In this article, I would like to show how the gamma of the trade is impacted by the time to expiration.

For those of you less familiar with the Options Greeks:

The option's gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price.

This might sound complicated, but in simple terms, the gamma is the option's sensitivity to changes in the underlying price. In other words, the higher the gamma, the more sensitive the options price is to the changes in the underlying price.

When you buy options, the trade has a positive gamma - the gamma is your friend. When you sell options, the trade has a negative gamma - the gamma is your enemy. Since Iron Condor is an options selling strategy, the trade has a negative gamma. The closer we are to expiration, the higher is the gamma.

Lets demonstrate how big move in the underlying price can impact the trade, using two RUT trades opened on Friday March 21, 2014. RUT was trading at 1205.

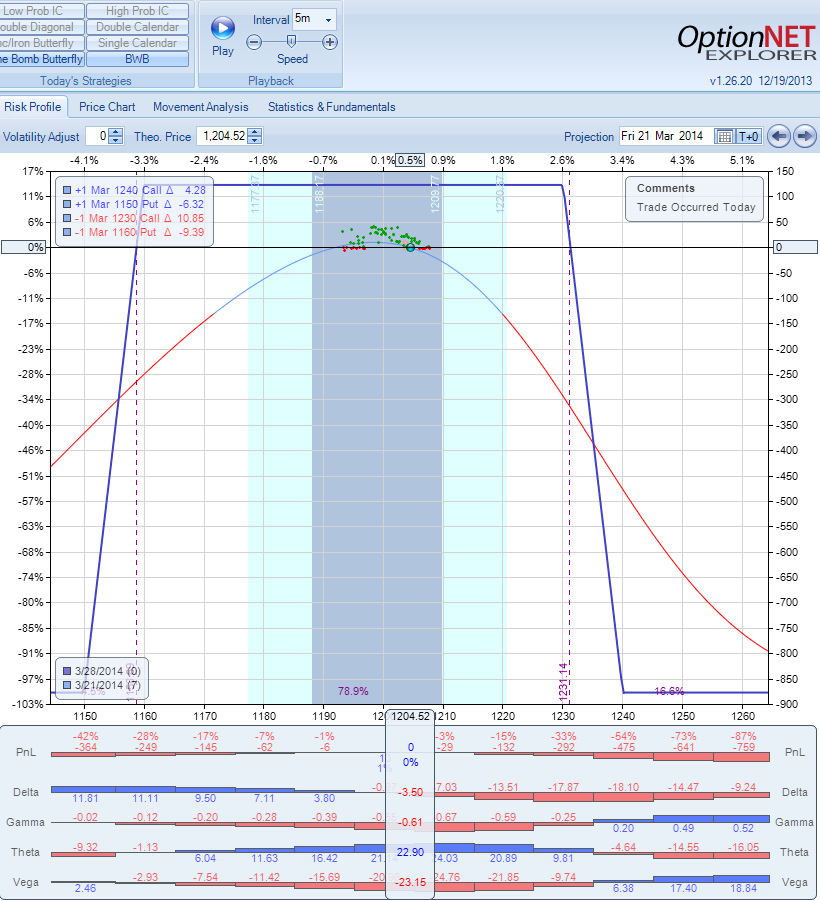

The first trade was opened using weekly options expiring the next week:

- Sell March 28 1230 call

- Buy March 28 1240 call

- Sell March 28 1160 put

- Buy March 28 1150 put

This is the risk profile of the trade:

As we can see, the profit potential of the trade is 14%. Not bad for one week of holding.

