.thumb.jpg.edde250417e33aecd7c978191bcf8a5f.jpg)

It's a core tenant of how options are priced, and it's often the trader with the most accurate volatility forecast who wins in the long term.

Whether you like it or not, you're taking an inherent view on volatility anytime you buy or sell an option. By purchasing an option, you're saying that volatility (or how much the options market thinks the underlying will move until expiration) is cheap, and vice versa.

With volatility as a cornerstone, some traders prefer to do away with forecasting price directionality entirely and instead trade based on the ebbs and flows of volatility in a market-neutral fashion.

Several option spreads enable such market-neutral trading, with strangles and straddles being the building blocks of volatility trading.

But even though straddles and strangles are the standards, they sometimes leave something to be desired for traders who want to express a more nuanced market view or limit their exposure.

For this reason, spreads like iron condors and butterflies exist, letting traders bet on changes in options market volatility with modified risk parameters.

Today, we’ll be talking about the iron condor, one of the most misunderstood options spreads, and the situations where a trader may want to use an iron condor in favor of the short strangle.

What is a Short Strangle?

Before we expand on the iron condor and what makes it tick, let's start by going over the short strangle, a short-volatility strategy that many view as the building blocks for an iron condor. An iron condor is essentially just a hedged short strangle, so it's worth understanding them.

A strangle comprises an out-of-the-money put and an OTM call, both in the same expiration. A long strangle involves buying these two options, while a short strangle involves selling them. The goal of the trade is to make a bet on changes in volatility without taking an outright view on price direction.

As said, strangles and straddles are the building blocks for options volatility trading. More complex spreads are constructed using a combination of strangles, straddles, and "wings," which we'll explore later in the article.

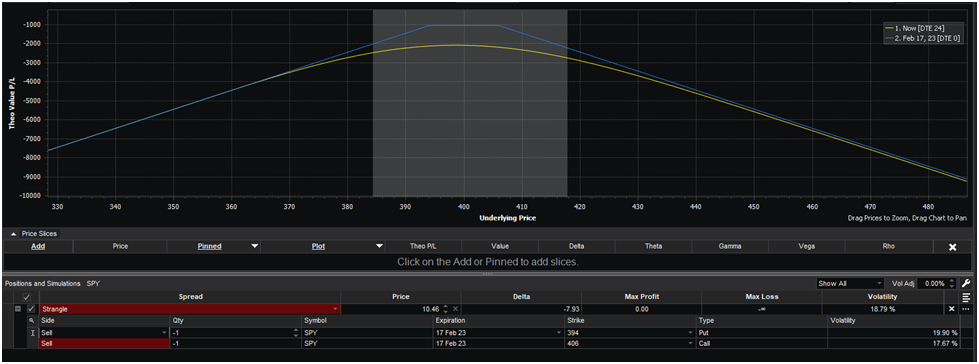

Here’s an example of a textbook short strangle:

The goal for this trade is for the underlying to trade within the 395-405 range. Should this occur, both options expire worthless, and you pocket the entire credit you collected when you opened the trade.

However, as you can see, you begin to rack up losses as the market strays outside of that shaded gray area. You can easily calculate your break-even level by adding the credit of the trade to each of your strikes.

In this case, you collect $10.46 for opening this trade, so your break-even levels are 415.46 and 384.54.

But here's where the potential issue arises. As you can see, the possible loss in this trade is undefined. Should the underlying go haywire, there's no telling where it could be by expiration. And you'd be on the hook for all of those losses.

For this reason, some traders look to spreads like the iron condor, which lets you bet on volatility in a market-neutral fashion while defining your maximum risk on the trade.

Iron Condors Are Strangles With “Wings”

Iron condors are market-neutral options spreads used to bet on changes in volatility. A key advantage of iron condors is their defined-risk property compared with strangles or straddles. The unlimited risk of selling strangles or straddles is

Iron condors are excellent alternatives for traders who don't have the temperament or margin to sell straddles or strangles.

