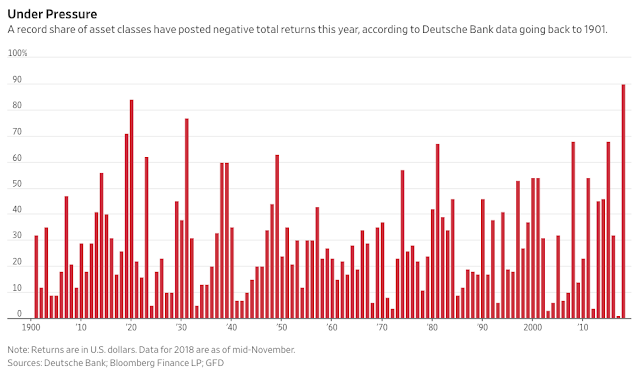

The graph below highlights the fact that while less than 2% of assets were negative in 2017, 90% of assets are negative YTD in 2018 -- they highest percentage since... ever.

2018 was a unique year in many areas. For example, 2018 was the only positive year for VXX since inception. On Monday, February 5, the Dow Jones Industrial Average declined by 1,175 points — its largest point drop in one day ever. VIX more than doubled in a single day — for the first time ever. The VelocityShares Daily Inverse VIX Short-Term exchange-traded note (XIV), a product issued by Credit Suisse, and the ProShares Short VIX Short-Term Futures exchange-traded fund (SVXY), both plunged by 80 percent in the hours after the VIX’s spike.

Those unprecedented events caused many funds to blow up their clients accounts. We covered the The Spectacular Fall Of LJM Preservation And Growth and James Cordier: Another Options Selling Firm Goes Bust, among others.

Many investors also learned in 2018 that “Blue Chip” is a marketing term. Owning these stocks will not shield you from losses. For example, IBM’s share price finished 25.6% lower in 2018, and it is one of many blue chip stocks that were punished by the market in 2018.

Some of the previous market darlings have been also punished hard in 2018. Facebook ended the year 25 percent down for 2018, and Apple was down 7 percent.

There was virtually no place to hide in 2018.

As Charlie Bilello mentions, in 2018, more than any year in recent history, the overwhelming majority of asset classes are down. In the table below of 15 asset classes ranging from stocks to bonds to REITs to Gold and Commodities, only one is higher: Cash.

If you maintain a globally diversified portfolio, this has likely been the worst year for you since 2008, with a 60/40 portfolio (AOR ETF) down just over 6%.

During periods like 2018, many traders started to realize that incorporating options strategies into their portfolios might be not a bad idea. Here is how our strategies performed in 2018:

-

Steady Options: This is our flagship service, trading variety of non directional strategies like Straddles, Iron Condors, Calendar Spreads, Butterflies, etc. The service produced 129.5% gain in 2018, proving once again that those strategies can make money in any market if implemented correctly. The model portfolio produced 17.3% return in December 2018 while most major indexes were down double digits.

-

Anchor Trades: An Anchor trades goal is to protect long portfolios and to prevent loss of capital while still generating a positive return in all market conditions. It produced 5.4% loss in 2018, slightly outperforming the S&P 500. If the correction continues, the outperformance should continue, and the hedge should start to kick in. We will be implementing more changes in 2019 to improve the strategy performance in all market conditions.

-

Steady Condors: This is a variation of Steady Condor strategy managed by the Greeks. It produced 12.9% loss in 2018, mainly driven by two huge corrections in February and October. While it is not pleasant to lose money, it is near impossible to make money with gamma negative vega negative strategy when the indexes move 3-4 SD in a matter of days and volatility doubles. Considering the market conditions, the strategy managed to keep the overall loss under control.

-

Creating Alpha: The service has two model portfolios, trading mostly VXX and TLT. The strategy produced 13.0% gain in 2018. Considering that it was short volatility during a year when VXX almost doubled and some short volatility fund blew up their accounts, we consider it a remarkable result. The Incredible Winning Trade In SVXY provides some insights on how we trade the strategy. When volatility stabilizes, the strategy should produce much better results.

2018 was a wake-up call for a whole new generation of investors who entered the stock market after 2009 and watched their long portfolios going up year after year. As we have seen, the markets can go down as well. And when they do, you are better to be prepared. This might be just the beginning.

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.