Background

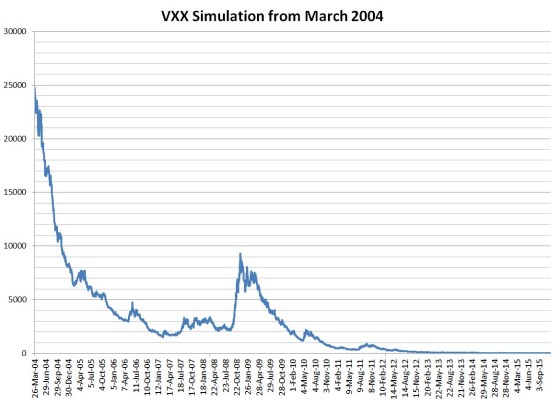

Shorting volatility proved to be very profitable historically. The reason is that VIX futures are drifting lower over time, so all you have to do is being short a product that is long volatility (like VXX) or being long an inverse product (like SVXY). Looking at VXX historical chart tells the whole story:

So what's the catch? Well, the issue with going short VXX (or being long SVXY) is those occasional big spikes, like the one in 2008. So the trick is to find a strategy that goes short VXX or long SVXY, but at the same time, doesn't lose much during those occasional spikes.

This article tells the story of an incredible SVXY trade that was a big winner despite the total collapse of SVXY.

Few months ago, SteadyOptions introduced a new strategy called PureVolatility. The portfolio is managed by our veteran member and mentor, Scott Batchelar. Here is an extract from the strategy introduction:

Strategy Description

We will be looking to hold constant exposure to short volatility while the curve is in significant Contango in an effort to harvest volatility premium. We will also look to go long volatility when the curve is in significant Backwardation and indicators reveal the trend will continue in the short term. Because the curve is in Contango approximately 80% of the time, we will hold short exposure to volatility most of the time. The main strategy to gain this exposure will be through a Collar spread.

The PureVolatility model portfolio will be based on total capital amount of $10,000 with a 5% allocation on risk. This is very important as those who are trading in a Reg-T account would on average need $10,000 in initial margin to hold the position even though the risk may only be $500. Portfolio Margin accounts would only require the $500 max loss amount. Reg-T is somewhat antiquated when it comes to margin for a Collar spread. However, this really should not be an issue because if one does not have $10,000 to put aside for this strategy it is probably not appropriate. Furthermore, the increased margin amount will keep members from over allocating to this very aggressive strategy. We will target a risk reward of better than 1:1 for a two week holding period.

Here is an example of the Hedged Collar strategy sized for the model portfolio:

- 100 shares of SVXY at 101.93

- Short 1 contract of the 11/10 110 Call at (1.35)

- Long 1 contract of the 11/10 103 Put at 5.54

Using the above example, here is the P/L chart of the trade:

Please note that the profit potential is around $400 and risk around $300.

For a strategy that wins around 80% of the time, this is an incredible risk/reward.

But it gets even better.

One of our other veteran members posted the following comment on the forum:

QuoteI agree with the trade rationale, but had a thought about a tweak to improve the trade structure that I wonder if you considered - that is replacing the 100 shares of SVXY with a deep ITM call, 90 delta or more. I see two main benefits.

- Significantly lower the capital requirement while maintaining basically the same dollar increases when the SVXY rises since the deep ITM call will grow in value almost as quick as being long the SVXY shares.

- In the event of a large volatility spike where the SVXY would drop in value very quickly, the deep ITM calls would hit a point where they are losing less than the SVXY shares (as that deep ITM strike gets closer to ATM its delta would decrease).

After some discussion, it has been decided to modify the trade and use deep ITM calls instead of the shares.

