.thumb.jpg.34e68265831055a6b173dc419a59b53e.jpg)

Within our Steady Momentum Put Write service, we reduce the impact of timing luck by diversifying our contracts across multiple expirations and multiple underlying products.

To illustrate, we’ll use the ORATS Wheel to backtest SPY 40 delta puts using the expiration closest to 30 days. Trades are assumed to be held until expiration, at which point a new trade is initiated. We find a near double digit difference in year to date performance if trading started at the close on December 31st 2019 vs. starting on expiration Friday January 17th 2020.

YTD results with 12/31 start date: +4.65%

YTD results with 01/17 start date: -4.76%

Difference: 9.41%

Monthly returns, 12/31 start date:

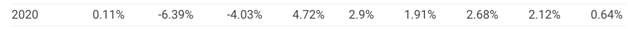

Monthly returns, 01/17 start date:

With options, the expiration “clock” can work for or against you. This luck is an uncompensated source of risk, which we can diversify away by laddering contracts across multiple expirations. For example, if your position sizing algorithm required you to trade 4 contracts you can minimize the impact of timing luck by laddering the contracts across 4 expirations.

Each week as a contract expires, you can redeploy that contract to the new expiration closest to 30 days. This keeps your total portfolio delta more stable since you’re resetting contracts at your target delta every week.Placing all contracts on the same expiration results in an undesirable portfolio delta of 0 or 1 to the underlying on a more frequent basis. This laddering approach is less time and transaction cost intensive than delta hedging, which is often used as an alternative.

Summary

Over time, the impact of a laddered approach may increase the risk-adjusted returns of a put write strategy by smoothing out portfolio volatility. Trades that experience bad luck are balanced out by trades that experience good luck. Combining the two sets of returns shown in this article would create an approximately breakeven result so far in 2020. Laddering, along with diversifying across products tracking other indexes such as IWM, EFA, and EEM helps increase the long-term reliability of positive returns.

Put writing has a positive expected return over time due to the volatility and equity risk premiums, and our goal should be to maximize these factors as the variables that explain our returns.This is similar to an insurance company building a profitable business around the law of large numbers. By diversifying their risk of claims across many different policyholders, the probability of getting the expected outcome increases.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

- Combining Momentum And Put Selling

- Combining Momentum And Put Selling (Updated)

- Steady Momentum ETF Portfolio

- Equity Index Put Writing For The Long Run

- Can You "Time" The Steady Momentum PutWrite Strategy?

- How Steady Momentum Captures Multiple Risk Premiums

- Put Selling: Strike Selection Considerations

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now