QuoteShort term weekly options trading remains a tough road in 2016 as the weekly market volatility is whipping around weekly option traders. Case in point, our newsletter experienced a losing trade last week as bulls hammered markets higher. The loss was unfortunate but what really stood out to us were the reactions and sheer surprise of some traders.

Below is a copy of what we sent to our members over the weekend to remind them of just how aggressive (and volatile) weekly options trading can be:

Last week's loss stings, of course. The market ground higher all day Friday eating further into the expiring call spread. What was worse was that prudent adjustments for the trade were nonexistent.

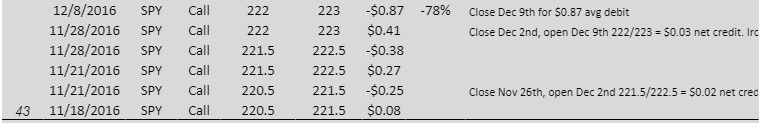

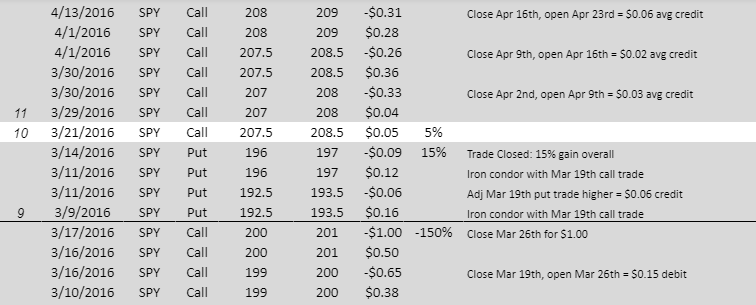

Our weekly credit spreads are highly exposed to Short Gamma (the option greek) and the latest trade was a textbook example of it. As SPY ground higher debits to adjust exceeded $0.10 to simply the move the trade out a week and up $0.50. Doing so would have resulted in the new adjusted trade still being well in the money. We have been bitten before by that bug (paying to adjust higher while not actually reducing the risk to the new adjusted trade) before in March 2016 and did not want to repeat that experience.

The issue with weekly credit spreads is that everybody likes the fast pace weekly profits of weekly credit spreads until they take a loss. The weekly credit spread game is that there are many, many small profits and the losses are ALWAYS larger than the gains. That is how it works. That is risk curve of weekly credit spreads.

Although, when a loss occurs, retail traders become flabbergasted. The biggest misstep most retail traders make is underestimating the aggressiveness of our newsletter (and weekly credit spreads in general) due to its years of fairly smooth profits.

Retail traders are lulled into a false sense of security with weekly credit spreads forgetting that along with extreme profits (>4% per week and >100% per year) comes a healthy dose of risk. Look at it from another view: If large profits like that were easily available at low risk wouldn't everybody be producing them? Mutual funds and the like?

Weekly credit spreads are very volatile and aggressive; despite how their ease and consistency can lull you into a sense of safety. Think about, you don’t make >4% PER WEEK by not taking risk.

The real success and consistency over the long term in selling options is using expirations further out.

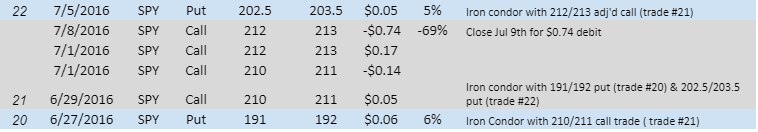

I appreciate the email. Those are very wise words. Too bad this email came after three devastating losses the newsletter experienced in 2016 (150%, 78% and 69% losses before commissions).

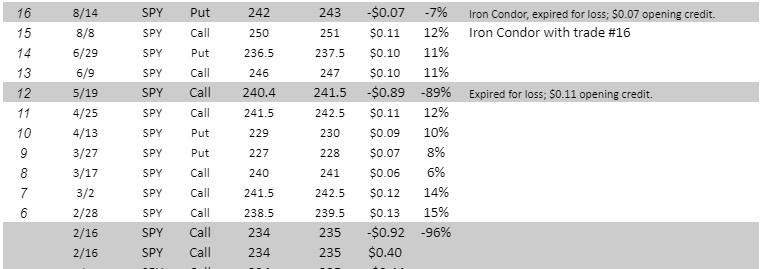

Unfortunately, it looks like they didn't really learn any lessons from those losses. The newsletter members already booked two more devastating losses of 96% and 89% in the first five months of 2017.

Definition of insanity is "doing the same thing over and over again and expecting different results".

From the FAQs of this newsletter:

Quote

Q: How much money can I lose?

A: You can lose $100 per spread traded, less whatever we received as a credit when we entered the trade. We do everything we can to prevent large losses and have yet to have greater than a -15% loss on any trade. Statistically and as experienced in our Track Record, losses should not occur very often.

As we mentioned here: Oftentimes you'll find this in a credit spread newsletter where the big loss just hasn't happened yet (it will).

Here is the problem with weekly credit spreads: most of the time, they will do fine, but if the market really does go south the position will be in trouble well before the short options go in-the-money. If the market drop is fast and severe (e.g., flash crash) there will be nothing you can do - the trades will be blown out with no way to recover, your entire investment will be gone.

We warned about those "easy gains" several times. This is what we wrote in Can You Really Make 10% Per Month With Iron Condors? article:

Here are some mistakes that people do when trading Iron Condors and/or credit spreads:

- Opening the trade too close to expiration. There is nothing wrong with trading weekly Iron Condors - as long as you understand the risks and handle those trades as semi-speculative trades with very small allocation.

- Holding the trade till expiration. The gamma risk is just too high.

- Allocating too much capital to Iron Condors.

- Trying to leg in to the trade by timing the market. It might work for some time, but if the market goes against you, the loss can be brutal and there is no another side of the condor to offset the loss.

Unfortunately, many options gurus present those strategies as safe and conservative. Nothing can be further from the truth. As mentioned (correctly) in the above email, weekly credit spreads are very volatile and aggressive. You should allocate only small portion of your options account to those trades.

Related articles:

- Can You Really Make 10% Per Month With Iron Condors?

- Why Iron Condors Are NOT An ATM Machine

- Why You Should Not Ignore Negative Gamma

- Get Real

- Trade Iron Condors Like Never Before

Want to learn how we reduce our risk?

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.