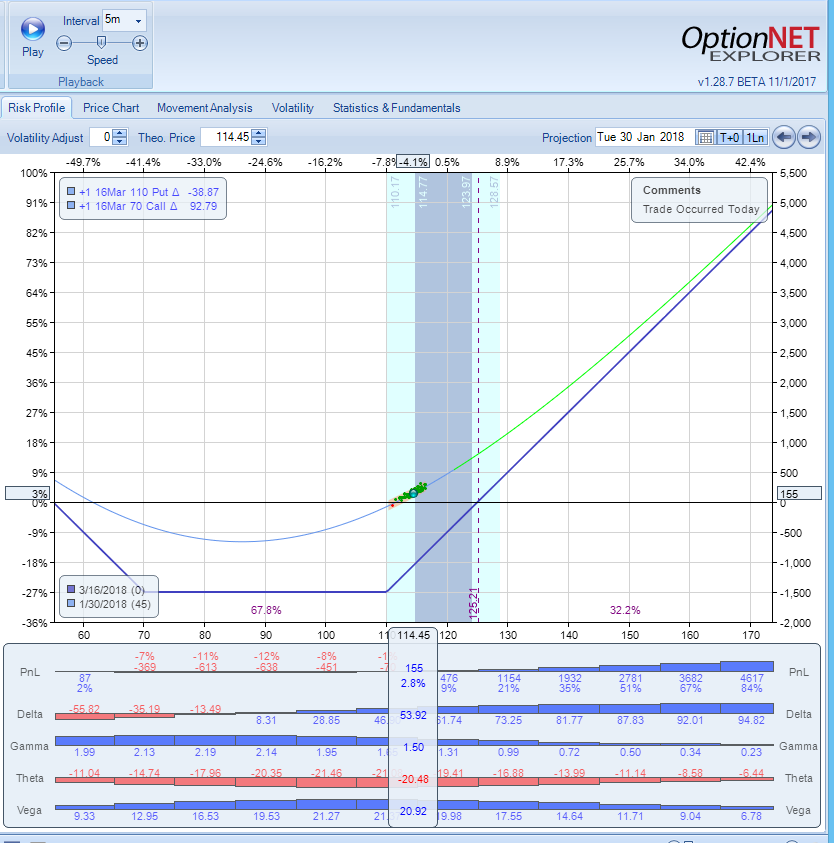

Here is an SVXY "modified" collar entered on January 30 with SVXY at 114:

QuoteI opened a new collar but I'm holding off on selling the call:

- BTO 1 March 16, 2018 70 Call

- BTO 1 March 16, 2018 110 Put

P/L chart:

Please notice how using ITM calls instead of shares allows to reduce the risk if the stock makes a big down move.