The spread is made up of four contracts; two calls and two puts. To simplify, let's create a hypothetical. Our underlying SPY is at 400. Perhaps we think implied volatility is too high and want to sell some options to take advantage of this.

We can start by constructing a 0.30 delta straddle for this underlying. Let's use the same example: selling the 412 calls and the 388 puts. We're presented with the same payoff diagram as above. We like that we're collecting some hefty premiums, but we don't like that undefined risk.

Without putting labels on anything, what would be the easiest way to cap the risk of this straddle? A put and a call that is both deeper out-of-the-money than our straddle. That's pretty easy. We can just buy further out-of-the-money options. This is all an iron condor is, a straddle with "wings."

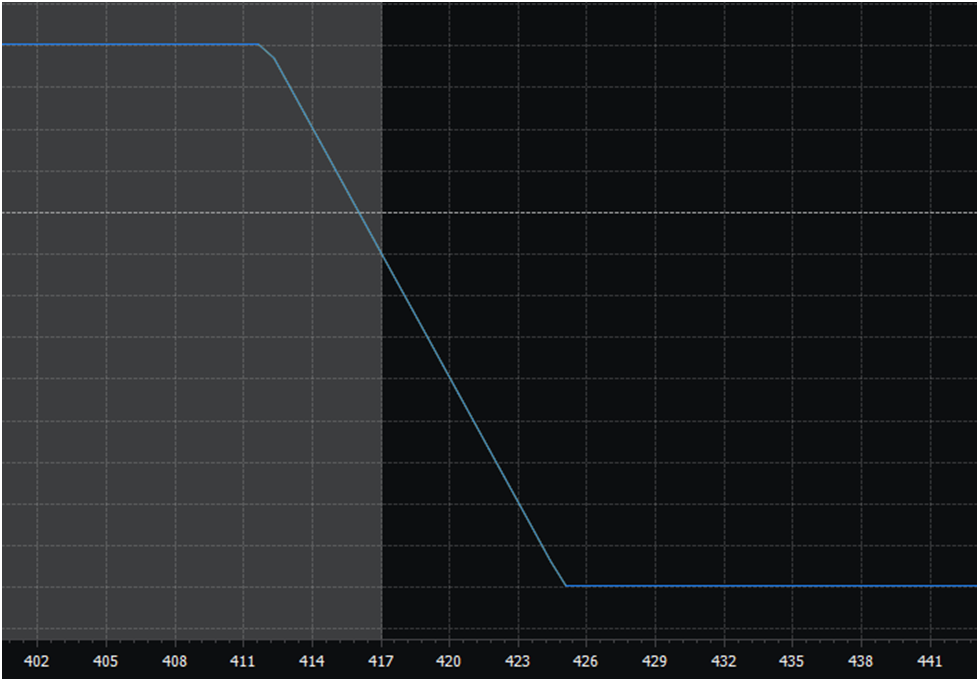

Another way of looking at iron condors is that you’re constructing two vertical credit spreads. After all, if we cut the payoff diagram of an iron condor in half, it’s identical to a vertical spread:

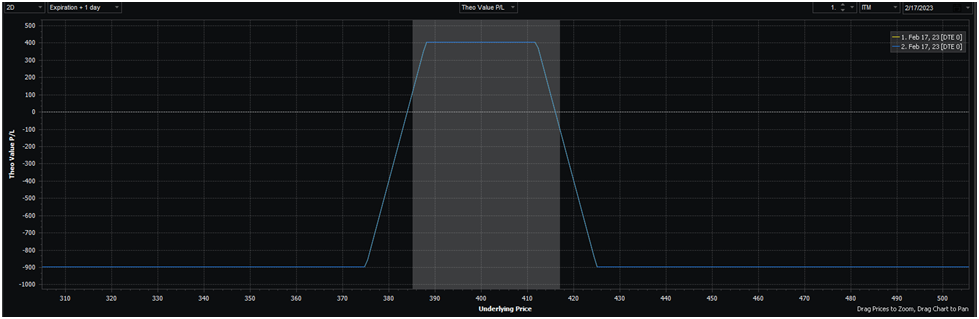

Here’s what a standard iron condor might look like when the underlying price is at 400:

● BUY 375 put

● SELL 388 put

● SELL 412 call

● BUY 425 call

The payoff diagram looks like this:

The Decision To Use Iron Condors vs. Short Strangles

Ever wonder why the majority of professional options traders tend to be net sellers of options, even when on the face of things, it looks like you can make huge home runs buying options?