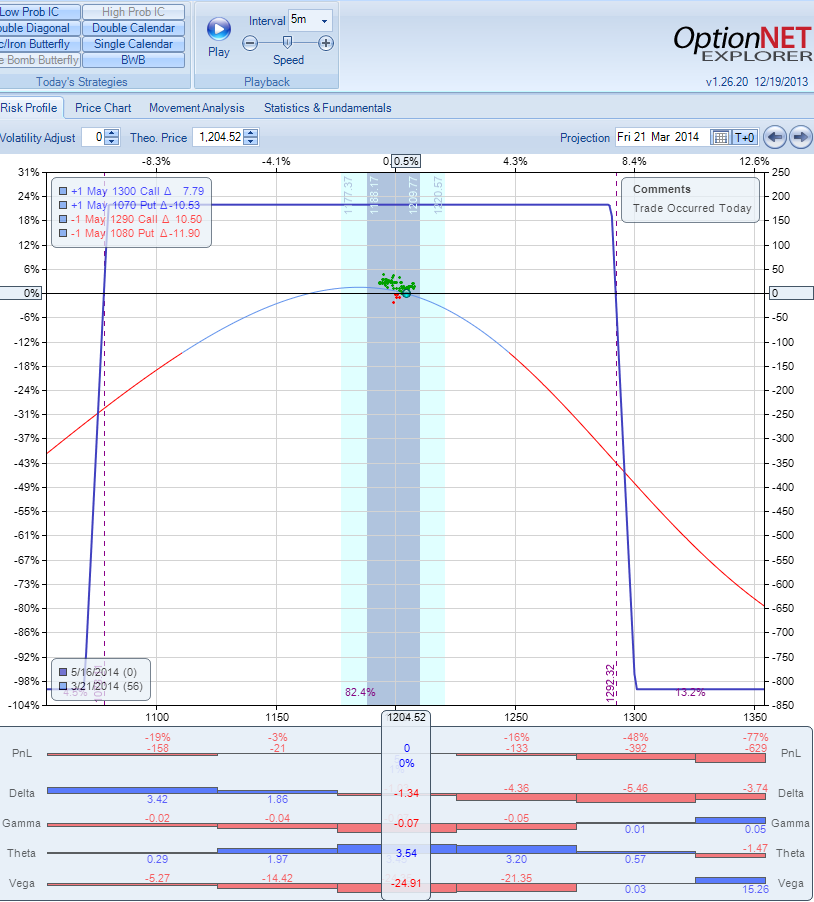

The second trade was opened using the monthly options expiring in May:

- Sell May 16 1290 call

- Buy May 16 1300 call

- Sell May 16 1080 put

- Buy May 16 1070 put

This is the risk profile of the trade:

The profit potential of that trade is 23% in 56 days.

And now let me ask you a question:

What is better: 14% in 7 days or 23% in 56 days?

The answer is pretty obvious, isn't it? If you make 14% in 7 days and can repeat it week after week, you will make much more than 23% in 56 days, right? Well, the big question is: CAN you repeat it week after week?

Lets see how those two trades performed few days later.

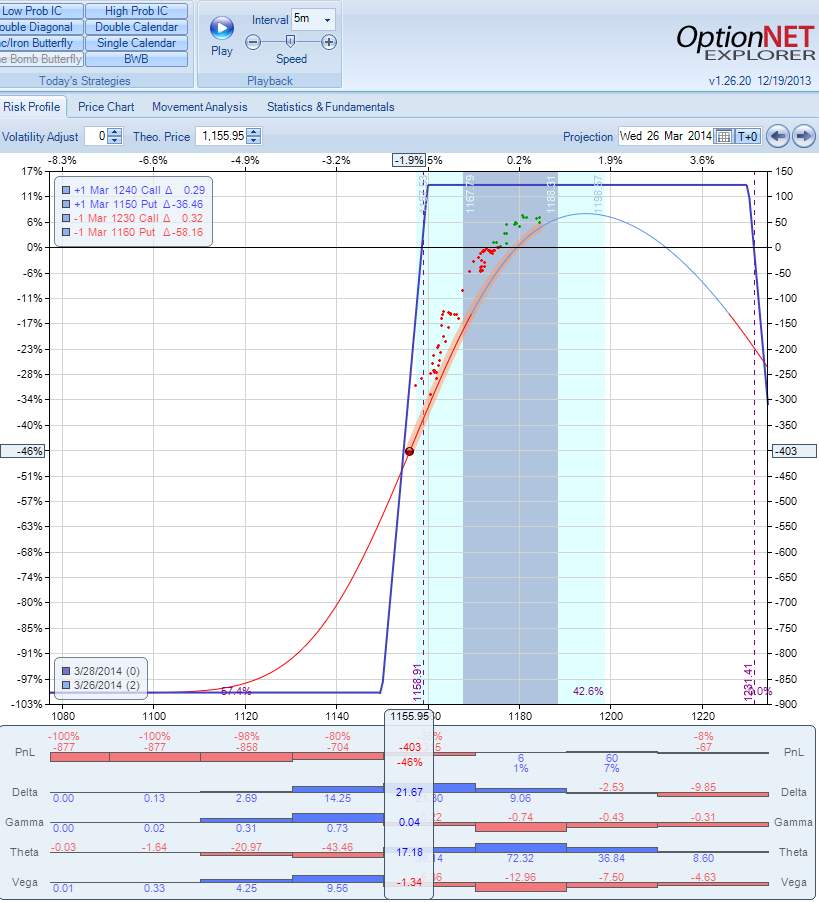

This is the risk profile of the first trade on Wednesday next week:

RUT moved 50 points and our weekly trade is down 45%. Ouch..

