Introduction

In November of 2012, CBOE and C2 issued Information Circulars IC12-093 and IC12-015 announcing the expansion of the number of Weeklys that can be listed for certain securities. CBOE and C2 may now list up to five consecutive Weeklys in a class provided that an expiration does not coincide with one that already exists.

According to CBOE, "Weeklys were established to provide expiration opportunities every week, affording investors the ability to implement more targeted buying, selling and spreading strategies. Specifically, Weeklys may help investors to more efficiently take advantage of major market events, such as earnings, government reports and Fed announcements."

Not every stock or index has weekly options. For those that do, it basically means that every Friday is an expiration Friday. That opens tremendous new opportunities but also introduces new risks which can be much higher than "traditional" monthly options.

Basically, just about any strategy you do with the longer dated options, you can do with weekly options, except now you can do it four times each month.

Let's see for example how you could trade SPY using weekly or monthly options.

Are they cheap? Lets buy them

SPY is traded around $218 last Friday Aug. 19, 2016. Looking at ATM (At The Money) options, we can see that Sep. 16 (monthly) calls can be purchased at $2.20. That would require the stock to close above $220.20 by Sep. 16 just to break even. However, the weekly options (expiring on August 26, 2016) can be purchased at $1.08. This is 50% cheaper and requires much smaller move.

However, there is a catch. First, you give yourself much less time for your thesis to work out. Second and more importantly, the weekly options are much more exposed to the time decay (the negative theta).

The theta is a measurement of the option's time decay. The theta measures the rate at which options lose their value, specifically the time value, as the expiration draws nearer. Generally expressed as a negative number, the theta of an option reflects the amount by which the option's value will decrease every day. When you buy options, the theta is your enemy. When you sell them, the theta is your friend.

For the monthly 218 calls, the negative theta is -$4.00. That means that the calls will lose ~1.8% of their value every day all other factors equal. For the weekly calls, the negative theta is a whopping -$7.70 or 7.1% per day. And that number will accelerate as we get closer to the expiration day. You better be right, and you better be right quickly.

Buying is too risky? Maybe selling is better?

If this is the case you might say - why not to take the other side of the trade? Why not to use the accelerating theta and sell those options? Or maybe be less risky and sell a credit spread? A credit spread is when you sell an option and buy another option which is further from the underlying price to hedge the risk.

Many options "gurus" ride the wave of the weekly options trading and describe selling of weekly options as a cash machine. They say that "It brings money into my clients account weekly. Every Sunday my clients access their accounts and see + + +.” They advise selling weekly credit spreads and present it as a "a safe option strategy because we’re combining an option purchase with an option sale resulting with a credit into your account".

This short term option trading strategy can work very well... until it doesn't.

Imagine for example someone selling a 206/205 put credit spread on Thursday June 23, 2016 with SPY around $210.80. That seems like a pretty safe trade, isn't it? After all, we have just one day, what could possibly go wrong? The options will probably expire worthless and the clients will see more cash in their account by Sunday. Well, after the market close, news about Brexit took traders by surprise. The next day SPY opened below $204 and the credit spread has lost almost 100%. So much for the "safe strategy".

Of course this example of weekly options trading risks is a bit extreme, but you get the idea. Those are very aggressive trades that can go against you very quickly.

Be Aware of the Negative Gamma

So what is the biggest problem with selling the weekly options? The answer is the negative gamma.

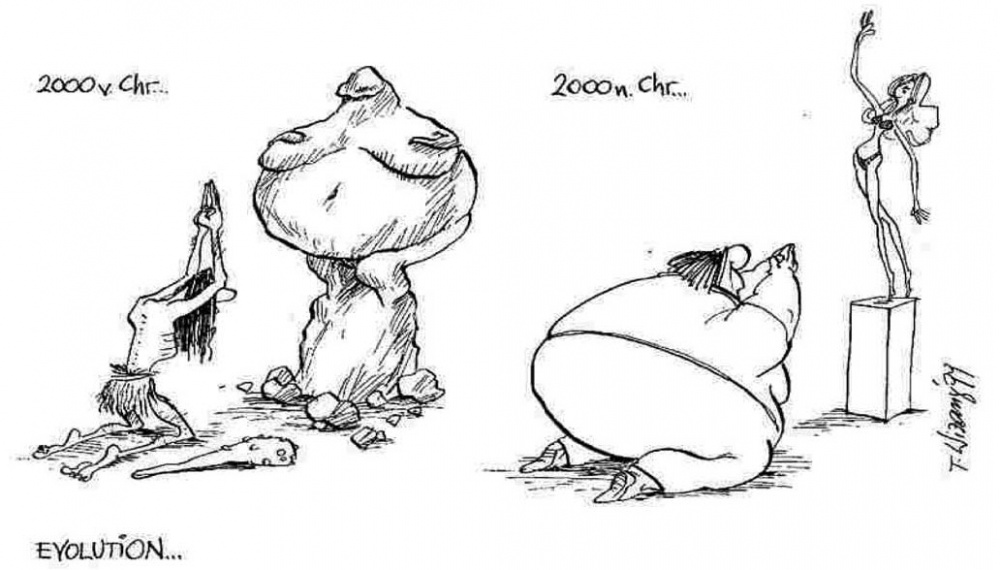

Condor Evolution. Source: http://tylerstrading.blogspot.ca/2010/09/condor-evolution.html

The gamma is a measure of the rate of change of its delta. The gamma of an option is expressed as a percentage and reflects the change in the delta in response to a one point movement of the underlying stock price. When you buy options, the gamma is your friend. When you sell them, the gamma is your enemy.

When you are short weekly options (or any options which expire in a short period of time), you have a large negative gamma. Any sharp move in the underlying will cause significant losses, and there is nothing you can do about it.

Here are some mistakes that people make when trading Iron Condors and/or credit spreads:

- Opening the trade too close to expiration. There is nothing wrong with trading weekly Iron Condors - as long as you understand the risks and handle those trades as semi-speculative trades with very small allocation.

- Holding the trade till expiration. The gamma risk is just too high.

- Allocating too much capital to Iron Condors.

- Trying to leg in to the trade by timing the market. It might work for some time, but if the market goes against you, the loss can be brutal and there is no another side of the condor to offset the loss.

The Bottom Line

So is the conclusion that you should not trade the weekly options? Not necessarily. Short term option trading can be a good addition to a diversified options portfolio - as long as you are aware of the risks and allocate only small portion of the account to those trades.

Just remember that those options are aggressive enough to create quick profits or quick losses, depending on how you use them.

Related articles:

- The Options Greeks: Is It Greek To You?

- The Risks Of Weekly Credit Spreads

- Options Trading Greeks: Gamma For Speed

- Options Trading Greeks: Theta For Time Decay

- Why You Should Not Ignore Negative Gamma

- Make 10% Per Week With Weeklys?

Want to learn how to reduce risk and put probabilities in your favor?

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now