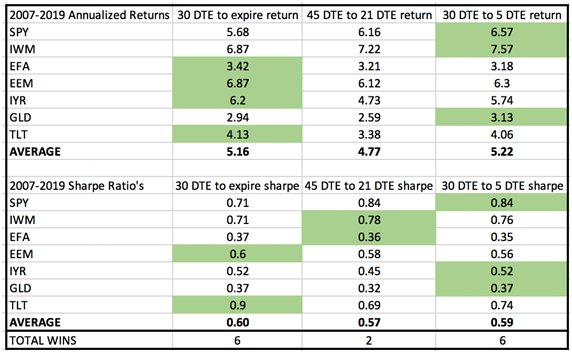

We’ll test this methodology on 7 different underlying assets from 2007-2019 (the data period available in ORATS Wheel). We’ll also test entering at 45 days until expiration (DTE) with an exit at 21 DTE. Lastly, we’ll test a 30 DTE entry with exits occurring when 75% of the credit received has been earned or 5 DTE, whichever occurs first. We’ll look at both excess annualized returns, net of estimated transaction costs, as well as risk adjusted returns with the Sharpe Ratio. Sharpe Ratio is a popular risk adjusted return measurement that is calculated as annualized excess return divided by annualized volatility.

Results

Interpreting The Data

There are many ways to interpret what this data is telling us. I prefer to increase the sample size when reviewing parameter choices by averaging results across multiple underlying assets. In this case, 7 symbols were tested over a period of 13 years, with entries assumed to occur every 7 days, creating a sample size of more than 4,500 total trades. A large sample size helps minimize the impact of any outlier trades that may have occurred during the sample period that might otherwise skew results in a way that could lead to false conclusions.

Overall, it doesn’t look like there was a significant difference in results based on the trade parameters over this time period. This is good, as we prefer to see broad parameter stability. The 45 DTE to 21 DTE method produced average results that were slightly worse than the other 2 methods, which is interesting considering this approach is recommended by a popular options trading educator and brokerage firm.

In SMPW, we enter our short puts around 30 DTE and look to exit when we’ve made 75% or more of the credit received or about 5 DTE, whichever occurs first. With lower priced ETF’s that represent International equities we typically wait to exit winning trades until they are worth a nickel or less, as certain brokers allow you to exit these positions commission free. The logic, which is generally supported by the data in the chart, is that rolling winning trades ahead of expiration when we’ve made most of the potential profit maymodestly increase returns over the long term since we expect the equity premium to persist. Exiting losing trades a few days before expiration slightly reduces the risk of large losses due to the negative gamma of a short option that increases as expiration approaches.

Conclusion: The Power of Diversification

My final point is meant to highlight the power of diversification. Looking specifically at the 30 DTE to 5 DTE results, we see an average Sharpe Ratio of 0.59. I had the ORATS Wheel combine together all 7 symbols into an equal weighted portfolio, and the result was a Sharpe Ratio of 0.76...a 29% relative increase. Diversification is a generally accepted way to either A. increase returns for the same risk or B. maintain the same return with lower risk. Diversification can be achieved in many ways, and it’s one of the most compelling opportunities for “craftsmanship alpha” in the portfolio construction process that is used in our SMPW strategy.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

Related articles:

- Combining Momentum And Put Selling

- Combining Momentum And Put Selling (Updated)

- Steady Momentum ETF Portfolio

- Equity Index Put Writing For The Long Run

- Can You "Time" The Steady Momentum PutWrite Strategy?

- How Steady Momentum Captures Multiple Risk Premiums

- Put Selling: Strike Selection Considerations

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.