SMPW is based on a $100,000 model portfolio that sells slightly out of the money put options on global equity indexes and ETF’s. The strategy uses modest accounting leverage, targeting 125% notional exposure. The strategy also increases expected returns by holding collateral assets in short to intermediate term fixed income ETF’s.

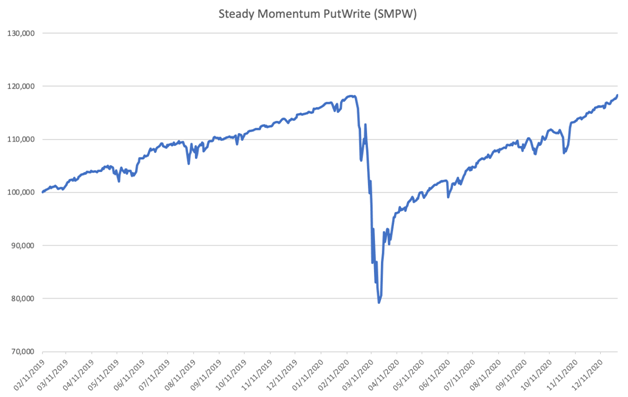

The SMPW model portfolio returned 2.75% in 2020, outperforming the PUTW benchmark return of 1.65%. Since the official February 11, 2019 inception, our SMPW approach to put writing has outperformed PUTW by 7.12%. The SMPW annualized return since inception is currently 10.59%, vs 5.74% for PUTW. One of the unique characteristics of SMPW is the level of transparency we offer to members. The long-term theory and data for the strategy has been posted on the member board and in my various blog posts, and every trade alert provides the updated account value of the model portfolio. Additionally, at the end of every month an excel spreadsheet is provided to members showing the daily account value since inception. Our members feel confident in their ability to manage the strategy in their self-directed accounts and to replicate model portfolio results.

2020 will be remembered for the record setting speed of the February and March bear market as equity prices quickly adjusted to the potential economic impact of the global pandemic. From February 19th to March 23rd the S&P 500 dropped 33%, creating the first major stress test for our strategy. As expected, our model portfolio declined along with the market as put option values increased dramatically due to the price change and volatility increase.

Put writing provides a risk and return profile similar to insurance contracts. The put option buyer transfers the risk of surprise market losses to the option seller in exchange for a premium set by the supply and demand of market participants. Like an insurance company, put option sellers take on this risk with the expectation of long-term profits. If this were not true, no market participant would rationally sell puts. Occasional losses occur depending on strike selection which is similar to a deductible, providing the insurance like protection the put option buyer desires and is willing to pay for. For this reason, we believe put option writing is a sustainable alternative risk premium that can be earned in a passive manner without needing to skillfully time entries and exits. Historical market data shows a large and consistent tendency for option implied volatility to exceed realized volatility, which is in essence our source of expected profits along with the fixed income returns of our collateral ETF’s.

Our model portfolio recovered to new highs from April through year end as option prices adjusted upward to the pandemic risks similar to how insurance prices often increase after claims are paid out. We enter 2021 with VIX at $22.75, which is slightly above its long-term average. With the S&P 500 at all-time highs, market participants are still pricing in the potential for volatility until there is more certainty that the pandemic and all of its economic ramifications are behind us.

In 2021 the tactical element of the SMPW strategy strike selection process will be removed. The short delta of the strikes sold will no longer be determined by momentum signals, as this element of the strategy has been a net detractor to performance since inception. This decision is based on observations about how equity markets have evolved. Therefore the service will be renamed to "Steady PutWrite". We'll also be making an ETF change to our underlying fixed income collateral assets.

Our approach will otherwise remain consistent, selling and rolling put contracts in a disciplined manner with the goal of continuing to add value relative to our benchmark. Below is a chart displaying the path traveled for our model portfolio since inception that is useful as a visual aid to supplement the monthly returns listed on the strategy performance page.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

- Combining Momentum And Put Selling

- Combining Momentum And Put Selling (Updated)

- Steady Momentum ETF Portfolio

- Equity Index Put Writing For The Long Run

- Can You "Time" The Steady Momentum PutWrite Strategy?

- How Steady Momentum Captures Multiple Risk Premiums

- Put Selling: Strike Selection Considerations

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.