They get a bad name because of their short-term nature, but at their core, they're just options with a shorter lifespan. All of the same principles of options apply to them, so if you can get past the stigma associated with them, there are plenty of trading opportunities present. As Euan Sinclair once said about this subject, “the house cat and tiger have more similarities than differences.”

And by the way, for those associating weekly options with gambling, you should know that most major financial institutions nowadays are significant players in weeklies. Just ask Roni Israelov, the former manager of options strategies at AQR, who told the FT, "If I have monthly options, I get 12 independent bets per year. If I have weekly, I get 52 bets per year. Daily gives me 252. If you're generating trading strategies, the ability to have more 'at bats' and more diversification by taking more independent trades can be useful."

Increased Capital Turnover

Suppose you're a mechanical options trader who routinely sells options in 45-60 DTE expirations with high implied volatilities. Take your profits at 50% of max profit. And you could hold your average trade for a few weeks before reaching your desired profit level.

If we take the same assumptions but with shorter, 10-15 day expirations, you'll be holding your average trade for just a few days.

You're turning over your capital several times quicker, and assuming you can select trades with a similar expected value, you're able to generate higher returns, increasing your sample size and, in theory, decreasing the variance of your portfolio.

I'm simplifying in a big way. Short-dated options have different properties in the form of market dynamics and Greeks that'll affect this equation considerably.

However, the concept is that getting more "at-bats," to use Israelov's word from the intro of this piece, is typically better, assuming you can keep the rest of the variables relatively constant.

Volatility is More… Volatile in Weekly Options (“Vol-of-Vol”)

As a principle, shorter-dated (i.e., weekly options) have less vega than longer-dated options. To note, vega is an option's sensitivity to changes in implied volatility. Just like delta, theta, and gamma, the consequences of an option's vega are straightforward to calculate. For each one-point increase in implied volatility, the option price should change by its vega.

For instance, let's take an SPX call option worth $10.00 with an implied volatility of 18 and a vega of .20. Should the implied volatility of the chances increase to 19, the option's price would increase to $10.20. This works in both directions.

Because short-dated options typically have low vega, many traders mistakenly assume that weekly options are relatively unaffected by vega, i.e., the risk of implied volatility increasing or decreasing.

But that would be incorrect. While short-dated options have low vega on the face, the implied volatility on short-dated possibilities is much more volatile. In other words, volatility is more… volatile.

The effects of short-term volatility dampen with time. Without referencing actual numbers, think about the difference in how the value of a 1-year LEAP and a 1-day weekly option would respond to a 10% change in the underlying price. Sure, both values are affected, but with a whole year until expiration, that 10% one-day change is almost a blip on the radar as far as where the underlying will be a year out.

So short-term implied volatility needs to account not only for these "black swan" type risks but also for business-as-usual, which is realized volatility being below implied.

The sellers of these options aren’t naive and need to be compensated for taking on this wide range of risks, so they demand a higher variance premium.

So this property of short-dated options can both help and harm you, depending on which side of the trade you’re on and what type of risks you prefer to take.

Volatility is Sometimes Too High (Or Low)

In the previous section, we discussed how the implied volatility on short-dated options is more volatile than the IVs on longer-dated options. This is because, with so little time to expiration, a slight short-term aberration like order flow or a piece of news can dramatically affect where the underlying trades are at expiration. With more time to expiration, these factors sort themselves and volatility tends to remain closer to a longer-term average

With volatility being more volatile in these options, you can sometimes identify periods in which the market overreacts and you deem volatility too high or low, allowing you to swoop in and make a good trade quickly.

