FB is one of the mostly watched stock in the US stock market. Many options traders try to play earnings using FB options.

There are few alternatives. We will backtest them using CMLviz Trade Machine.

1. Buying Call Options

This strategy involved buying call options on the day of the earnings announcement and selling them the next day. Here are the results:

Tap Here to See the back-test

This doesn't look so good. How about a bearish trade?

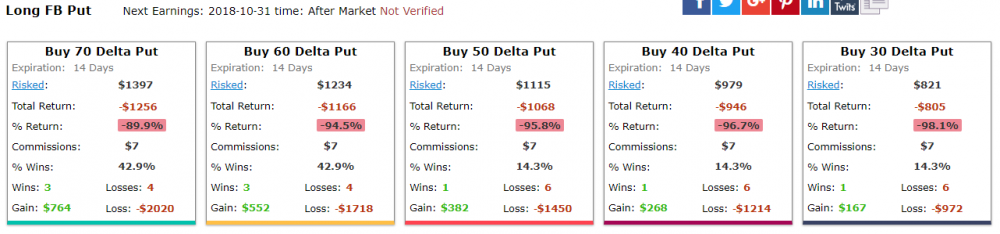

2. Buying Put Options

This strategy involved buying put options on the day of the earnings announcement and selling them the next day. Here are the results:

Tap Here to See the back-test

Looks much better. However, this result was heavily impacted by the last earnings release. You remove the gains from the last cycle, the strategy would be a loser as well.

Tap Here to See the back-test

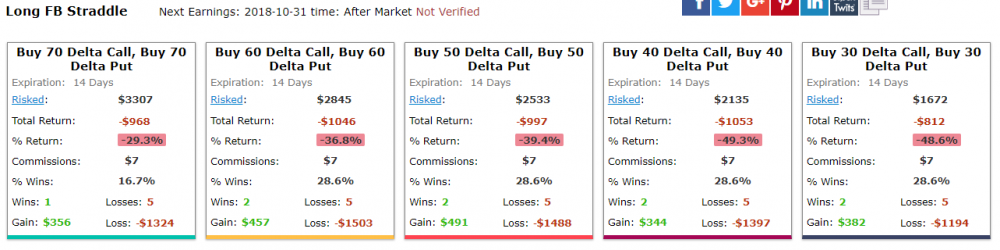

How about buying a straddle (both calls and puts)?

3. Buying a straddle

This strategy involved buying a straddle on the day of the earnings announcement and selling them the next day. Here are the results:

Tap Here to See the back-test

Once again, big chunk of the gains came from the last cycle when the stock tanked ~20%. Removing the last cycle causes the overall return to become negative:

Tap Here to See the back-test

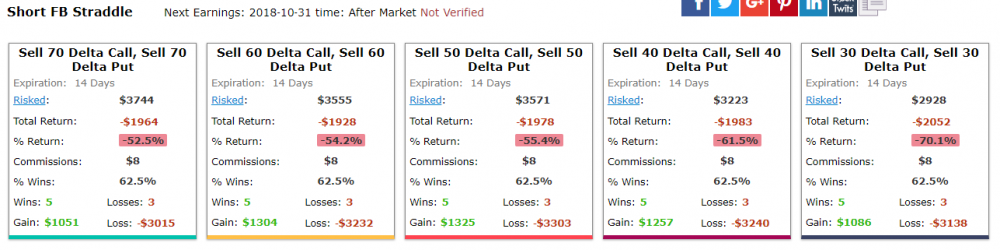

How about selling the straddle?

4. Selling a straddle

This strategy involved selling a straddle on the day of the earnings announcement and selling them the next day. Here are the results:

Tap Here to See the back-test

Overall loss - but again, ALL of the total loss came from the last cycle. If we remove the last cycle, the overall result becomes positive:

Tap Here to See the back-test

We performed the back testing using the CMLviz Trade Machine which an option back-tester created by Capital Market Laboratories (CML). It is a very powerful tool that allows you to back test almost any possible setup.

