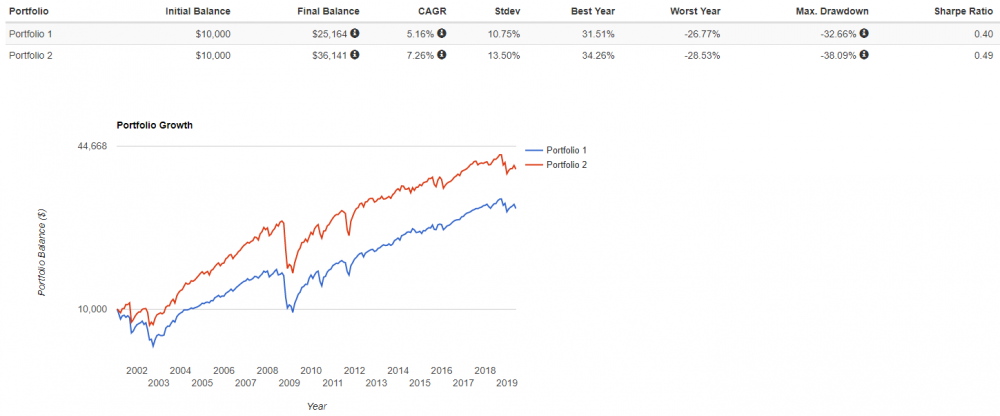

In addition to the S&P 500, CBOE also tracks the same strategy on RUT with their index PUTR. Below is the historical data since 2001.

Portfolio 1: PUT

Portfolio 2: PUTR

Past performance doesn't guarantee future results, and shouldn't be relied upon exclusively when making investment decisions.

