Backtest 1: The Bullish Option Trade Before Earnings in Alphabet Inc

We start with the backtest that shows a higher historical return, but lower historical win rate.

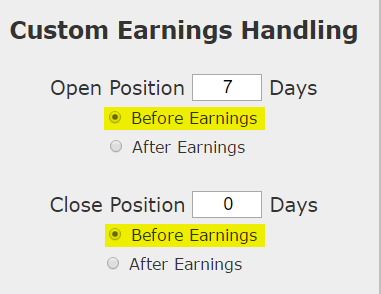

We will examine the outcome of getting long a weekly call option in Alphabet Inc 7-days before earnings (using calendar days) and selling the call before the earnings announcement if and only if the stock price is above the 50-day simple moving average.

Here's the set-up in great clarity; again, note that the trade closes before earnings since GOOGL reports earnings after the market closes, so this trade does not make a bet on the earnings result.

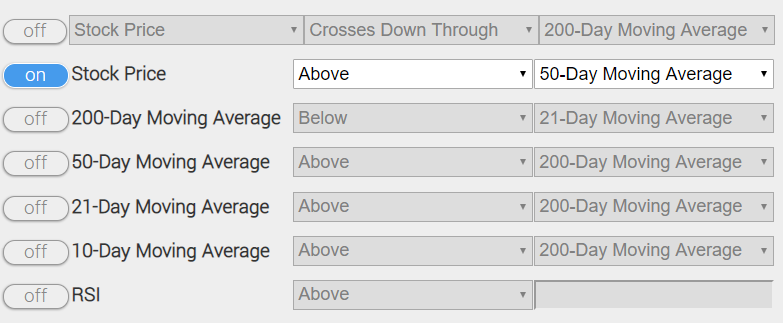

And here is the technical analysis -- note only one is "turned on," and that is the 50-day moving average requirement.:

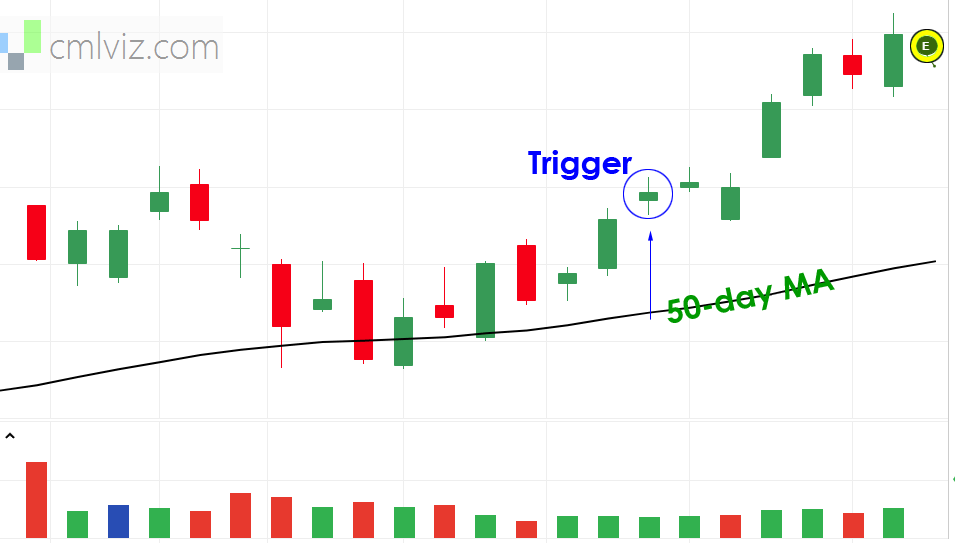

Here's a visual representation, where the stock price 7-days before earnings (circled) is above the 50-day moving average (black line), and therefore triggers a back-test.

If the stock price fails the technical requirement, it's fine, we just put a pin in it and check next quarter.

RISK MANAGEMENT

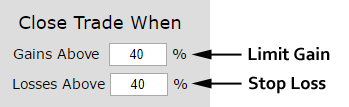

We can add another layer of risk management to the back-test by instituting and 40% stop loss and a 40% limit gain. Here is that setting:

In English, at the close of each trading day we check to see if the long option is either up or down 40% relative to the open price. If it was, the trade was closed.

RESULTS

Here are the results over the last three-years in Alphabet Inc:

| GOOGL: Long 40 Delta Call | |||

| % Wins: | 70% | ||

| Wins: 7 | Losses: 3 | ||

| % Return: | 277% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Notice that while this is a 3-year back-test and we would expect four times that many earnings triggers (4 earnings per year), the technical requirement using the 50-day moving average has avoided 2 pre-earnings attempts. In other words -- it's working.