Tap Here to See the Tools at Work

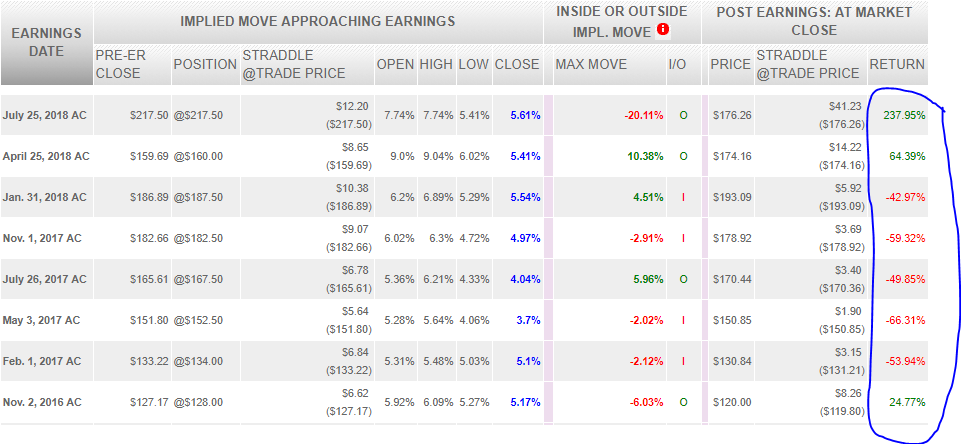

Those backtests confirm what we already knew (more or less):

Buying straddles before earnings is on average a losing proposition. You will lose most of the time, but you might win big couple times when the stock makes a huge move.

Chart from optionslam.com.

Based on those statistics, many options "gurus" suggest selling options on high flying stocks like FB,AMZN, NFLX etc. They claim this is a "high probability strategy".

What they "forget" to mention (or maybe simply don't understand) is that high probability doesn't necessarily mean low risk.

Here is an excellent example used by our guest contributor Reel Ken:

We load a six-shooter gun with one deadly round and play Russian Roulette for $100 per trigger squeeze. The odds are 83% (5/6) that you win. Does that make it low-risk? What would low-risk look like? How about a 13-round Glock where your probability of success is over 90%. For certainly, if one defined risk as favorable odds, we would expect many takers, but I'll bet there wouldn't be any.

The reason is simple: One doesn't define risk by the probability of success. I often see this mistake when pundits promote investing strategies such as selling deep-out-of-the-money-puts (DOTM) on volatile stocks and lauding the low-risk-nature of the trade. "The stock would have to drop over x% (6%,7%, 10%) for you to lose". Well, Facebook reminded us of the real risk in such strategies.

Yes, risk isn't the chance of loss, it is the magnitude of potential loss. Too many simply confuse probability with risk.

This confusion is because investors don't understand there is a completely other operative metric. They can easily put their hands around the potential loss and even recognize when a probability is very high or very low (I hope).

But probability isn't risk. And, though maximum loss is risk, maximum loss is very, very rare. The maximum loss on the S&P is it going to ZERO, and though that's possible, it isn't helpful for us to evaluate investing loss.