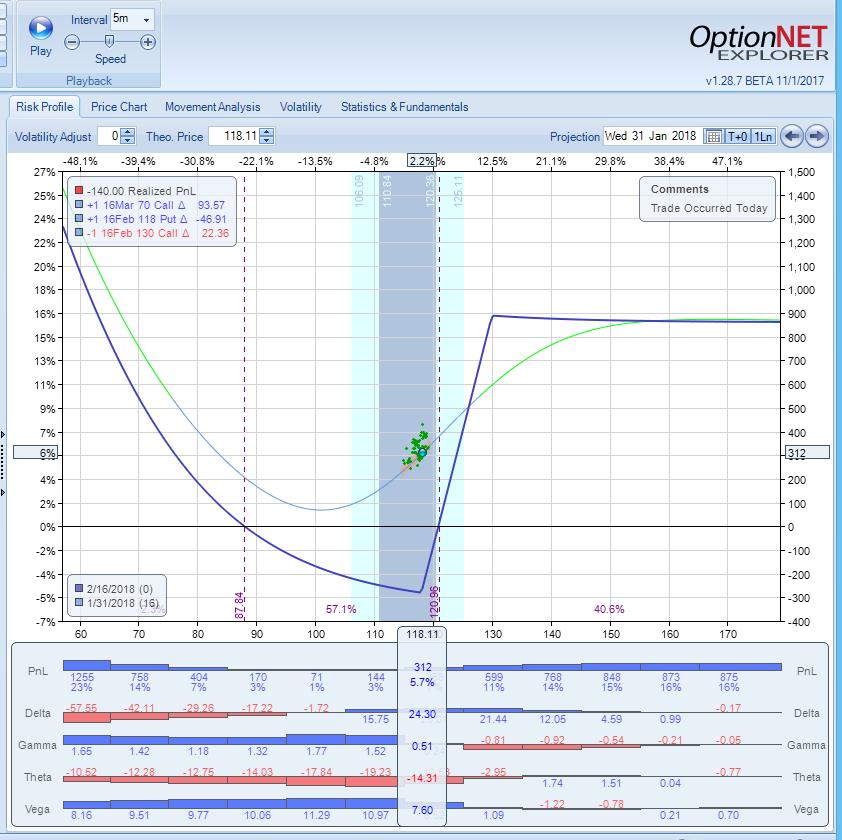

The next day SVXY moved higher and short call has been added.

On February 2 SVXY started to move down. By the end of the day on February 5, SVXY went down around 40%. After few adjustments the P/L chart looked like this:

The trade was down $750 or 7.5% loss on $10,000. This is completely reasonable, considering that the underlying was down 40%. Any bounce to $90 area should bring the trade back to breakeven.

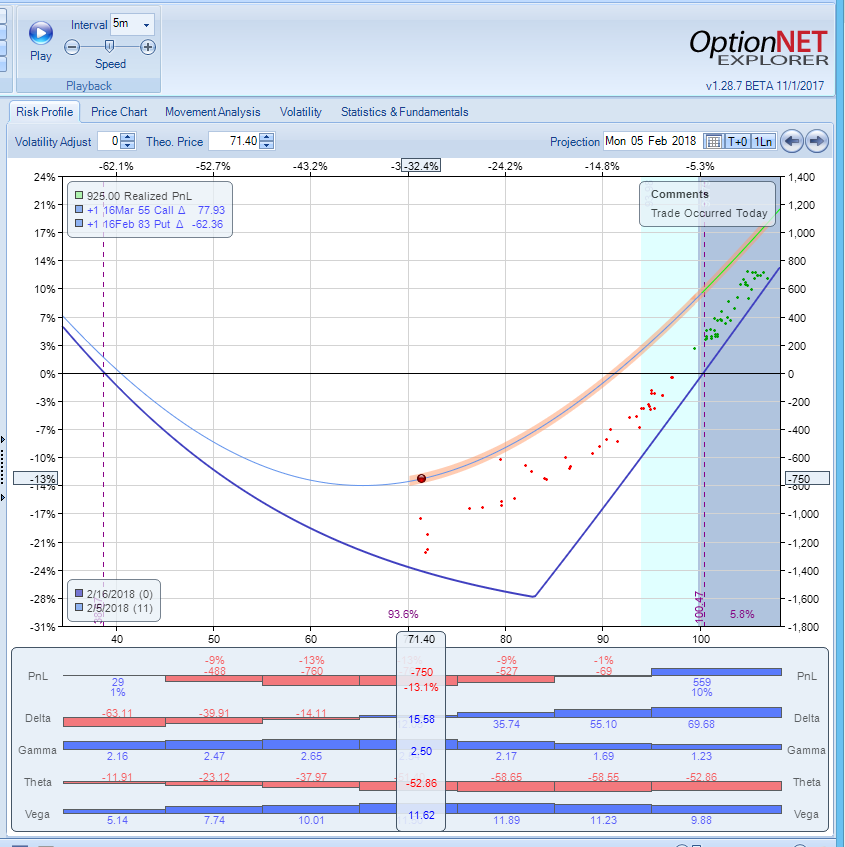

But then black Tuesday came. SVXY opened around $11, 60% down. The calls became nearly worthless, but the puts were the big winners, far outpacing the losses in the calls:

Overall this trade produced almost 45% gain on margin or 26% gain on $10,000 portfolio.

The bottom line:

A trade that was long SVXY, was a big winner after SVXY went down 90%+. This is options trading at its best. And this is the power of our trading community.

Read the full description of the PureVolatility strategy here.

Related articles:

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now