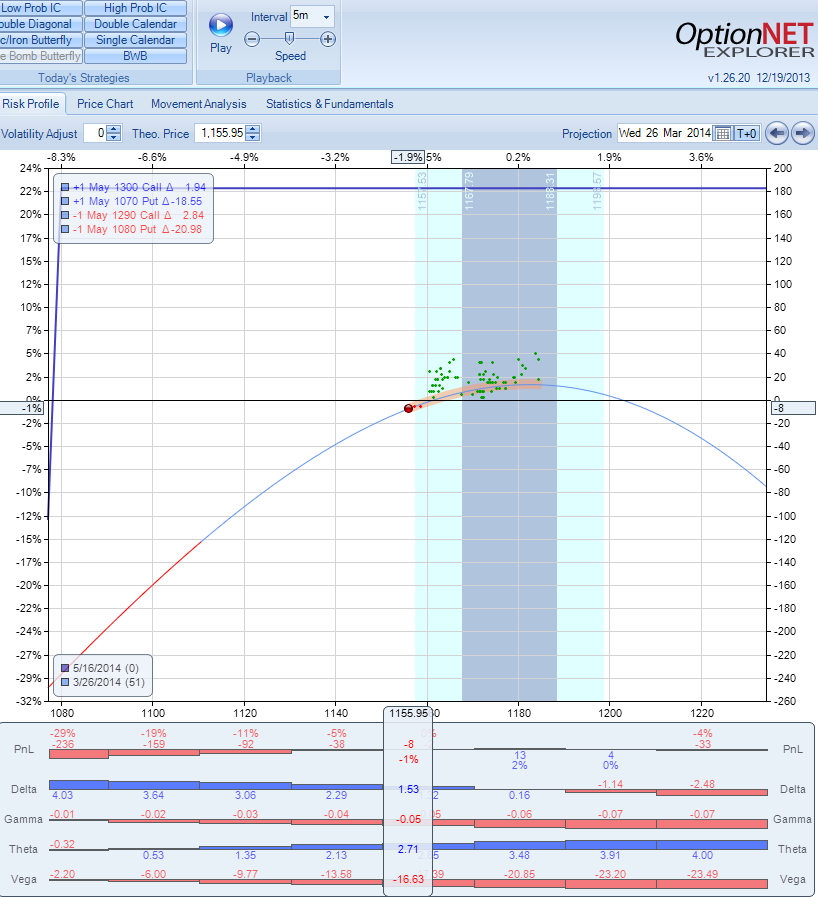

The second trade performed much better:

It is actually down only 1%.

The lesson from those two trades:

Going with close expiration will give you larger theta per day. But there is a catch. Less time to expiration equals larger negative gamma. That means that a sharp move of the underlying will cause much larger loss. So if the underlying doesn't move, then theta will kick off and you will just earn money with every passing day. But if it does move, the loss will become very large very quickly. Another disadvantage of close expiration is that in order to get decent credit, you will have to choose strikes much closer to the underlying.

As we know, there are no free lunches in the stock market. Everything comes with a price. When the markets don't move, trading close expiration might seem like a genius move. The markets will look like an ATM machine for few weeks or even months. But when a big move comes, it will wipe out months of gains. If the markets gap, there is nothing you can do to prevent a large loss.

Does it mean you should not trade weekly options? Not at all. They can still bring nice gains and diversification to your options portfolio. But you should treat them as speculative trades, and allocate the funds accordingly. Many options "gurus" describe those weekly trades as "conservative" strategy. Nothing can be further from the truth.

Related articles

- Options Greeks: Theta, Gamma, Delta, Vega And Rho

- Options Vega Explained: Price Sensitivity To Volatility

- Options Theta Explained: Price Sensitivity To Time

- Options Delta Explained: Sensitivity To Price

- Options Gamma Explained: Delta Sensitivity To Price

- The Use And The Abuse Of The Weekly Options

- The Risks Of Weekly Credit Spreads

- Should You Trade Weekly Options?

- Make 10% Per Week With Weeklys?

Would you like to learn in real time how to identify those opportunities and trade them? Click the button below to get started!

Join SteadyOptions Now!

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now