Iron Condor Description

Iron Condor is a vega negative gamma negative trade. Choosing the strike prices for your iron condor position – and deciding how much cash credit you are willing to accept for taking on the risk involved – are irrevocably linked. If your strike has lower deltas, you will get less credit, but also higher probability. As we know, Risk/reward and Probability of Success have reverse relationship.

Construction:

-

Buy one out-of-the-money put with a strike price below the current price.

-

Sell one out-of-the-money put with a strike price closer to the current price.

-

Sell one out-of-the-money call having a strike price above the current price.

-

Buy one out-of-the-money call with a strike price further above the current price.

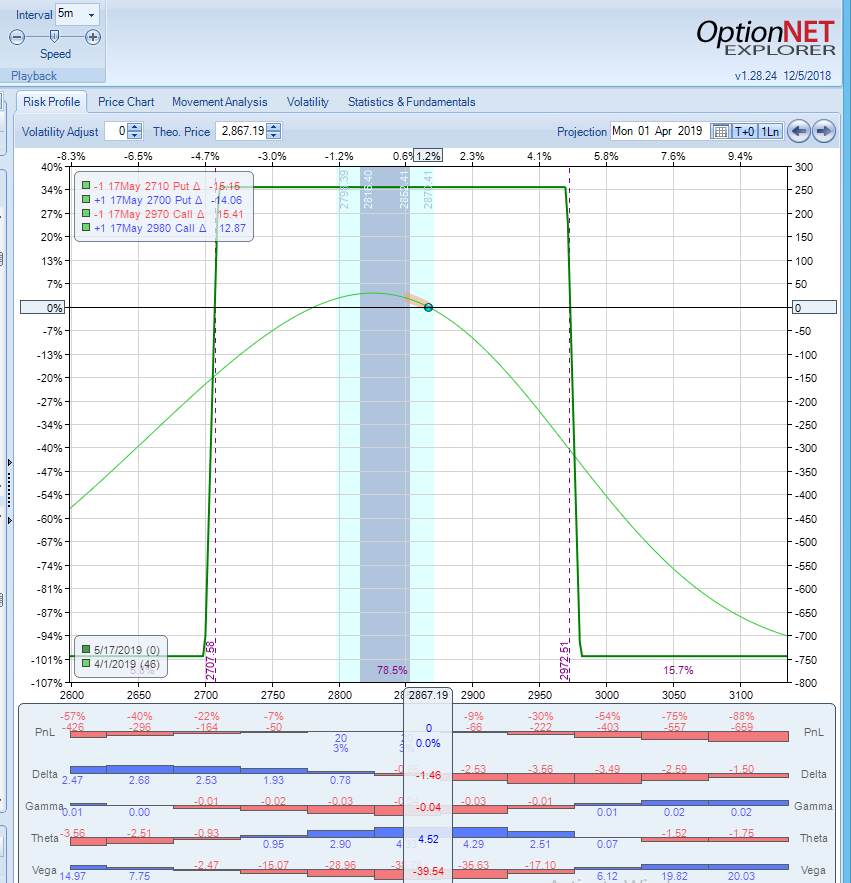

Lets take a look at typical Iron Condor trade using SPX and 15 deltas for the short options.

As we can see, we are risking ~$750 to make ~$250 (around 33% gain), but we have a fairly high probability of success (~78%). We can select tighter strikes, for higher credit and better risk/reward, but we will be sacrificing the probability of success.

Iron Butterfly Description

Iron Butterfly spread is basically a subset of an Iron Condor strategy using the same strike for the short options.

Construction:

-

Buy one out-of-the-money put with a strike price below the current price.

-

Sell one at-the-money put.

-

Sell one at-the-money call.

-

Buy one out-of-the-money call with a strike price above the current price.