Theta Decay is Different in Weekly Options

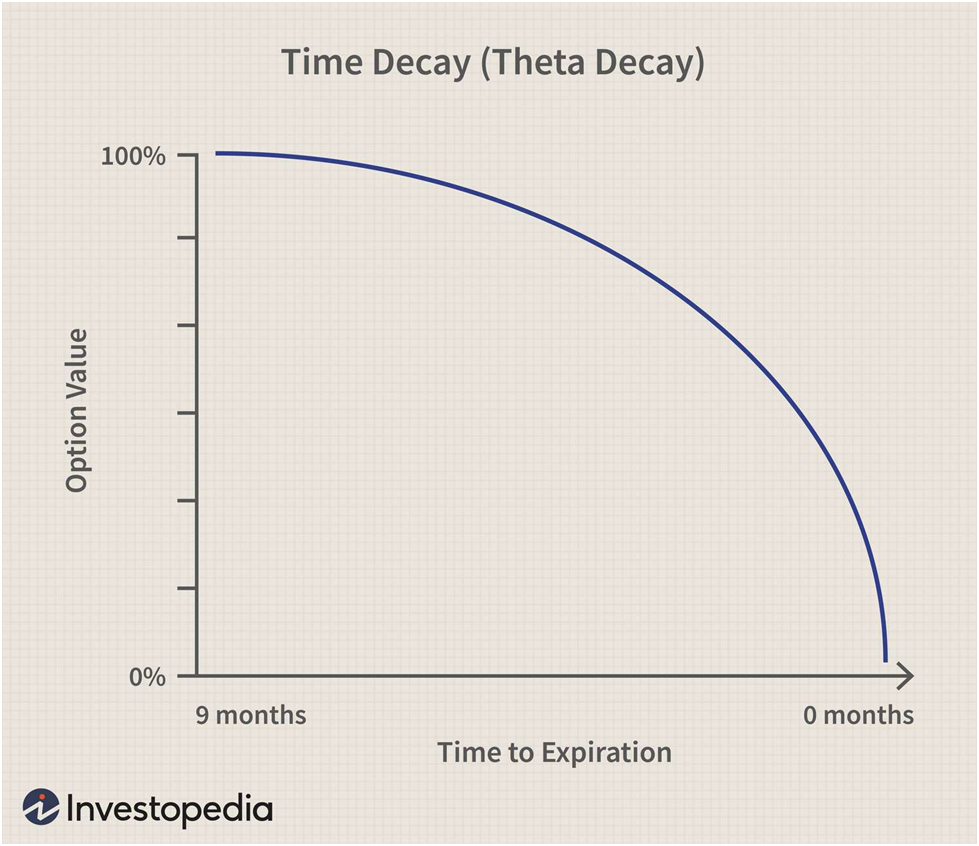

Longer-dated options benefit from significantly positive theta, giving a trader who sells longer-dated options a positive carry from theta decay. Throughout the life of the option, theta decay occurs at a non-linear rate. Here's a chart for an intuitive sense:

One of the most common arguments in favor of longer-dated options, specifically in the range of 30-45 days to expiration, is that these options not only have much theta, but they're right at the sweet spot where the rate of theta decay begins to accelerate. Indeed a strong argument.

And proponents of this philosophy are right. The absolute level of theta for longer-dated options is indeed higher. The theta decay per day as a percentage of the option price is much higher in shorter-dated options.

Let’s compare the same strike in two different expirations. A $SPY .30 delta call expiring in five days is trading for $1.21 with a theta of -0.21, representing a -17% rate of decay daily, while a .32 delta call expiring in 37 days is trading for $4.10 with a theta of -0.11, which is a -2.61% rate of daily decay. Of course, the rate of theta decay will accelerate in the longer-dated option as expiration nears.

So you have two options, both of which are inherently correct. You can go with the longer-dated option at the "sweet spot" of the theta decay curve and ride it for a few weeks, or you can churn and burn weekly options, turning your capital over and moving on from trades very quickly.

Weekly Options Have Very High Gamma

If you recall, gamma is the rate of change of delta. The higher the gamma, the more dramatically a tick in the underlying will affect the delta. As a rule, the closer options get to expiration, the higher their gamma is, especially for near-the-money options.

But why is this? As expiration nears, options that aren't in the money expire worthless. This makes the value of near-the-money options highly suspect and subject to massive price swings, which is the intuitive definition of gamma.

There's an increased uncertainty as to which options will expire worthless, so each tick in the underlying creates more significant swings in the delta as you get closer to expiration.

This is a gift and a curse. If you're on the right side of the market, you see significant gains quickly, but getting caught on the other side means your fortune quickly wanes.

Bottom Line

Weekly options to monthly options as day trading are swing trading. Fortunes are won and lost more rapidly in weekly options, and they favor the bolder, faster-acting trader over the analytical "dot the i's and cross the t's" type of trader.

Plenty of successful traders trade weekly options, those that trade longer-dated options, and many that trade both. Options trading is very much about trade-offs, and said trade-offs often come down to temperament or personal preference.

One sure thing is that if you trade weekly options, you have to become much more active as a trader, which is a cost in itself.

Related articles:

- The Use And The Abuse Of The Weekly Options

- The Risks Of Weekly Credit Spreads

- Should You Trade Weekly Options?

- Make 10% Per Week With Weeklys?

- Are Weekly Options A Form Of Gambling?

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now