Search for "Trading Options for Income", and you will get a bunch of results:

- Learn how to generate consistent stream of income trading options and earn high profits.

- How to Earn Consistent Income Trading Weekly Options.

- Make Money Selling Naked Puts - How I Make An Extra $3k - $5k Per Month In The Stock Market.

- How to Sell Naked Puts for Big Income.

And many more.

So how does it work?

You would implement an options trading strategy where you can get a credit, and your account would be credited with the money you got. Some of those strategies include:

- Iron condor

- Short straddle

- Short strangle

- Iron butterfly

Example

You decided to follow an advice from an options guru who aims to provide you with consistent income of 5% per week. That would translate to 260% per year, not compounded. They would recommend entering weekly credit spreads, getting a credit and allowing them to expire worthless, so you keep the credit.

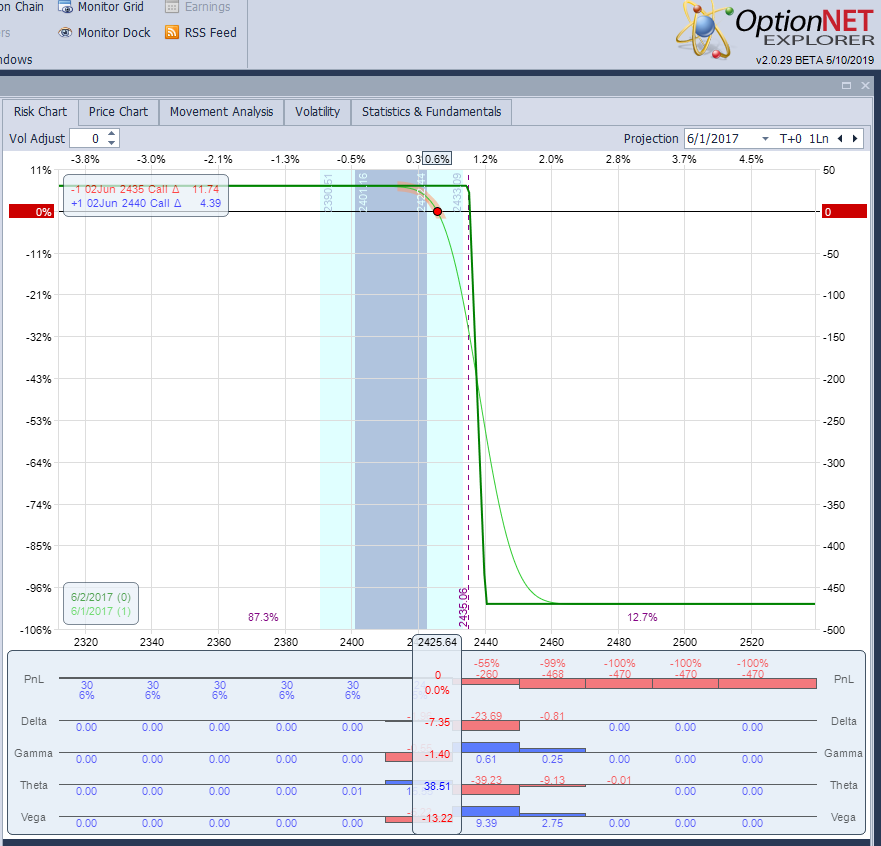

Lets say you follow their advice and enter 2435/2440 call credit spread on June 1, 2017. You get $0.30 credit, and the short calls have delta of 11 which gives the trade 89% probability of success. This is how the P/L chart looked like:

All you need is for SPX to stay below your 2435 short strike for one day - and you keep the whole credit. ~90% of the time, you will achieve that goal.

