Lets examine those statements and see how you should put them in context and consider other parameters as well. We will use vertical spread strategy as an example.

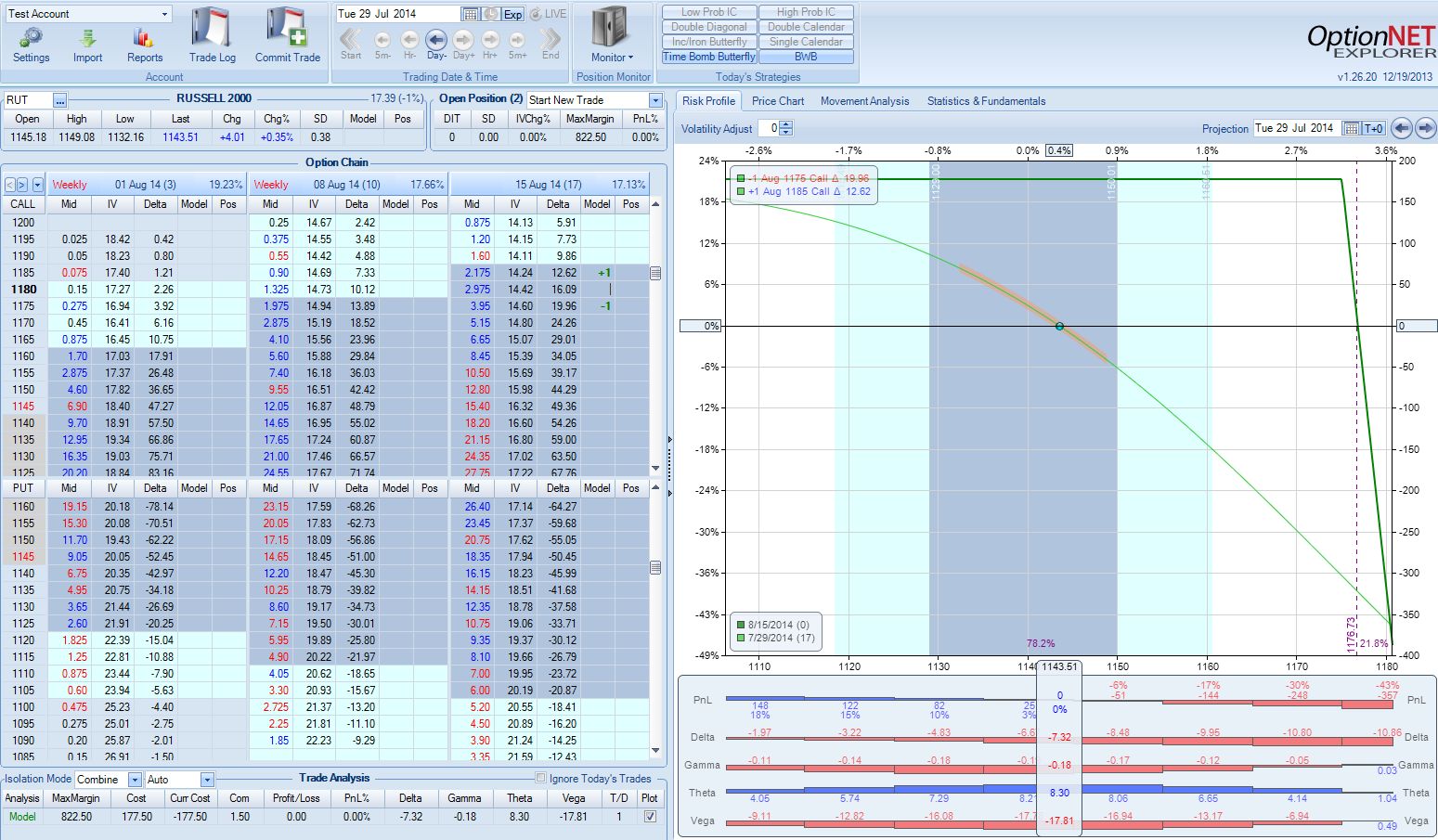

Lets take a look at the following trade:

- Sell to open RUT August 1175 call

- Buy to open RUT August 1185 call

This is the risk profile of the trade:

As we can see, we are risking $822 to make $177. This is pretty bad risk reward. However, the picture looks a lot better when we look at the probability of success: it is 78%. We need the underlying to stay below 1175 by August expiration, and there is 78% chance that it will happen.

In this trade, bad risk/reward = high probability of success.

