Yet as compelling as equities may be over the long run, professeor Siegel notes that "fear has a greater grasp on human action than does the impressive weight of historical evidence." We believe the attractive characteristics of collateralized put writing may give many investors the courage they need to indirectly participate in the equity markets for the long run.

We recently launched our Steady PutWrite strategy that includes alerts for an equity ETF BuyWrite portfolio and an equity index and ETF PutWrite portfolio. As an options focused website, naturally most of our subscribers are primarily drawn to the options portfolio. And for good reason, as equity index put writing is equally as compelling as owning equity ETF and mutual funds directly. In some ways, even more so.

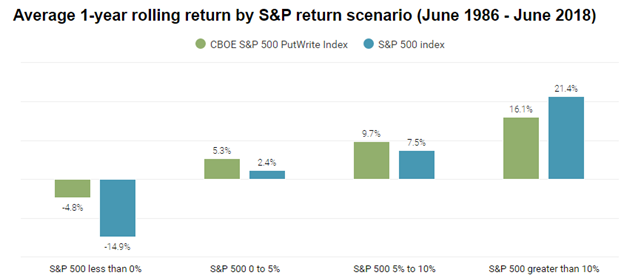

An August 28, 2018 InvestmentNews article titled "Equity index put writing: A strategy for uncertain markets" is a great read to develop a better understanding of collateralized put writing. Using the historical data of the S&P 500 CBOE PutWrite Index (PUT), the author shows how writing cash secured puts produced similar returns as the underlying S&P 500 index, but with lower volatility and maximum drawdown. One particular chart in the article provided a great visual of how put writing tends to perform in different environments.

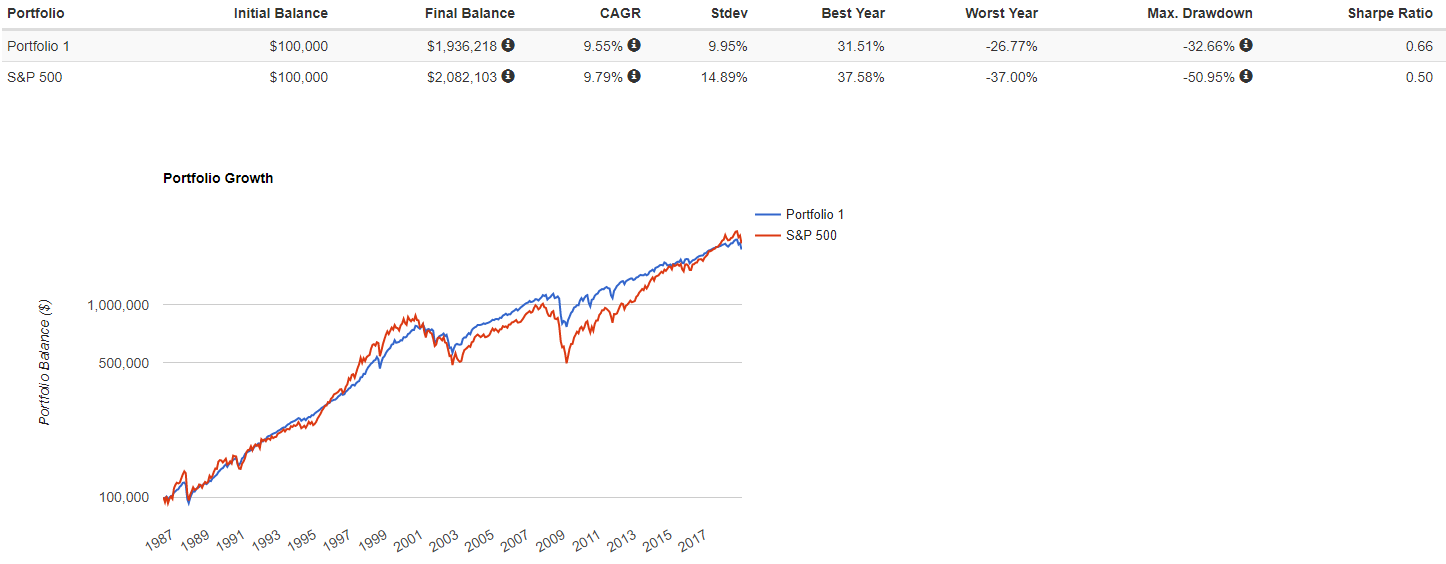

This next chart shows the total performance of PUT (portfolio 1) vs. the S&P 500 (portfolio 2).