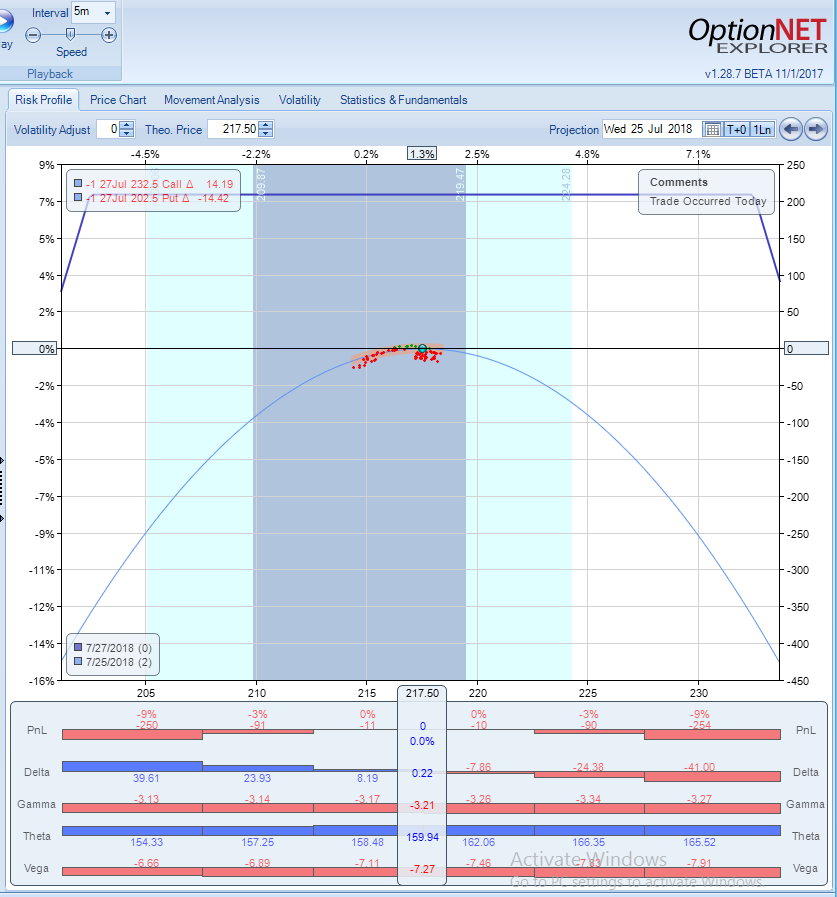

Lets check how this strategy would work for FB in the last cycle, by selling 1 SD strangle on the day of earnings. With the stock trading around $217, you would be selling 232.5 calls and $202.5 puts, for $208 credit. This is how P/L chart would look like:

The trade would tolerate around 7% move in each direction, which would work well most of the cycles. Based on the options deltas, the trade had ~70% probability of success. Not bad.

As a side note, the trade would require around $2,850 margin, so even if you kept the whole credit, your return on margin would be around 7%.

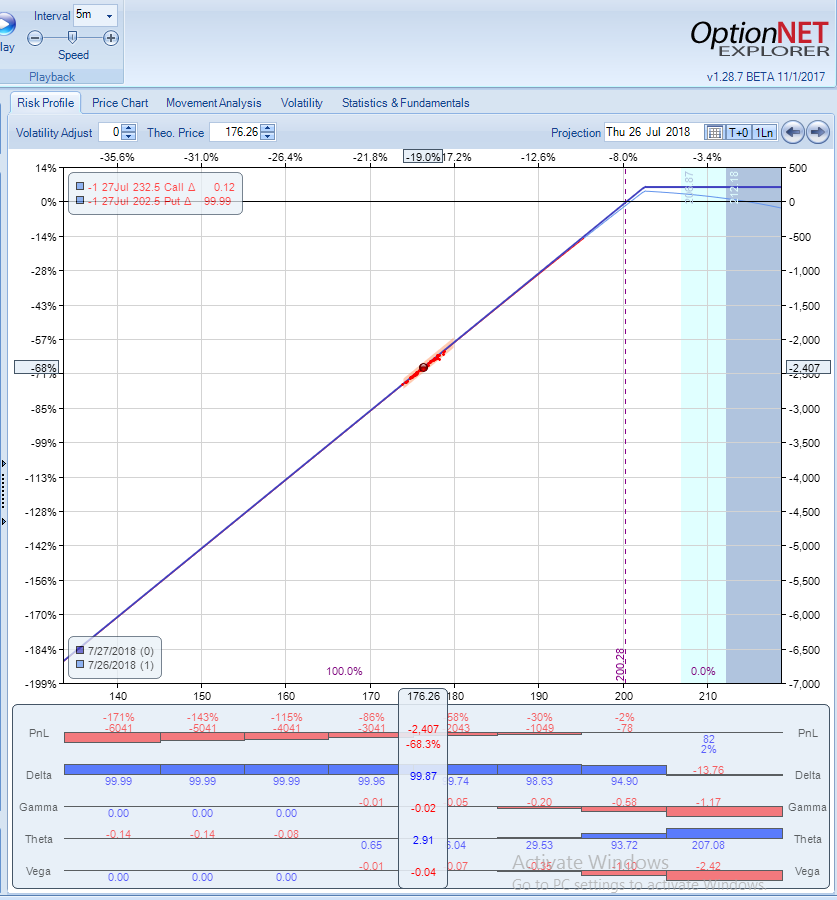

Fast forward to the next day after earnings have been announced and the stock was down almost 20%:

The trade was down a whopping $2,407, which would erase 12 months of gains (even if ALL previous trades were winners).

Conclusions

- Earnings are completely unpredictable. In order to make money from earnings trades held through the announcement, too many things have to go right and too many things can go wrong.

- Selling options around earnings have an edge on average for most stocks, but they have a much higher risk than buying options, especially if the options are uncovered.

- Don't confuse high probability with low risk. You can win 70-80% of the time, but you can also lose few times in a row. And when you lose, you can lose big time.

- Those "one in a lifetime events" happen more often than you believe.

- Even if you did your homework and backtesting and decided to hold your trade through earnings, always assume a 100% loss and size your position accordingly.

- Even if the backtesting shows 90% winning ratio for a certain strategy, one huge move (in any direction) can erase months and months of gains.

The bottom line: trading options around earnings can be a very profitable strategy - but closing the positions before earnings will produce much more predictable and stable results with much less volatility.

"Trying to predict the future is like driving down a country road at night with no headlights on and looking out the back window." - Peter Drucker

Related articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now