I've traded a wide range of options strategies, but, for a number of reasons, the Butterfly is my preferred trade.

The Butterfly option spread is possibly one of the least understood and least utilized options income strategies. Butterflies can be used to construct high probability positions with a profit range similar to and potentially larger than an Iron Condor with less risk. Alternatively, a short dated Butterfly option can provide a great risk/reward ratio when traded slightly out of the money. Perhaps my favorite characteristic of the Butterfly is that the position can make money prior to expiration even if price trades outside of the expiration break even points.

In this post we'll take a look at four different Butterflies with very different trading characteristics.

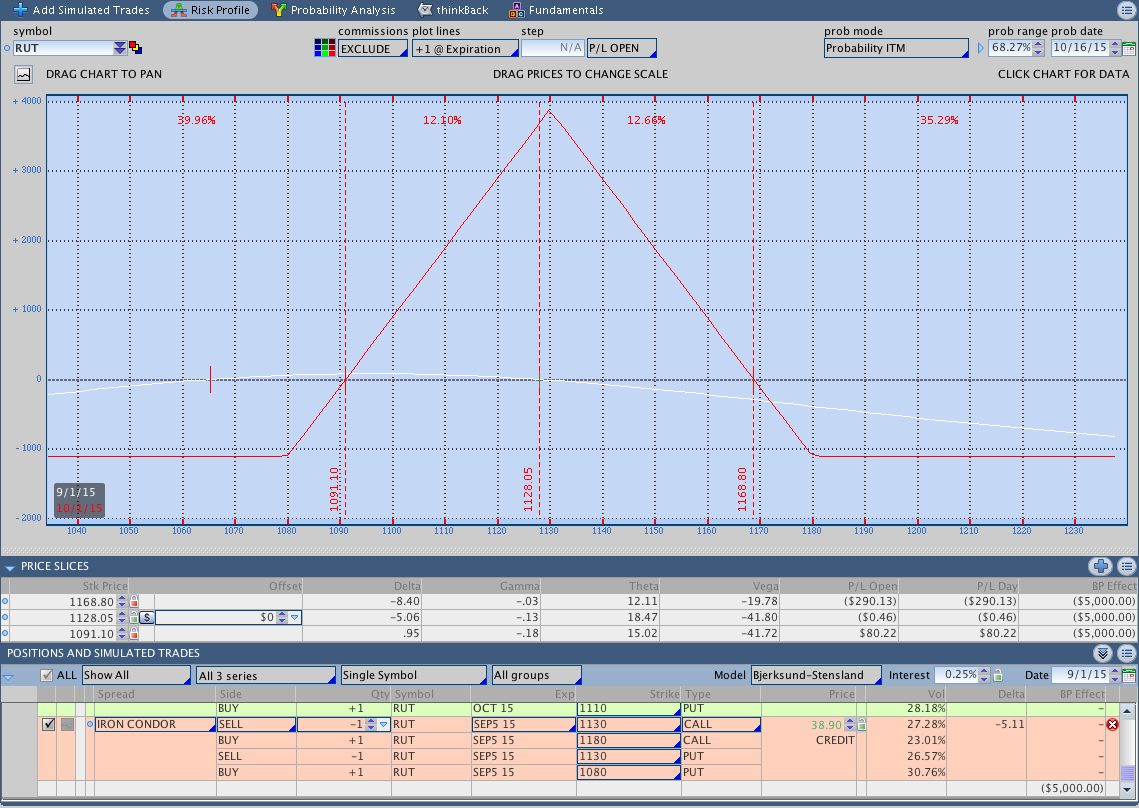

1. At The Money (ATM) Butterfly

The ATM Butterfly option is the common Butterfly spread that most options traders think about. The position is placed at the money with anywhere from 7 to 50 days to expiration depending on your strategy. The ATM Butterfly is a short delta trade and can be managed by rolling the initial position up or down or adding additional Butterflies when price trades outside of the expiration break even points. The ATM Butterfly is what most traders think of when they think of the Butterfly.

The Butterfly pictured below is an ATM Iron Butterfly in the Russell 200 (RUT) with 50 point wings and slightly under 30 days to expiration. The biggest challenge with the position is that it leans short delta and will take heat if the market rallies immediately after the trade is entered.

