What is the Options Wheel Strategy?

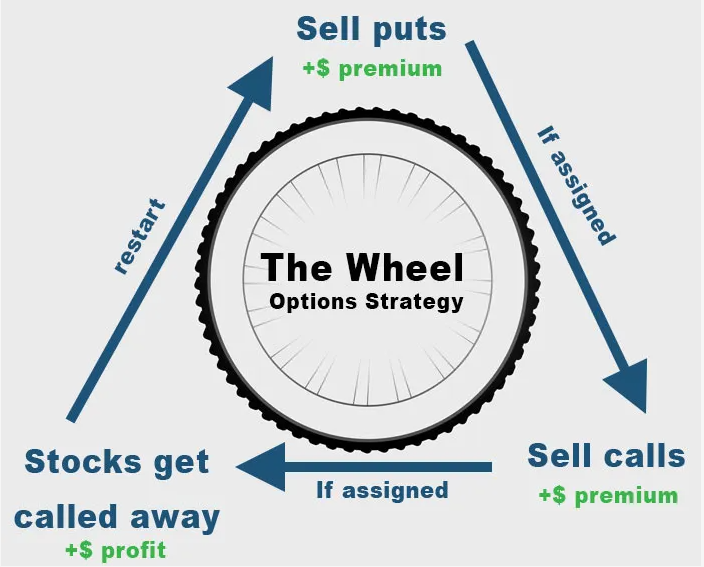

The options wheel strategy, also known as the “triple income strategy” is a method where a trader continuously sells cash-secured puts until assignment, at which point they start selling covered calls against the assigned shares. Once the covered calls are assigned, they start the process over again by selling more cash-secured puts.

This strategy is named “the wheel trade” as it cycles between selling puts and calls, much like a wheel’s rotation. Because a trader utilizing the wheel is constantly selling options, they’re always generating income from several sources: calls, puts, and potentially even long stock.

The following graphic is a great representation of the “cycle” of the options wheel strategy:

What is a Cash-Secured Put?

A cash-secured put option refers to selling a put option while having enough cash to cover the cost of purchasing 100 shares of the underlying stock if assigned on the option.

For instance, a put option with a strike price of $50 would require a trader to have $5,000 of cash in their trading account in order to cover the cost of buying 100 shares of the stock at $50.

How the Options Wheel Strategy Works

Step One: Sell a Cash-Secured Put

The first part of the options wheel strategy involves selling a cash-secured put. By selling the put option, you receive the price of the option as a credit, which you get to keep should the option expire worthless. For this reason, traders tend to choose out-of-the-money put options, as they’re highly likely to expire worthless allowing you to pocket the entire premium.

Step Two: Sell Covered Calls

If the underlying stock price drops below the strike price of the put option at expiration, the put will be assigned, and you’ll be obligated to buy 100 shares per contract at the strike price. At this point, you’re holding shares of the stock, which transitions us to the second step of the options wheel strategy: selling covered calls.

A covered call involves selling a call option for every 100 shares of the underlying stock you own. If I own 300 shares of Apple stock and I want to sell covered calls against them, I will sell three calls.

The covered call strategy aims to generate income by selling calls against a long stock position, with the hopes that the calls expire worthless, allowing you to keep the entire premium collected. Your position in the shares hedges out the upside risk should the stock price significantly increase.

The goal is to sell covered calls, have them expire worthless and then sell additional covered calls. You repeat this process until you get assigned on your calls.

Step Three: Repeat the Process

If the stock price surges above the strike price of the covered call by expiration, the call option will be exercised. This means that you’ll be forced to sell your 100 shares at the strike price of the call option, finalizing the options wheel cycle as your position in the stock is now flat.

Using the proceeds collected from selling the stock, you’re now ready to begin the process all over again by selling another cash-secured put, thereby setting the options wheel into motion once more. The continuous cycle of selling put options until assignment, then selling call options until assignment, forms the basis of the wheel strategy, offering multiple opportunities to earn income using different instruments: puts, calls, and long stock.

Characteristics of the Options Wheel Strategy

The Options Wheel Trade Benefits from Time Decay (Long Theta)

One of the most compelling benefits of the options wheel strategy is its inherent ability to exploit and benefit from time decay, making it a long theta trading approach.

Theta is the rate at which the price of an option will decay with each passing day. When you buy a put or a call, you’re working against the clock because the market has to move enough to counteract this factor. However, when you’re selling options as you do when trading the wheel, you’re constantly short options, meaning you benefit from the passage of time.

