Selling puts on the S&P 500 has been a good strategy since the mid 1980's, based on CBOE's Put Write Index (PUT). In the referenced article, I showed how adding a time series momentum filter to PUT further improved risk-adjusted results, while also mentioning that creative investors could use assets other than T-bills/money market as the underlying source of collateral. We'll also look at that here.

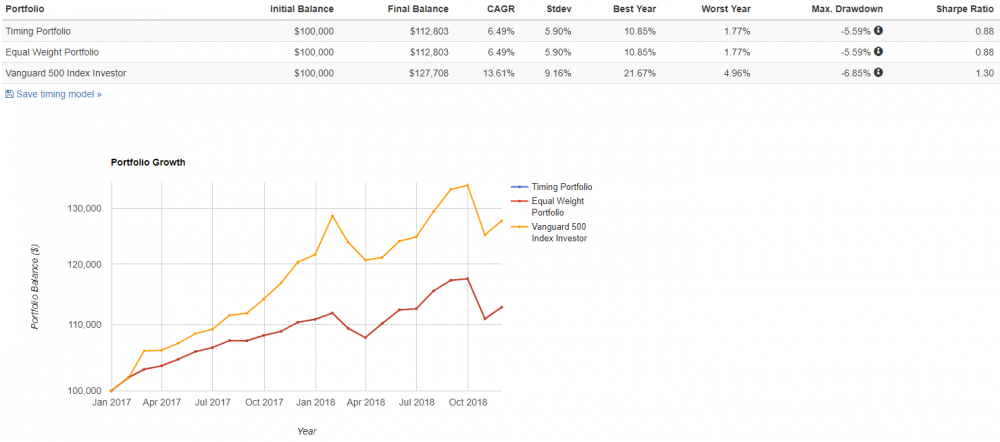

First: Replicating the strategy in the article, how has it done out of sample the last 23 months?

Notes...

Equal Weight Portfolio = PUT

Timing Portfolio = Times series momentum applied to PUT

Vanguard 500 Index Investor = VFINX

Given that the S&P 500 has been up so strongly during the last 23 months, it's no surprise that PUT underperformed the index. This is expected during strong bull markets where put selling has gains limited to the amount of monthly premium collected. The time series momentum overlay stayed invested the entire time, thereby doing its job since there were no major drawdowns along the way to avoid.

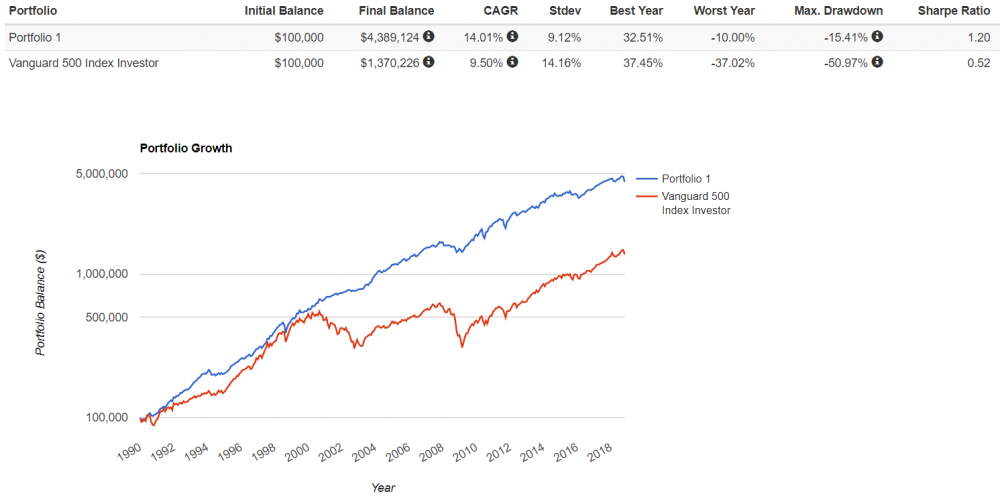

Next, we can look at two examples of ways to enhance the returns of our momentum approach. First, instead of holding bonds only when momentum is negative, we'll hold bonds (instead of T-bills) all the time (via VBMFX) in addition to our put selling. This further improves results, but it should be noted that this could only be done in a non-retirement margin account. All the brokers I'm aware of would prohibit this type of portfolio in an IRA.

The risk-adjusted results here are impressive for such a simple strategy. So what are the drawbacks? Here are a few to consider:

1. We saw in the last 23 months that put selling can underperform in a raging bull market. Investors could consider substituting part of their traditional equity exposure with put selling for this reason.

2. Future returns may be lower. As more market participants become aware of the strong historical risk-adjusted returns offered to those willing to sell options, more supply can impact premiums.

3. Risk-adjusted bond returns have been extraordinary since 1990 due to falling rates, with VBMFX producing a Sharpe Ratio of 0.78. This is unlikely going forward.

4. Time-series momentum can and will occasionally create whipsaw trades. Again, the solution to this is continuing to maintain a healthy portion of your equity portfolio with traditional index funds and/or ETF's.

5. The returns shown are pre-tax, and option selling is tax inefficient due to the high turnover, even after considering the special 60/40 treatment that cash settled index options receive. All of the bond income would be taxable as well (although substituting VBMFX with VWITX gives similar results). The ability to defer capital gains until sold and forever when bequeathed is one of many reasons why index funds are so attractive.

One more example: Instead of collateralizing 100% of our put selling with bonds, we'll do it with 20% equities and 80% bonds. Since PUT is based on large caps, we'll add factor diversification by allocating half of the equities to a US small cap value index, and the other half to an International small cap value and emerging market value index.

Adding cash equities to the portfolio further improves results, and would also improve tax efficiency. Even though this type of portfolio may be simple, its creativity makes it quite unconventional. But for someone willing to succeed unconventionally, the data suggests the minimal effort involved is worth it. And for those lacking the time, interest, or confidence to do it themselves, we run portfolios similar to this for clients if you'd like to have a discussion about it with us. Thanks for reading.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse is managing the PutWrite portfolio and forum, the LC Diversified Fund, as well as contributes to the Steady Condors newsletter.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now