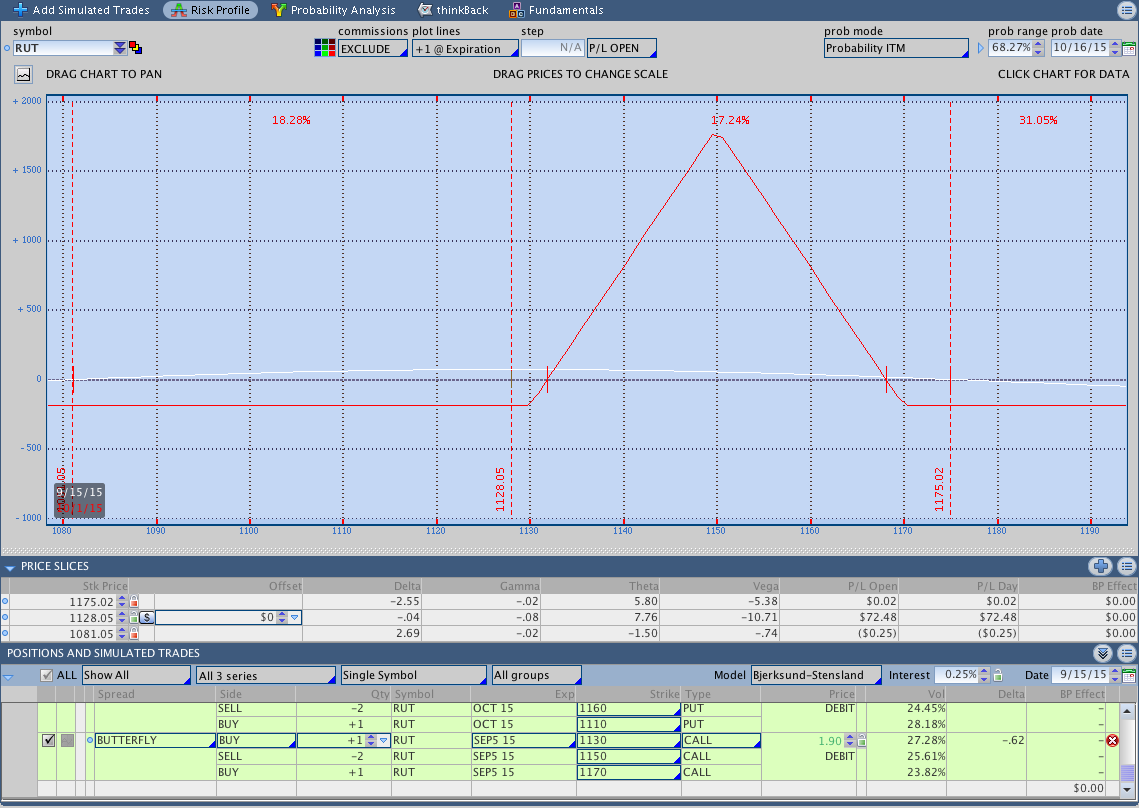

2. Directional Butterfly

The Directional Butterfly is a balanced butterfly option spread that is positioned slightly out of the money and works like a lottery ticket. Essentially you position the Butterfly above or below the market and want price to trade towards the short strike. Directional Butterflies can be purchased cheaply, which makes the risk/reward ratio very favorable. In the image below, the Russell 2000 (RUT) closed around 1130 and the image shows the 1130/1150/1170 Call Butterfly with around 30 days to expiration. The Butterfly cost is $190 with a maximum payout of around $1,800. However, risk reward isn't even the best part of the trade.

One of the great characteristics of the Directional Butterfly is that the profit/loss line will rise outside of the body of the Butterfly prior to expiration. What that means is that, prior to expiration, the range of potential profit is wider than the expiration break even lines would suggest. In the image below the T+Zero line has been advanced two weeks so we're really looking at the T+14 line. What's important to point out is that the range of profit at T+14 is from 1080 to 1175, which is almost 100 points (around an 8% range) and significantly wider than the body of the Butterfly would suggest.