Market Outlook: Neutral to Slightly Bullish

Another benefit to the options wheel strategy is it makes a profit even if the market doesn’t move. As a matter of fact, it works optimally in a market that’s relatively neutral or in a slow upwards trend. In other words, the strategy is profitable in neutral to slightly bullish markets and loses money in fast-moving bear markets.

Selling put options is making a bet that the underlying price won’t decline significantly. Later, if the put option is assigned, selling covered calls is making the bet that the price won’t surge significantly. Therefore, the best market conditions for this strategy are those that see slow, gradual price changes, rather than volatile shifts.

Options Wheel Strategy Risk Profile

Because the wheel trade shifts between selling puts and covered calls, the strategy’s risk profile evolves over time.

However, both short puts and covered calls have a limited profit potential, with potentially significant maximum loss.

Cash-Secured Put

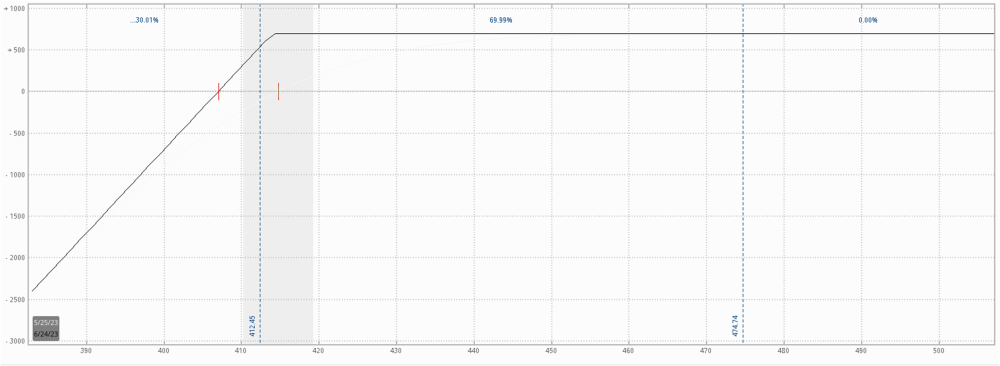

The following is a payoff profile for a short put:

Your maximum profit is the premium collected, which is the price you sold the put option for. In the above example, we’re looking at a put that costs $6.94, meaning $6.94 would be your max profit if you sold it at that price.

The maximum loss for a short put is a simple formula:

(Strike Price of Put Option * 100) - (Premium Collected)

Using our previous example, the formula would be:

(Strike Price[414] * 100) - (Premium[$694]) = $40,706

As you can see, once the underlying stock hits the strike price of your put option, your exposure becomes identical to being long 100 shares of stock. With each dollar the stock declines, you will lose a dollar in your short put position.

Covered Calls

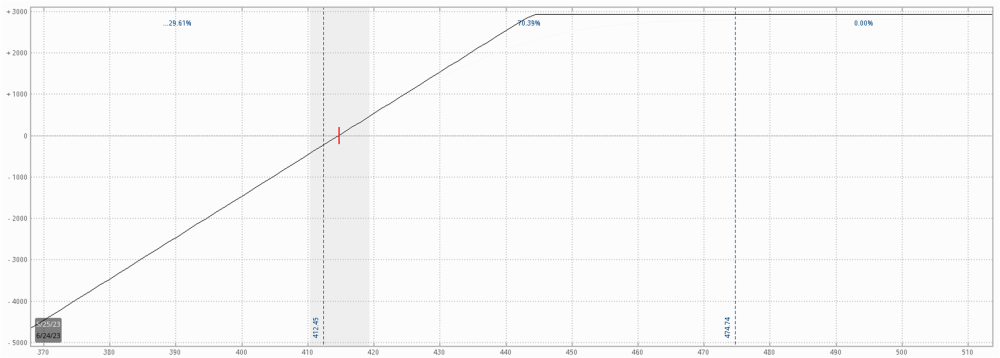

Here is the payoff profile of a covered call:

Similarly to the short put, the strategy benefits most from neutral to slightly bullish market conditions.

Covered Call Maximum Profit Formula:

(Strike Price of Call - Stock Cost Basis) + (Premium Received from Selling Call)

If we initiated a covered call position with the following criteria:

- Call Strike Price: 430

- Stock Cost Basis: 414

- Premium Received: $1.08

The math would look like this:

(Strike Price[430] - Cost Basis [414]) + (Premium [$1.08]) = $1,708

Whereas the maximum loss is simply the cost basis of the stock minus the premium collected. Using the same numbers as above, the math would be as follows:

(Cost Basis [414]) - (Premium [$1.08]) = $41,292

The Pros and Cons of the Options Wheel Strategy

Pro: Income Generation

Since this strategy involves continuously selling options, it’s a great way to generate regular income from the premium received.

