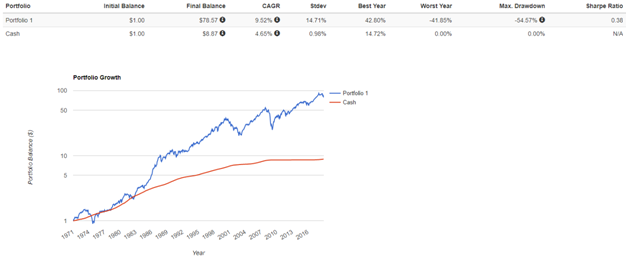

Our Steady Momentum ETF Portfolio (SMETF) starts with a focus on global equities. From 1971-2018, the MSCI All Country World Index (ACWI) had an annualized return of 9.52%. As a proxy for cash, US T-bills returned 4.65% during this period, meaning the global equity risk premium was 4.87% per year. As a side note, What's an ETF - The Ultimate Guide provides an excellent introduction to ETFs.

Charts created at www.portfoliovisualizer.com

This risk premium, known as market beta, is one that we expect to persist in the future, and it forms the foundation of our investment philosophy. The future size of the equity risk premium is of course impossible to predict, but history is a great teacher.

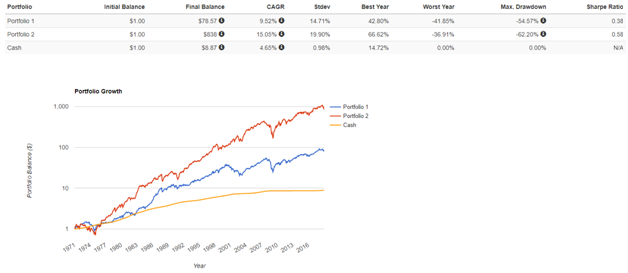

In addition to market beta, I’ve written about other factors that drive equityreturns, such as company size (large cap vs. small cap) and relative price (value vs. growth). See my article Do All Stocks Have the Same Expected Returns? Small stocks that are also value stocks have higher than market risk, and therefore higher than market expected returns. Below I’ll add the Dimensional Small Cap Value Index to our chart as portfolio 2.

Like market beta, the size and value factors have been persistent throughout time and pervasive across the world. By including US and Ex-US small cap value ETF’s in our SMETF Portfolio, we increase expected returns and diversification. But market beta risk still dominates the portfolio, meaning that whether it’s US or Ex-US, large cap or small cap, value or growth, they are still equities and tend to decline simultaneously during most periods of crisis such as 1973-1974, October 1987, 2000-2002, 2007-2009, and even more recently in Q4 2018.

To manage downside exposure, there is one additional return driver that factor research has found to be robust and that meets our strict criteria.

“Momentum is the biggest example (of an anomaly to EMH). It’s very difficult after that to find anything that is robust…Lots of anomalies disappear when you apply them to new data but not the momentum effect. Robustness is the name of the game…momentum is one anomaly that seems to be robust, and it is what it is, you have to live with it…it contradicts market efficiency I think, but that’s the name of the game. All scientific theories have anomalies…otherwise they’re not theories, they are reality.” –Eugene Fame, Nobel Laureate, Economic Rockstar podcast 2018

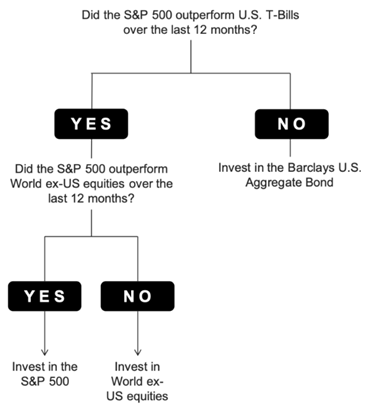

In SMETF, we incorporate momentum based on the “dual momentum” concepts pioneered by the author and blogger, Gary Antonacci. The ruleset for Gary Antonacci’s Global Equities Momentum version of dual momentum is as follows:

Chart from Newfound Research article

Gary’s research focuses on a 12-month lookback for a variety of valid reasons, but in our SMETF Portfolio we use an ensemble approach of multiple lookbacks to minimize parameter selection risk. We also implement a noise threshold in order to reduce unproductive turnover when portfolio changes would otherwise be small on a month to month basis. Newfound and Resolve have both written educational papers and articles on these ideas intended to build upon the excellent work of Gary Antonacci.

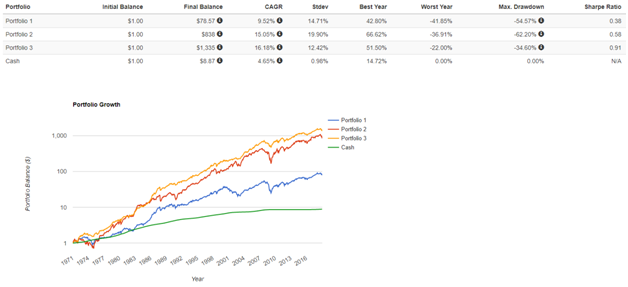

To bring it all together, portfolio 3 in the next chart gives us a loose historical representation of how a strategy similar to our SMETF Portfolio may have performed. Rebalancing is assumed to occur monthly.

No transaction costs, taxes, or other fees have been included, and past performance doesn’t guarantee future results.Investors cannot invest directly in an index. Backtested results have certain limitations that should be considered. Investors should not rely exclusively on this information to make investment decisions.

Conclusion

We started this article by showing how a simple globally diversified equity index has provided a significant risk premium over the last 47 years. We then built upon this base case by including additional factors such as company size and relative price. Finally, we looked to the “premier market anomaly” of momentum to further improve results. Members of Steady Momentum have access to this simple yet powerful portfolio in the form of monthly trade alerts with a small basket of ETF’s. There is also additional education on the member’s forum, along with the precise portfolio allocations. For only $79/month, we welcome you to join us on our long-term journey together as a community. Start your free trial today.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now