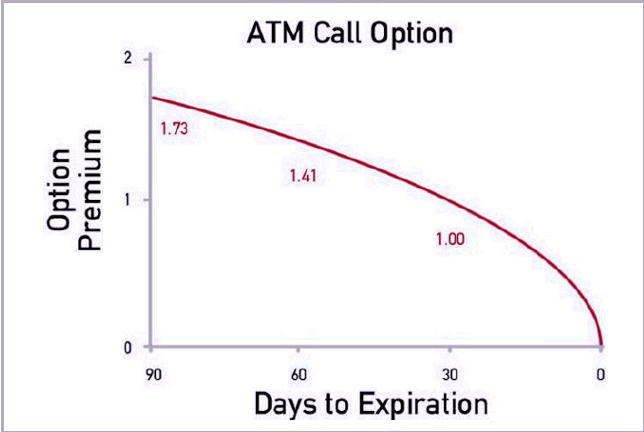

In other words, an option premium that is not intrinsic value will decline at an increasing rate as expiration nears.

The Theta is one of the most important Options Greeks.

Negative theta vs. positive theta

Theta values are negative in long option positions and positive in short option positions. Initially, out of the money options have a faster rate of theta decay than at the money options, but as expiration nears, the rate of theta option time decay for OTM options slows and the ATM options begin to experience theta decay at a faster rate. This is a function of theta being a much smaller component of an OTM option's price, the closer the option is to expiring.

Theta is often called a "silent killer" of option buyers. Buyers, by definition, have only limited risk in their strategies together with the potential for unlimited gains. While this might look good on paper, in practice it often turns out to be death by a thousand cuts.

In other words, it is true you can only lose what you pay for an option. It is also true that there is no limit to how many times you can lose. And as any lottery player knows well, a little money spent each week can add up after not hitting the jackpot for a long time. For option buyers, therefore, the pain of slowly eroding your trading capital sours the experience.

When buying options, you can reduce the risk of negative theta by buying options with longer expiration. The tradeoff is smaller positive gamma, which means that the gains will be smaller if the stock moves.

Option sellers use theta to their advantage, collecting time decay every day. The same is true of credit spreads, which are really selling strategies. Calendar spreads involve buying a longer-dated option and selling a nearer-dated option, taking advantage of the fact that options expire faster as they approach expiration.

You can see the accelerated curve of option time decay in the following graph:

As a general rule of thumb, option sellers want the underlying to stay stable, while option buyers want it to move.

List of positive theta options strategies

- Short Call

- Short Put

- Short Straddle

- Short Strangle

- Covered Call Write

- Covered Put Write

- Long Calendar Spread

- Vertical Credit Spread

- Iron Condor

- Butterfly Spread

List of negative theta options strategies

- Long Call

- Long Put

- Long Straddle

- Long Strangle

- Vertical Debit Spread

Watch this video:

Related articles:

- The Options Greeks: Is It Greek To You?

- Options Trading Greeks: Vega For Volatility

- Options Trading Greeks: Delta For Direction

- Options Trading Greeks: Gamma For Speed

Want to learn how to put the Options Greeks to work for you?

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now