Pro: Cost Reduction

Selling put options allows you to potentially purchase the underlying stock at a discount to the current market price because the premium received from selling puts reduces your cost basis.

Pro: Risk Management

By selling covered calls, you can generate income while limiting the impact of a stock price decline on your long share position.

Pro: Benefit from Time Decay (Theta)

Options are wasting assets and they lose value as the expiration date gets closer. As a seller of options, you benefit from this time decay. The longer your short options remain out-of-the-money, the more that time decay works in your favor.

Con: High Capital Requirements

The options wheel strategy requires significant capital upfront, because it involves selling cash-secured puts. A cash-secured put requires you to be able to buy 100 shares of the stock per contract if you’re assigned at expiration.

Con: Limited Upside

While selling covered calls and cash-secured puts provides income, it also caps the potential profit. As with short-option strategy, your profit is limited to the amount of premium you collect from selling the options. So you don’t get to benefit from significant price moves in the underlying stock as you would with a long straddle.

Con: Large Potential Losses

As you can see from the payoff diagrams of both the covered call and short put, the maximum loss levels far exceed the maximum profit positions.

However, these maximum risk levels need to be put in perspective. Once the short put becomes in-the-money, your downside risk profile becomes nearly identical to that of holding 100 shares of the underlying stock.

Most traders don’t think of their maximum loss from holding 100 shares of the stock as the price of the stock. Instead, they set a stop loss and exit the position when it exceeds a certain level. You should develop similar rules for trading the wheel strategy.

Con: Dependent On Certain Market Conditions

The options wheel strategy works best in a neutral or slowly trending market. In highly volatile markets, the risks can be substantial and the potential for profits dwindles.

Options Wheel Strategy Example Trade

Let’s illustrate the options wheel strategy with an example. Assume you’re interested in a stock currently trading at around $27 and you’d like to use the options wheel strategy. We’ll use Intel (INTC) for the sake of the example.

You’ll start by selling a cash-secured put on the stock. Most wheel traders tend to use an out-of-the-money put. The distance between the current stock price and your put option strike price is up to your own taste. The deeper OTM you go, the higher your probability of success, but the premium you collect will be smaller.

For the sake of the example, we’ll pick a strike price about 10% below the current market price and opt for a strike price of $25.

So we’ll start by selling a cash-secured put with a strike price of $25, expiring in a month, for a premium of $0.36. This means you have $2,500 in your account to buy the stock if assigned. If the stock’s price stays above $25, the put option expires worthless and you collect the premium. At this point, you’d simply sell another put roughly 10% below the current stock price and continue to repeat this process until assigned.

However, if the stock price drops below $25 at expiration, you’ll get assigned and be obligated to buy the stock for $25 per share. Now you own 100 shares of Intel, costing you $24.64 per share ($25 - $0.36 premium).

At this point, you transition to selling covered calls against the long stock position you just established. We’ll choose a strike roughly 10% above the assumed market price of $27 and sell a call with a strike price of $29, collecting $0.59 in premium. If the stock price remains below $29 until expiration, you’ll keep the $0.59 premium at which point you can sell another covered call.

But if the stock price rises above $29 and the call is assigned at expiration, you’ll be obligated to sell the stock for $29 per share.

At this point, you’ve completed one cycle of the options wheel strategy, earning premiums from both selling puts and calls, as well as potentially profiting from owning the stock. You can choose to do another cycle of the wheel or start fresh on a different stock.

Bottom Line

The options wheel strategy is a systematic method of generating options income through selling call and put options. It’s not magic and like any options trading strategy, requires a solid understanding of options and risk management.

The most significant risk to the wheel trade involves a sharp downward move in the stock price. For this reason, it's essential to only utilize the wheel strategy when you expect calm market conditions going forward.

Related articles

- Uncovering The Covered Call

- Selling Naked Put Options

- The Naked Put, A Low-Risk Strategy

- Covered Calls –Does Rolling Forward Mean Higher Risk?

- Leverage With A Poor Man’s Covered Call

- Selling Puts: The Good, The Bad And The Ugly

- 2 Tweaks To Covered Calls And Naked Calls

- Dangers Of The Covered Call

- Naked Options: Redefining High Risk

- Are Covered Calls a ‘Sure Thing?’

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now