This article describes the different variations of the butterfly spread.

Long Butterfly Spread

This is a limited profit, limited risk options strategy. There are 3 strikes involved in a butterfly spread and it can be constructed using calls or puts. It is entered when the trader believes that the underlying will not move much by expiration.

Construction:

- Buy 1 ITM Call

- Sell 2 ATM Calls

- Buy 1 OTM Call

OR

- Buy 1 ITM Put

- Sell 2 ATM Puts

- Buy 1 OTM Put

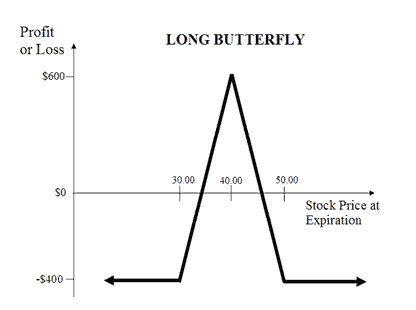

P/L chart:

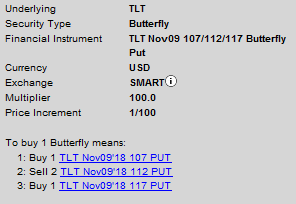

There is some confusion regarding terminology, but most sources and brokers agree that "Buy a butterfly" or Long Butterfly means selling the body strikes and buying the wings. Here is a screenshot from Interactive Brokers:

Please note that Butterfly spread is purchased for a debit. In order to make a profit, you would aim to sell it for more than you paid for it (exactly like a stock). There is no margin requirement to buy a butterfly, except for the debit paid.

Maximum profit for the long butterfly spread is achieved when the underlying price is exactly at the short strikes at expiration.

Long Iron Butterfly Spread

The same trade can be constructed using combination of calls and puts.

Construction:

- Buy 1 OTM Put

- Sell 1 ATM Put

- Sell 1 ATM Call

- Buy 1 OTM Call

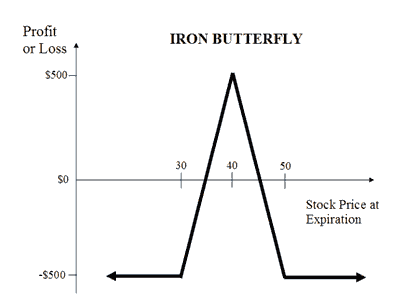

P/L chart is identical to the long butterfly spread:

Please note that Iron Butterfly spread is purchased for a credit. In order to make a profit, you would aim to buy it back for less debit than the credit you got (exactly like a short stock). There is margin requirement equal to the distance between the short and the long strikes. Buying Iron Butterfly is basically selling ATM straddle and hedging it with OTM strangle.

Maximum profit for the long butterfly spread is achieved when the underlying price is exactly at the short strikes at expiration.

Example:

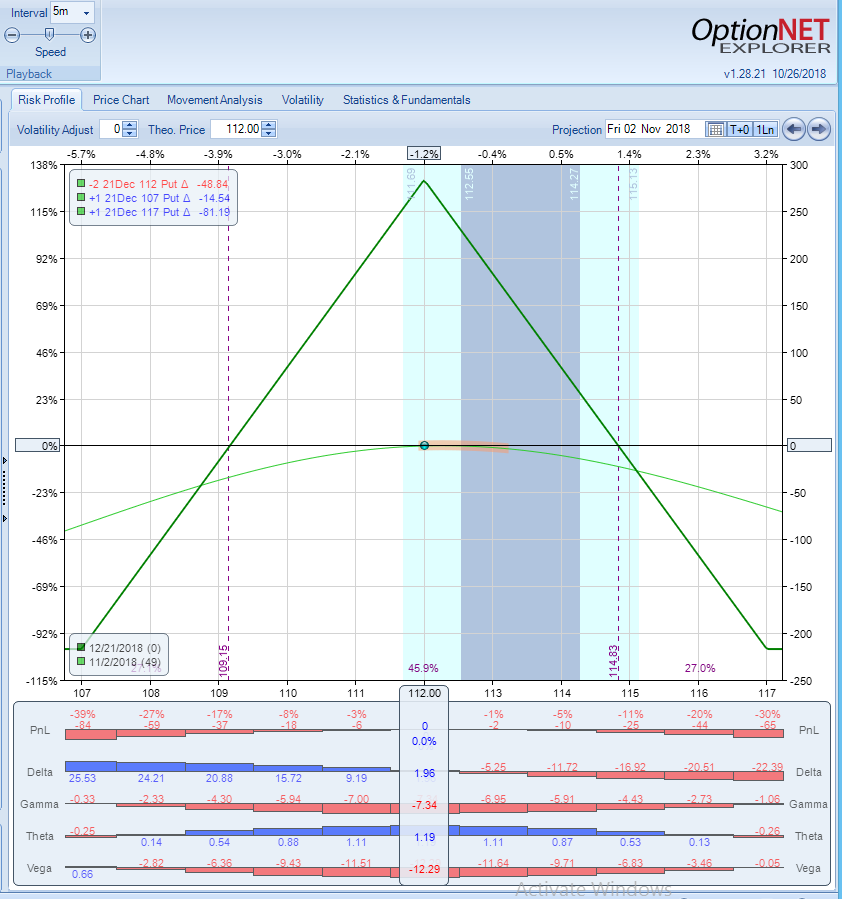

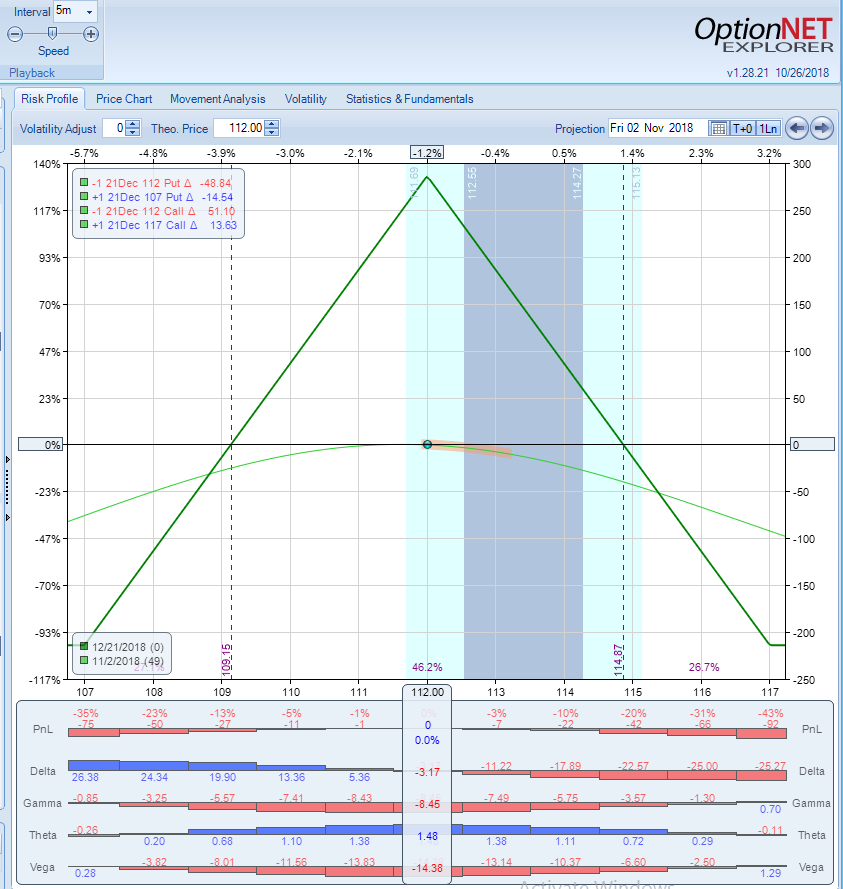

With TLT trading around $112, we could enter the following butterfly, using calls only:

- Buy 1 December 21 107 Put

- Sell 2 December 21 112 Put

- Buy 1 December 21 117 Put

This is a $5 wide butterfly, and the debit would be around $2.15, The maximum price at expiration is $5, so the profit potential is $2.85 or 132%:

Same trade could be constructed as an Iron Butterfly, using combination of puts and calls:

- Buy 1 December 21 107 Put

- Sell 1 December 21 112 Put

- Sell 1 December 21 112 Call

- Buy 1 December 21 117 Call

This is a $5 wide butterfly, and the credit would be around $2.85. The margin requirement is 5.00-2.85=2.15, exactly the same as the debit of the put butterfly:

As you can see, the P/L chart and the profit potential of the butterfly and iron butterfly are very similar when same strikes are used.