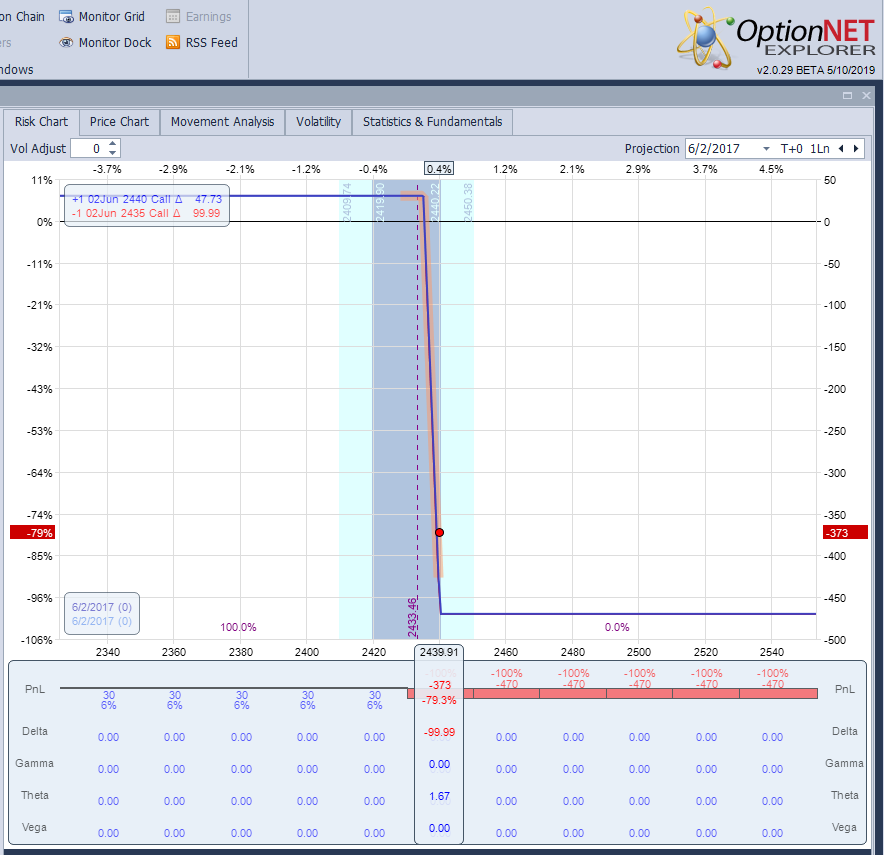

The next day, something "unexpected" happens. SPX rises to 2440, and the trade is losing 80%.

Now you need to buy back the credit spread for the full $5.00, resulting a $470 loss. Congratulations! You just gave back a year worth of previous months "income".

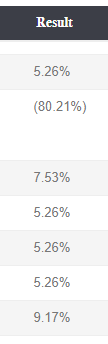

The track record of this "guru" looks something like this:

You might say that this example is a bit extreme, but it was a real trade recommended by a real subscription service. Of course you can select a different expiration or strikes, but the principle remains the same. The fact that your trade resulted a credit doesn't mean that the money will stay in your account. This is NOT an income. If the trade goes against you, you will need to close it for a debit which might be higher than the credit you got. Sometimes MUCH HIGHER. In some cases, one bad month can eat the "income" of a whole year.

Conclusion

As our contributor Mark Wolfinger mentions: "If you trade the options “income” strategies (iron condor, credit spread, naked put, covered call, etc), the credit collected has NOTHING to do with how much loss you should be willing to accept."

But isn't it just semantics? Well, the biggest risk of "trading options for income" is if that income is needed or expected to be used as current income. That is, if it's needed to cover your current expenses. If you start depending on income from "income generating strategies", you must recognize that there will be months that you lose. Not only do losing months eliminate that month's income, many times the losses will be equivalent to having to "pay back" income from previous months.

There's just no way that the Market is so predictable that you can target and achieve a predefined amount of income month in and month out.

Options trading is NOT an income producing strategy. If you want a consistent stream of income, buy dividend stocks, rental properties, bonds etc. When you are trading options (or any other instrument), there will be losing weeks, losing months and sometimes even losing years, no matter how good you are. If you see someone promising you a consistent stream of income from trading or investing, they are probably doing something similar to Bernie Madoff.

Does it mean you should not be selling options for credit? Not at all. Options selling strategies should be part of any well diversified portfolio. Just stop treating it as "income" and start treating it as regular trading, that will have its ups and downs.

Related articles

- 10 Options Trading Myths Debunked

- Do 80% Of Options Expire Worthless?

- Selling Options Premium: Myths Vs. Reality

- The Use And The Abuse Of The Weekly Options

- The Risks Of Weekly Credit Spreads

- Make 10% Per Week With Weeklys?

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.