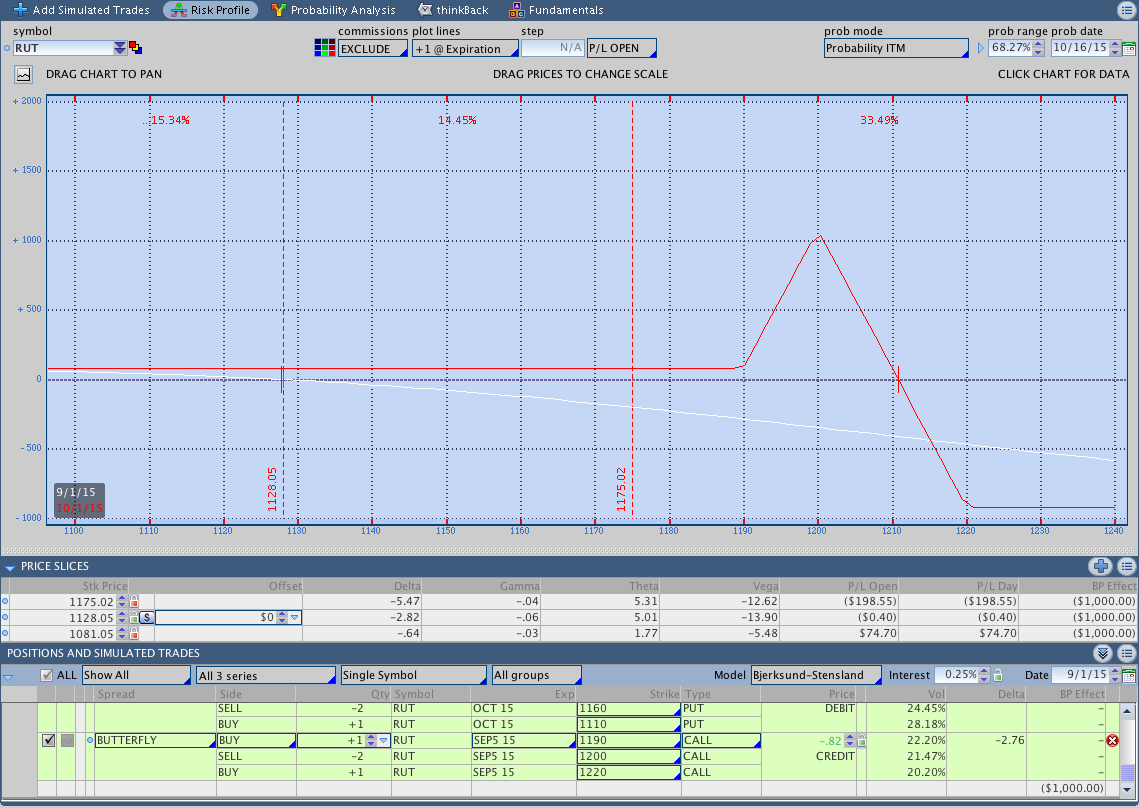

3. Broken Wing Butterfly (BWB)

The BWB is positioned slightly away from the money with unbalanced wings. The trade is usually initiated for a credit and has trading characteristics similar to an out of the money vertical spread. Since Butterflies are made up of two vertical spreads, that doesn't come as a surprise.

The broken wing Butterfly pictured below is the RUT 1190/1200/1220 Call Butterfly with 28 DTE that could have been opened for a credit of around .80. At the time of writing, the short strikes at 1200 were around 15 delta. The position is short delta and benefits directionally if price falls, but the T+Zero line will rise up near the body of the Butterfly as the trade approaches expiration.

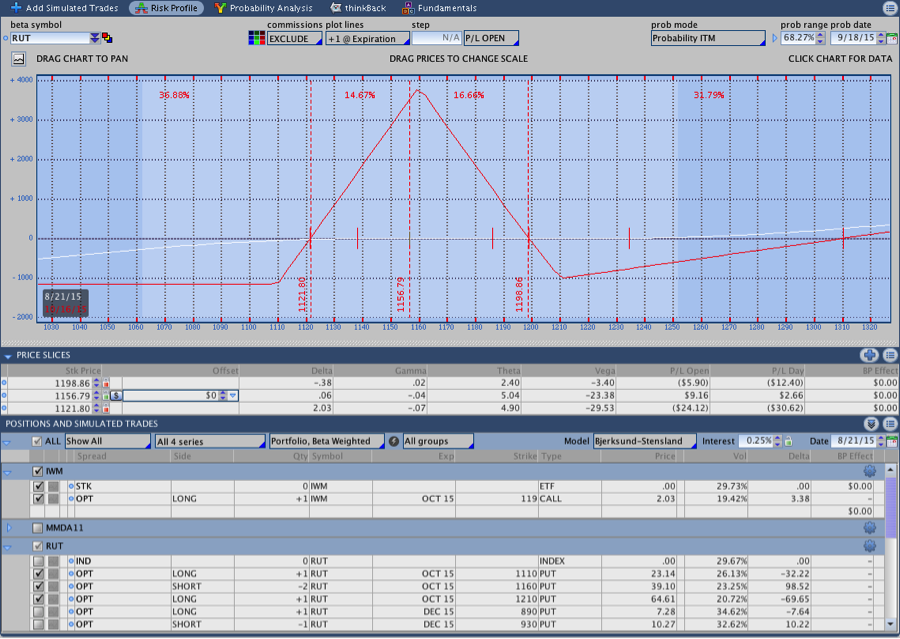

4. Consistent Income Butterfly (CIB)

The Consistent Income Butterfly is my primary trade. The CIB is the combines a Butterfly that is positioned slightly below the money with a long call. The position is constructed with 50 point wings in the Russell 2000 (RUT) and uses a ratio of one Butterfly to one IWM call. On the upside, the position is adjusted by adding up to two additional Butterflies and calls and on the downside the trade is simply rolled down.

The philosophy behind the CIB is to keep trade size small on the downside when we expect increased volatility in the markets. On the upside, we add to the position and wait for the bullish trend to rest or pull back. When the trade is started, the position has a very flat T+zero line with the goal of taking on as little directional risk as possible.

The image below shows the October 2015 position that is currently open and discussed every weekend. Notice that there is very little directional risk in the trade and a flat T+Zero line when the trade is entered.

Now what?

One of the big challenges with trading any options strategy is coming up with a set of rules for the strategy. All of the trade ideas above provide a starting point for designing an income strategy. One of the reasons the Butterfly provides a great starting point for an income strategy is that the positions have much wider break evens than you might expect. This post discusses how a Butterfly can be constructed to have a range of profit almost as wide as a high probability Iron Condor.

Even though the positions above seem forgiving, it's essential to have a trading plan before placing any trade. Trading well always means making positive expectancy decisions.

This article is presented by Dan, founder of Theta Trend, a site focused on simple, objective options trading with an awareness of trend.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now