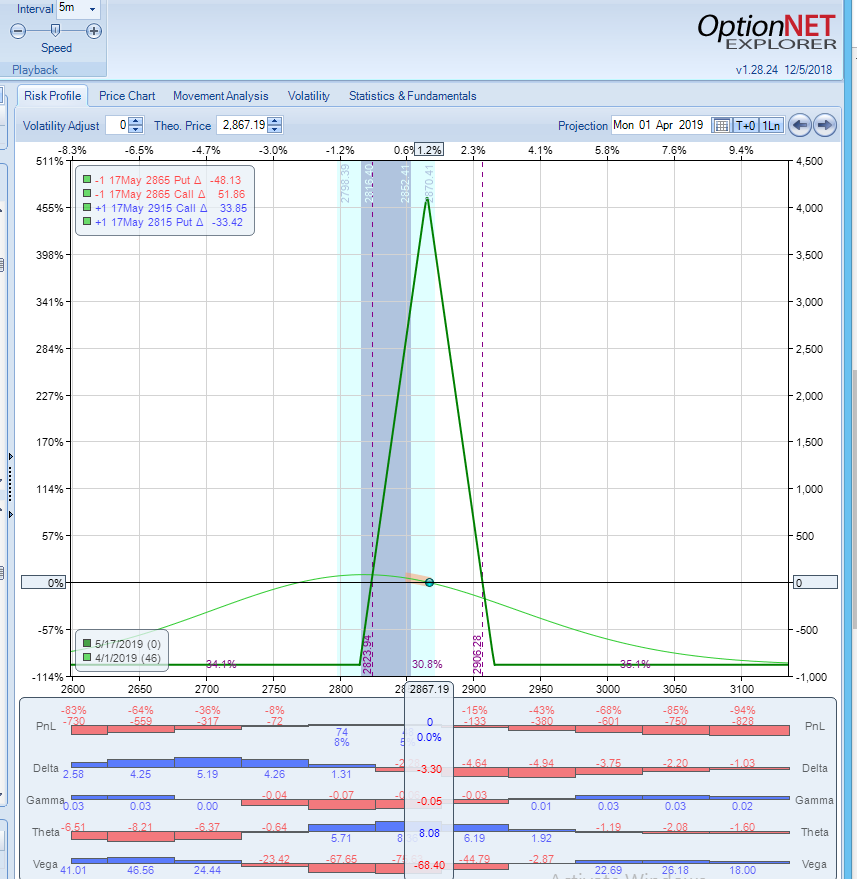

Lets take a look at Iron Butterfly trade using SPX:

As we can see, we are risking ~$880 to make ~$4,120 (around 455% gain), but we have a fairly low probability of success (~30%). We can select further OTM long strikes, for lower credit and higher probability of success. But generally speaking, Iron Butterfly will usually have a better risk/reward but lower probability of success than Iron Butterfly.

Which one is better?

As you can see, there are tradeoffs to each strategy. Both strategies benefit from range bound markets and decrease in Implied Volatility. The Iron Butterfly has more narrow structure than the Iron Condor, and has a better risk-to-reward, but also lower probability of success. If the underlying stays close to the sold strike, the iron Butterfly trade will produce much higher returns.

Both strategies require that the underlying price stay inside of a range for the trade to be profitable. The Iron Condor gives you more room, but the profit potential is usually much less.

Generally speaking, Iron Condor is a High(er) Probability trade and Iron Butterfly is a Low(er) Probability trade. However, those probabilities refer to holding both trades till expiration. In reality, we rarely hold them till expiration. We usually set realistic profit targets and exit at least 2-3 weeks before expiration, to reduce the negative gamma risk.

The bottom line is that the strategies are pretty similar because they profit from the same conditions. The major difference is the maximum profit zone, for a condor is much wider than that for a butterfly, although the tradeoff is a lower profit potential.

Related articles

- Trading An Iron Condor: The Basics

- Butterfly Spread Strategy - The Basics

- 4 Low Risk Butterfly Trades For Any Market Environment

- Using Directional Butterfly Spread

- Options Trading Greeks: Gamma For Speed

- Options Trading Greeks: Vega For Volatility

- Why You Should Not Ignore Negative Gamma

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.