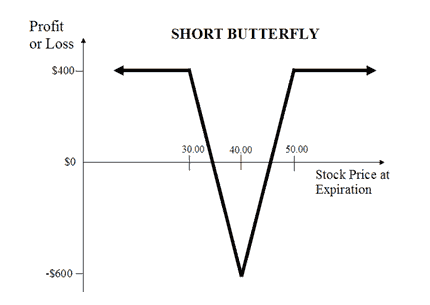

Short or Reverse Butterfly Spread

This is a limited profit, limited risk options strategy. There are 3 strike prices involved in a butterfly spread and it can be constructed using calls or puts. It is entered when the trader believes that the underlying will move by expiration. This is basically an opposite trade to a long butterfly

Construction:

- Sell 1 ITM Call

- Buy 2 ATM Calls

- Sell 1 OTM Call

OR

- Sell 1 ITM Put

- Buy 2 ATM Puts

- Sell 1 OTM Put

P/L chart:

As we can see, the underlying has to move in order for the trade to make a profit. Maximum profit is achieved when the underlying is above the upper sold strike or below the low sold strike. The trade is executed for a credit.

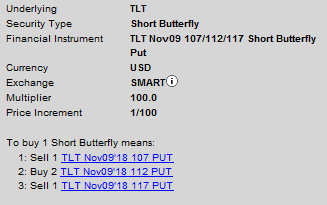

Once again, to avoid any confusion, here is a screenshot from Interactive Brokers:

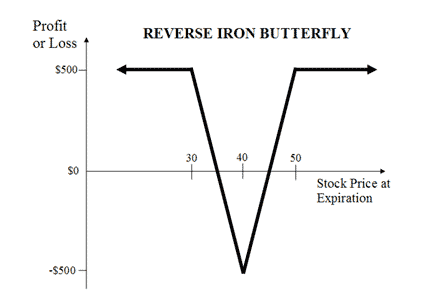

Short or Reverse Iron Butterfly Spread

The same trade can be executed using a combination of puts and calls.

Construction:

- Sell 1 OTM Put

- Buy 1 ATM Put

- Buy 1 ATM Call

- Sell 1 OTM Call

P/L chart:

The trade is executed for a debit. Selling Iron Butterfly is basically buying ATM straddle and hedging it with OTM strangle.

Frequently Asked Questions

How the long butterfly spread makes money?

The first way is the time decay. The idea is that ATM options will lose value faster than the ITM and OTM options. The second way a Butterfly Trade makes money is with an decrease in volatility.

What is the risk?

The maximum theoretical risk of the long butterfly is the debit paid. If we hold the trade till the expiration and the stock trades outside of the P/L zone, the trade will lose 100%. As a general rule of thumb, the average loser size should not exceed the average winner size.

Calls vs. puts

In general, there should not be a significant difference between calendar spread using calls or puts. The P/L graph is usually very similar. When opening a delta negative fly, I tend to open it with puts. The reason is that OTM options tend to be slightly more liquid, and there is no assignment risk.

Can I be assigned on my short options?

If your short options become deep ITM, you can be assigned. Assignment risk becomes real only if there is very little time value left on the short options. There is no assignment risk on indexes like SPX or RUT, but stocks like SPY or IWM (or individual stocks) do have assignment risk. Assignment by itself is not a bad thing - unless it causes a margin call and forced liquidation. Usually you are 100% covered - each dollar you lose in the stock you gain in the options.

Directional or non-directional?

At SteadyOptions, we trade non-directional trading. So in most cases, we will want to be as delta neutral as possible. However, in some cases we will structure the trade slightly directional if we have a strong bias about the underlying.

Summary

The butterfly spread has few variations, but they all have few things in common:

- Three equidistant strikes involved.

- Same expiration.

- Limited profit, limited loss.

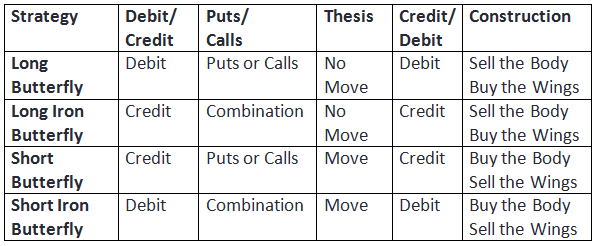

The following table summarizes the most important features of the different variations of the Butterfly Spread strategy.

If you want to learn more how to use the butterfly spread and other profitable strategies and increase your odds:

Related articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now