In our Steady PutWrite portfolio, we believe we can make incremental improvements to further increase the attractiveness of a put write portfolio. For example:

-

PUT holds winning trades until expiration. Writing puts limits profits to the premium collected. During rising markets, we believe we can capture more upside by rolling trades before expiration when the vast majority of profits have already been earned. Sitting on dead options for several days or even weeks doesn't make much sense to us.

-

PUT will also hold losing trades until expiration, which means during large market declines it will at times act like synthetic stock. We believe we can slightly reduce downside by rolling losers prior to expiration. Both #1 and #2 are modest active management techniques, as we want to maintain the "beta" of put writing overall. In other words, the historical evidence is clear that PUT isn't broke, so we don't want to spend too much time fixing it.

-

PUT holds short term 1-3 month US Treasury bills as collateral. In our Steady PutWrite portfolio, we believe it's sensible to replace T-bills with a small amount of term risk in the form of a low cost 3-7 year US Treasury ETF serving as our collateral. The term premium of 5 year Treasuries minus T-bills has been just under 2% per year over the last century, with premiums often showing up when most needed (equity bear markets). Of course, this is not guaranteed to be the case as well in the future, so we consider this an expected risk premium.

-

PUT is an index based on just one underlying, the S&P 500. Just as we believe in size and geographical diversification when owning equities directly, the same is true in designing a put write portfolio. In addition to the S&P 500, we add exposure to the Russell 2000 and the MSCI EAFE and Emerging Market indices. CBOE also has an index for put writing on the Russell 2000, PUTR, since 2001.

-

In addition to asset diversification, we believe we add incremental improvements to risk adjusted returns by adding time diversification. PUT holds all contracts in the same expiration at the same strike. The dynamics of option greeks mean that PUT will sometimes move dollar for dollar with the index and at other times only pennies on the dollar. Our Steady Momentum put write portfolio splits up its holdings into more than one expiration, and oftentimes more than one strike, in order to produce more consistent exposure over time. We don't necessarily believe this improves absolute returns, but is likely to improve risk-adjusted returns.

- Lastly, PUT is fully cash secured, or collateralized. Due to all of the above expected improvements, we believe it's reasonable to use a modest amount of leverage to increase expected returns. Our Steady PutWrite portfolio targets notional exposure of 125%. Just as owning more shares of the underlying index increases your expected return, so does selling more contracts. We understand that many have a binary view on leverage, as there certainly is a graveyard of traders and funds that no longer exist due to excessive leverage. The irony is that many who subscribe to our service realize it's much more conservative than what they are used to because their past experience with put selling was in the form of highly leveraged credit spreads. Simply put, our very modest use of leverage is designed to make sure that we survive for the long run.

Conclusion

The evidence of owning equities is compelling, but many are too frightened to do so because of short term volatility. Cash is comfortable in the short term and is hard for many investors to let go of. Collateralized put writing is one potential solution, allowing an individual to maintain their cash position and simply overlay a put selling strategy resulting in lower volatility and a higher success rate than owning equities outright. When implemented in a manner like we've described, put writing may even offer the opportunity for excess returns relative to indices. But as an advisor to clients for over a decade now, I can tell you this isn't what matters or what our PutWrite portfolio is really about. Instead, it's about simply staying in the game. This is what determines long-term real life outcomes. I'll take above average patience and discipline over above average intellect every single time when it comes to investing.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now