Many natural customers in the options market use them to hedge the downside in their portfolios, whether that involves buying puts or calls.

They essentially use options as a form of insurance, just like a homeowner in Florida buys hurricane insurance not because it's a profitable bet but because they're willing to overpay a bit for the peace of mind that their life won't be turned upside down by a hurricane.

Many option buyers (not all!) operate similarly. They buy puts on the S&P 500 to protect their equity portfolio, and they hope the puts expire worthless, just as the Florida homeowner prays they never have actually to use their hurricane insurance.

This behavioral bias in the options market results from a market anomaly known as the volatility risk premium. All that means is implied volatility tends to be higher than realized volatility. And hence, net sellers of options can strategically make trades to exploit and profit from this anomaly.

There's a caveat, however. Any source of returns that exists has some drawback, a return profile that perhaps isn't ideal in exchange for earning a return over your benchmark. With selling options, the risk profile scares people away from harvesting these returns.

As you know, selling options has theoretically unlimited risk. It's critical to remember that when selling a call, you're selling someone else the right to buy the underlying stock at the strike price. A stock can go up to infinity, and you're on the hook to fulfill your side of the deal no matter how high it goes.

So while there can be a positive expected value way to trade from the short side, many aren’t willing to take that massive, undefined risk.

And that's where spreads like the Iron Condor come in. The additional out-of-the-money puts and calls, often referred to as 'wings,' cap your losses, allowing you to short volatility without the potential for catastrophe.

But it's not a free lunch. You're sacrificing potential profits to assure safety from catastrophic loss by purchasing those two OTM options. And for many traders, this is too high a cost to harvest the VRP.

In nearly any, backtest or simulation, short strangles come up as the clear winner because hedging is generally -EV. For instance, take this CBOE index that tracks the performance of a portfolio of one-month .15/.05 delta iron condors on SPX since 1986:

Furthermore, there's the consideration of commissions. Iron condors are made up of four contracts, two puts, and two calls. This means that iron condor commissions are double that of short strangles under most options trading commission models.

With the entry-rate retail options trading commission hovering around $0.60/per contract, that’s $4.80 to open and close an iron condor.

This is quite an obstacle, as most iron condors have pretty low max profits, meaning that commissions can often exceed 5% of max profit, which has a big effect on your bottom line expected value.

Ultimately, it costs you in terms of expected value and additional commissions to put on iron condors. So you should have a compelling reason to trade iron condors in favor of short strangles.

Bottom Line

Too many traders get stuck in the mindset of "I'm an iron condor income trader" when the market is far too chaotic and dynamic for such a static approach. The reality is that there's an ideal strategy for risk tolerance at a given time, in a given underlying.

Sometimes the overall market regime calls for a short-volatility strategy, while others call for more nuanced approaches like a calendar spread.

There are times when it makes sense to trade iron condors when implied volatility is extremely high, for instance. High enough that any short-vol strategy will print money, but too high to be naked short options. Likewise, there are times when iron condors are far from the ideal spread to trade.

Another comparison is Iron Condor Vs. Iron Butterfly

Like this article? Visit our Options Education Center and Options Trading Blog for more.

Related articles

- Selling Naked Strangles: The Math

- Selling Short Strangles And Straddles - Does It Work?

- Trading An Iron Condor: The Basics

- Low Premium Iron Condors

- Why Iron Condors Are NOT An ATM Machine

- Can You Really Make 10% Per Month With Iron Condors?

- Comparing Iron Condor And Iron Butterfly

- Butterfly Spread Strategy - The Basics

- Iron Condor Vs. Iron Butterfly

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.