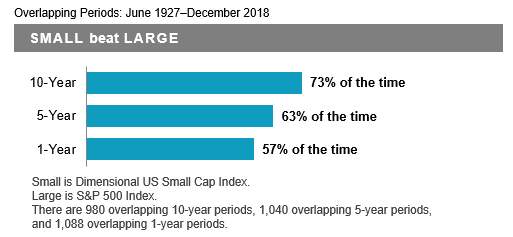

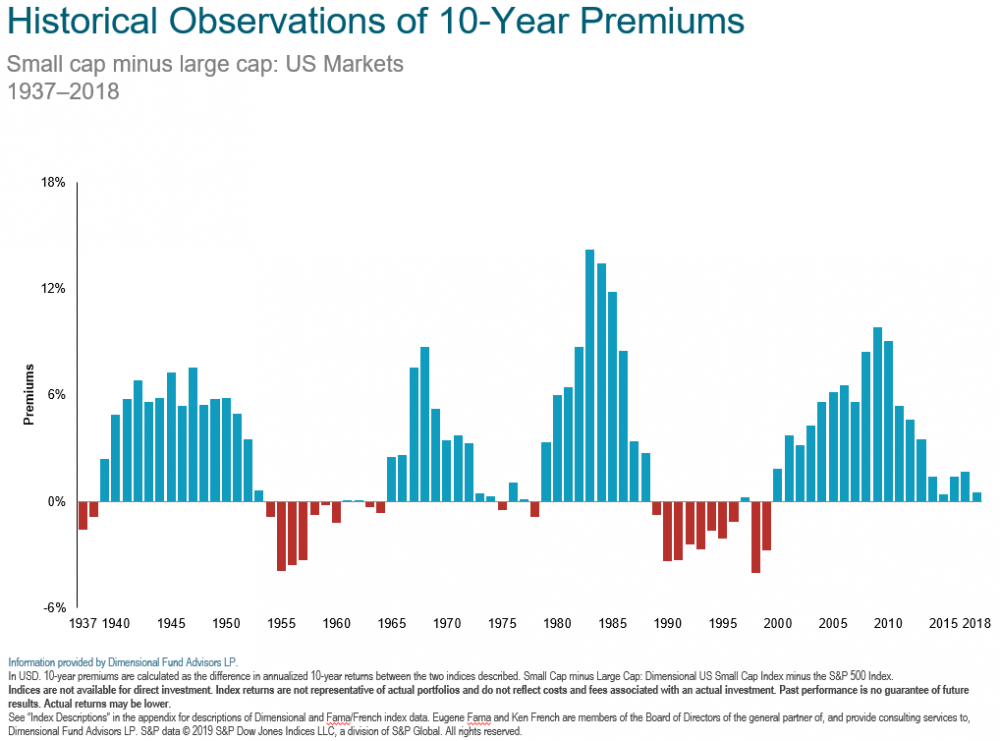

PUTR has beat PUT by 210 bps from 02/2001 - 05/2019, which is largely explained by the fact that IWM beat SPY by 199 bps (7.47% vs. 5.48%). This should not be thought of as random chance, as academic research has found there to be a persistent and pervasive size premium (small outperforms large...see charts below from Dimensional) in the historical data that is intuitive as a risk premium. For example, we can see that PUTR's 40% relative higher return (7.26% vs. 5.16%) came also with 25% higher risk (13.5% vs. 10.75%). Therefore the Sharpe Ratio's are similar. This is what would be expected in a world of highly (although not perfectly) efficient markets...All asset classes are expected to have roughly comparable Sharpe Ratio's over a long period of time, and therefore the best way to increase your expected Sharpe Ratio is with diversification.

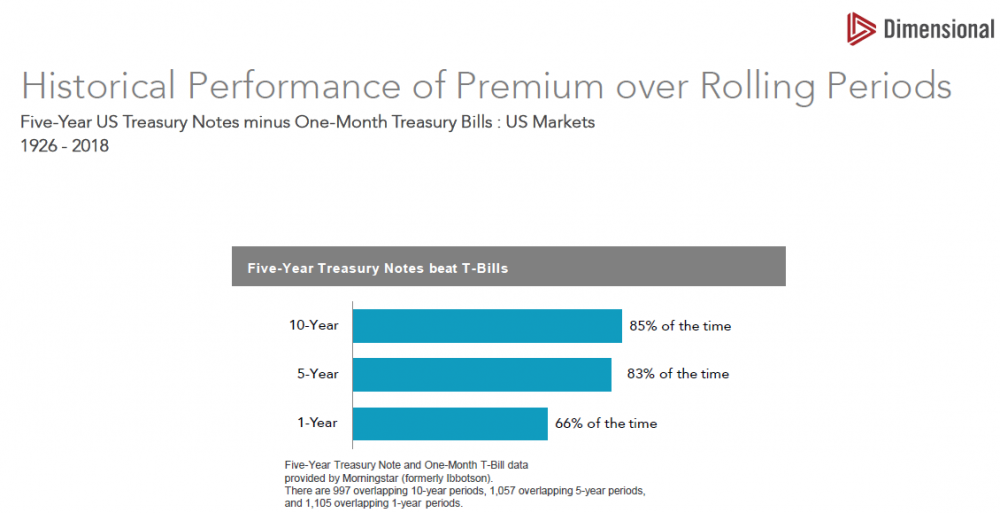

This same thought process of an expected long term risk premium can be applied to our usage of collateral in the form of ~ 5 yr treasuries. I had Dimensional create the following chart, highlighting the persistence of 5 yr treasuries outperforming T-bills since 1926.

I hope readers find this type of scientific data analysis transformational to your way of thinking, as I know I certainly did when I first learned of it. I believe this type of thought process should inform your entire investment portfolio, not just this particular strategy. For example, this same process has also gone into the construction of our ETF portfolio alerts, which are provided to Steady Momentum subscribers at no additional charge.

If you were seeking out advice for a health related issue you were having, wouldn't you rather get that advice from a professional who has spent their career studying peer reviewed scientific research vs. picking up a magazine at the checkout line at the grocery store or asking a friend/family member/co-worker what they think you should do? These sources of advice may be sincere, but the consequences of bad advice are simply too high. If so, shouldn't the same standard apply to your financial planning and investment decisions?

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now