What is IV Crush?

I liken IV crush to a concert venue two hours after the headliner finishes their set. If it’s not closed, very few people are still in the building. In the hours leading to the concert, more and more people entered the venue at an increasing rate. There’s a decent showing for the openers, more viewers for the co-headliner, and then everyone who has a ticket is in the building by the time the headliner gets on stage.

But as soon as the show ends, the building empties out.

The same thing in option prices in the lead-up to the announcement of an earnings report or other significant catalyst. Traders pay for a ticket (an option) to watch the concert (earnings report). Once the company’s done reporting, they pack up and go home (option prices go back to normal).

Oftentimes, even if a stock misses earnings expectations and the stock declines, IV crush will still occur, which makes little sense. However, you have to understand that uncertainty about the report is one of the primary reasons that IV gets elevated prior to a report, so even a bad report that leads to a price decline still gives investors piece of mind that they know where the company stands.

Implied Volatility

Let’s just get clear on what implied volatility is. IV is the market’s estimation of future volatility determined by market prices. Essentially, using the price of an option, you can reverse engineer what the market is forecasting the expected move to be.

When implied volatility is high that means option traders are paying up for options in the expectation of a large move, like an earnings beat or miss.

A Hypothetical Trade to Demonstrate IV Crush

Imagine we’re trading Netflix (NFLX) earnings. Perhaps they just released their biggest hit show in history, by a long shot. Many analysts and traders alike are betting that Netflix will show huge subscriber growth this quarter. Many of them are buying call options to potentially profit from Netflix stock rising on the good news.

But those speculating on Netflix earnings have to buy their options from someone. On the other side of that trade is usually a market maker, who is just there to provide liquidity and try to make a one tick profit on each trade. The market makers also know about the potential for Netflix to have a blockbuster earnings report, so they start charging more for their call options.

Some skeptical hedge fund managers come out of the fray and begin buying put options on Netflix because they think subscriber growth has peaked, and the talk of a blockbuster quarter is hype from retail traders. The market makers have to start charging more for puts too. The more uncertain they are, the higher a premium they need to take on risk.

Through a less-simplified-version of this process is how the implied volatility of options gets so high prior to an earnings report. Everyone knows stocks make big moves after earnings and there’s no free lunch in financial markets so of course market prices reflect this reality.

Fast forward, Netflix releases their earnings, the numbers are good but not great. The stock hardly moves, and perhaps even slightly declines as the market expected better. That unknown variable of earnings is now known, so there’s no justification for high implied volatility now. Option prices decline and earnings speculators experience losses, often even if they were marginally correct on the trade idea.

IV Crush Example

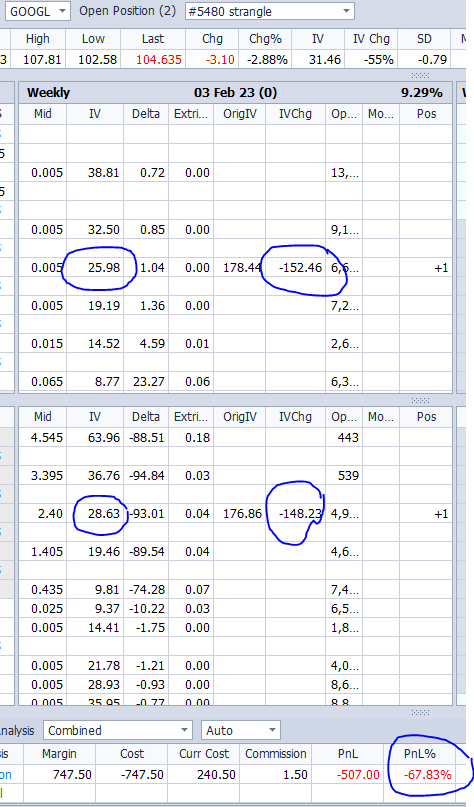

GOOGL was expected to announce earnings on Feb.2 2023. The options market expected 7.4% move (the price of the ATM long straddle. Options IV on Feb.2 was 178%.

You can calculate a stock’s implied move by determining the price of a straddle for the closest expiration after earnings. The straddle is the market’s expectation, or implied move, for the stock. For example, if a stock is trading at $100 the day before its earnings announcement and the combined price of an at-the-money (ATM) call and put is $5, the stock’s expected move is $5 or 5%. If the stock moves less than $5 in either direction after earnings, then the actual move of the stock was less than the implied move.

With GOOGL trading around $107.60 before the close, traders could buy the 107/108 long strangle, betting that the stock will move more than the Implied Move.

Fast forward to the next day - GOOGL moved only 3%, the options IV collapsed 150% and the strangle has lost almost 70%.

Remember: nobody can predict how much the stock will move after earnings. The only certain thing is IV crush.

Profit From IV Crush

It stands to follow that if habitual buyers of earnings volatility consistently lose, then the traders on the other side of their trades should consistently win. To an extent, this is true. But it’s not enough on its own.

If we think about IV crush, it’s the market overreacting to future uncertainty about a catalyst like earnings. They’re scared of volatility and will make a -EV bet (buying an earnings at a high IV) to mitigate that edge. Or maybe they’re just speculating on earnings, which is quite popular post-2020.

These are textbooks markers to a good trade. You have a counterparty that is trading for a reason other than to maximize gains and intentionally making a fundamentally poor trade.

But there’s a caveat to all of this. Earnings (and other events that lead to IV crush) are actual volatility events. Stocks routinely make big gaps on earnings! It’s easy to forget this when you’re in the weeds figuring out how to exploit IV crush--but the IVs are high for a reason, and realized volatility is routinely near or in excess of the IVs.

So, you can profit by taking the other side of the trade (selling options instead of buying them). But this is a very risky strategy because if the stock moves more than expected, you might face significant losses. So it’s not a layup trade. Like nearly any trade, you have to pick your spots tactically.

The bottom line

A volatility crush is an opportunity for traders to take advantage of a pattern of predictable price movement across the options market. When you understand premium rates increasing during a substantial event (like earnings) followed by the decrease in implied volatility, you can make smarter trades, informed positions, and better moves for your overall account.

For any trader, implied volatility (IV) is one of the most important considerations because it has a direct impact on pricing. It’s even more important now as IV spreads have grown significantly wider, and the concept of a “volatility crush” has become an increasingly viable options trading strategy. Implied volatility increases significantly before an earnings announcement and this increase is due to option writers who want to ensure adequate protection of their portfolios from significant price fluctuations in the market.

Like this article? Visit our Options Education Center and Options Trading Blog for more.

Related articles

- How We Trade Straddle Option Strategy

- Exploiting Earnings Associated Rising Volatility

- Buying Premium Prior To Earnings - Does It Work?

- Can We Profit From Volatility Expansion Into Earnings?

- Why We Sell Our Calendars Before Earnings

- Why We Sell Our Straddles Before Earnings

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.