Setting Expectations

While this strategy had an overall return of 277%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 27.6%.

Backtest 2: The "Not Bearish" Option Trade Before Earnings in Alphabet Inc

With a similar set-up, we examine the same phenomenon -- that is, pre-earnings bullish momentum. But, this time, rather than backtesting owning a call option with the earnings date occurring in the options expiration period, we look at the other side.

We examine selling a put spread in options that expire before earnings are announced. Specifically, we look at opening the trade 7 calendar days before earnings, selling a 40 delta / 10 delta put spread, in options that expire the closest to 5-days but before the earnings date. We don't us any stops or limits -- this backtest simply waits until expiration.

We also note that the technical requirements with the stock above the 50-day moving average, are identical -- this should result in the same number of trades.

This is a trade, unlike the long call, that takes a position on the stock that is simply "not bearish," as opposed to aggressively bullish.

RESULTS

Here are the results over the last three-years in Alphabet Inc for the short put spread -- again, since these options are selected to expire before the earnings dates, this backtest does not take earnings risk.

| GOOGL: Short 40 / 10 Delta put Spread | |||

| % Wins: | 100% | ||

| Wins: 10 | Losses: 0 | ||

| % Return: | 161% | ||

Tap Here to See the Back-test

The mechanics of the TradeMachine® stock option backtester are that it uses end of day prices for every back-test entry and exit (every trigger).

Setting Expectations

While this strategy had an overall return of 161%, the trade details keep us in bounds with expectations:

➡ The average percent return per trade was 20.5%.

Decision

So, there you have it in black and white. Owning the pre-earnings call yielded a substantially higher return, but with a 70% win rate, and the 3 losses, they were substantial, averaging -33.5%. returns (losses).

This is in contrast to the short put spread which has yielded considerably smaller returns, but no losses in the last 3-years.

Is This Just Because Of a Bull Market?

It's a fair question to ask if these returns are simply a reflection of a bull market rather than a successful strategy. It turns out that this phenomenon of pre-earnings optimism also worked very well during 2007-2008, when the S&P 500 collapsed into the "Great Recession."

The average return for this strategy, by stock, using the Nasdaq 100 and Dow 30 as the study group, saw a 45.3% return over those 2-years. And, of course, these are just 8 trades per stock, each lasting 7 days.

* Yes. We are empirical.

Back-testing More Time Periods in Alphabet Inc

Now we can look at just the last year as well. We start with the long call back-test in which the options include the earnings date within the expiration period.

| GOOGL: Long 40 Delta Call | |||

| % Wins: | 100.00% | ||

| Wins: 2 | Losses: 0 | ||

| % Return: | 115% | ||

Tap Here to See the Back-test

And now we can look at the short put spread in which the options exclude the earnings date within the expiration period.

| GOOGL: Short 40 / 10 Delta Put Spread | |||

| % Wins: | 100.00% | ||

| Wins: 2 | Losses: 0 | ||

| % Return: | 42.3% | ||

Tap Here to See the Back-test

Again, the contrast is clear, but the decision is personal and not obvious.

WHAT HAPPENED

Don't trade blind, please. Try pattern recognition.

Risk Disclosure

Past performance is not an indication of future results.

Ophir Gottlieb is the CEO & Co-founder of Capital Market Laboratories. Mr Gottlieb’s learning background stems from his graduate work in mathematics and measure theory at Stanford University and his time as an option market maker. He has been cited by Yahoo! Finance, CNNMoney, MarketWatch, Business Insider, Reuters, Bloomberg, Wall St. Journal, Dow Jones Newswire, Barron’s, Forbes, SF Chronicle, Chicago Tribune and Miami Herald. He created and authored what was believed to be the most heavily followed option trading blog in the world for three-years.

Related articles:

- The Incredible Option Trade In VXX

- Earnings Momentum Trade In Oracle

- Post Earnings Option Trade In Facebook

- Option Trade After Earnings In AutoZone

- Pre-Earnings Momentum Trade In Netflix

- Microsoft Pre-Earnings Momentum Trade

- Post Earnings Trade In FedEx

- Pre Earnings Pattern In Apple

- Earnings Momentum Trading In Google

- PANW Broke The Golden Rule

- How To Profit From PayPal Volatility

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now