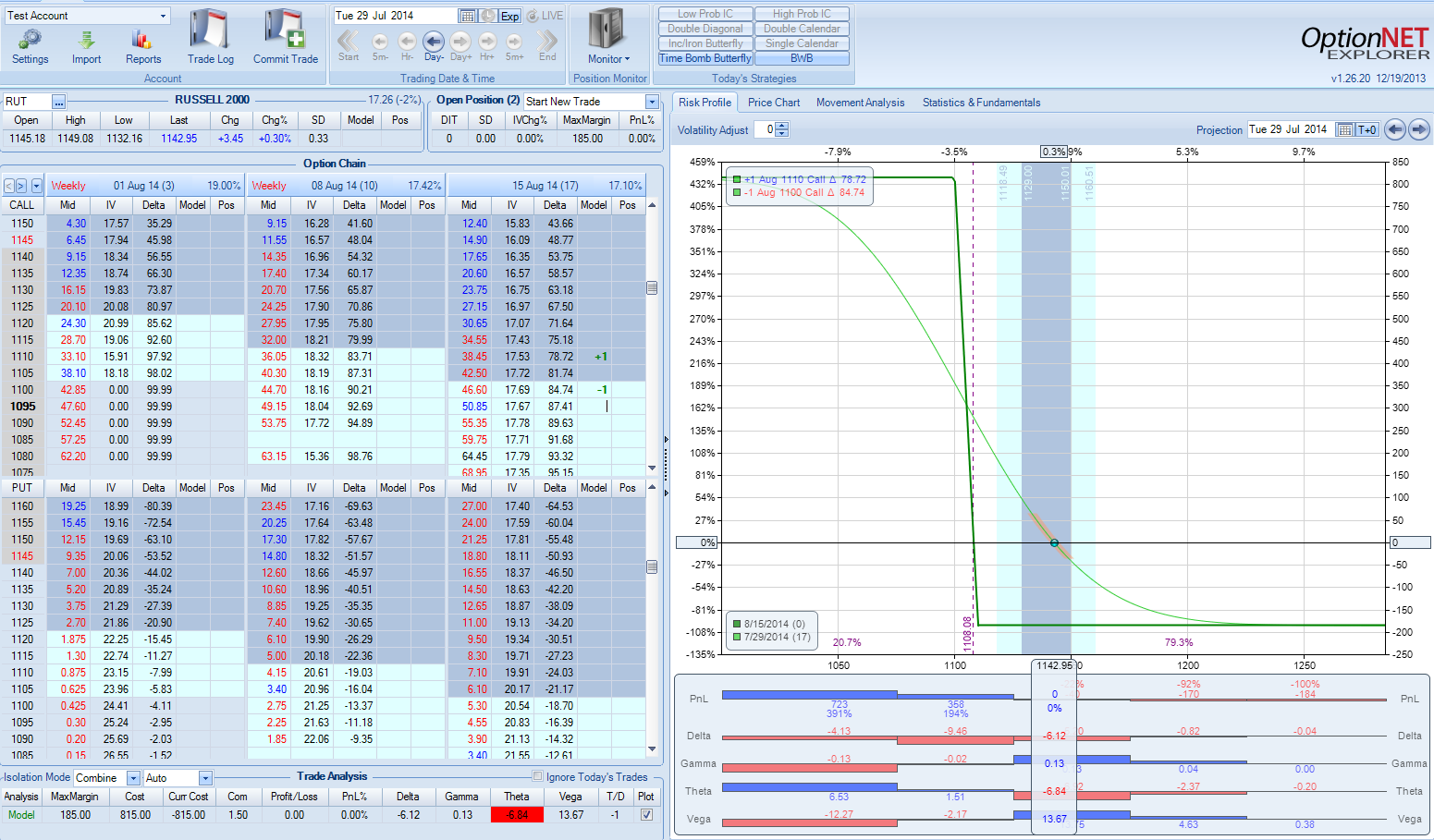

Lets take a look at another trade:

- Sell to open RUT August 1100 call

- Buy to open RUT August 1110 call

This is the risk profile of the trade:

As we can see, we are risking only $185 to make $815. That's terrific risk/reward (more than 1:4). The only problem is that RUT will have to go below 1110, and there is only 20.7% probability that this will happen. (In fact, to realize the full profit, RUT has to go below 1100 and stay there by expiration).

In this trade, excellent risk/reward = low probability of success.

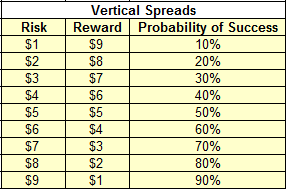

The following table illustrates the relation between probability of success and risk-reward:

Of course, this is not an exact science, but it helps us to see the approximate relation and trade-off between the risk-reward and the probability of success.

So next time someone will ask you: "Would you risk $9 to make $1?" - consider the context. Yes, it is a terrible risk/reward, but considering high probability of success, this is not such a bad trade. It will likely be a winner most of the time - the big question is what you do in those cases it goes against you?

At the same time, the answer to the question "Would you risk $1 to make $9?" is also not so obvious. It is an excellent risk/reward, but the probability to actually realize this reward is very low.

In trading, there is always a trade-off. You will have to choose between a good risk-reward and a high probability of success. You cannot have both.

Watch the video:

If you want to learn more about options strategies:

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now