Trade Explanation: For the Volatility Advisory in NFLX, we are selling the Apr 427.5 puts and 520 calls and buy the Apr 425 puts and 522.5 calls for a net credit of $0.91 to open.

Underlying Price: $474.22

Price Action: We are selling this $2.5-wide Iron Condor in the online streaming company for a credit of $0.91. For an Iron Condor trade, we sell an out-of-the-money Call Vertical (520/522.5) and Put Vertical (427.5/425) simultaneously. The company has earnings after the close and the option markets are pricing in a move of 8-9%. We expect the shares to move after the report but are giving ourselves a nice range of $92.5 between the short strikes. We need the shares to continue to trade between our break-even levels of $426.59 on the downside and $520.91 on the upside.

The following was described as a rationale for the trade:

Volatility: Volatility is elevated in the Apr options which makes this trade attractive. The IV percentile rank is elevated at 73% also which also gives us a good opportunity to sell this Iron Condor. We expect volatility to fall sharply after earnings which will contract the value of this short-term neutral position.

Probability: There is an 80% probability that NFLX shares will be below the $520 level and a 80% probability that it will be above the $427.5 level at Apr expiration. This trade offers a good Risk/Reward scenario with the amount of credit collected vs. the probability numbers for this position.

Trade Duration: We have 2 days to Apr expiration in this position. This is a short-term position and time decay will increase quickly due to the time frame and the earnings report.

Logic: We want to take advantage of the increased volatility in our option by initiating this earnings play. Our short verticals are outside of the anticipated one standard deviation move that the options are pricing in so our probabilities are positive. The shares will hopefully remain between our short verticals and we will be aggressive in closing the trade.

My comments:

-

It is true that Volatility is elevated in the Apr options, but this is completely normal, considering the upcoming earnings and does NOT make the trade attractive.

-

It is also true that volatility will fall sharply after earnings, but it is not relevant if the stock will be trading above the long strikes. In this case, the trade will still lose 100%.

-

2 days to Apr expiration makes the trade much more risky because there will be no time to adjust or take any corrective action.

-

"80% probability that NFLX shares will be below the $520 level" means nothing when earnings are involved. The price action will be determined by earnings only, not by options probabilities.

-

"The shares will hopefully remain between our short verticals" - hope is not a strategy.

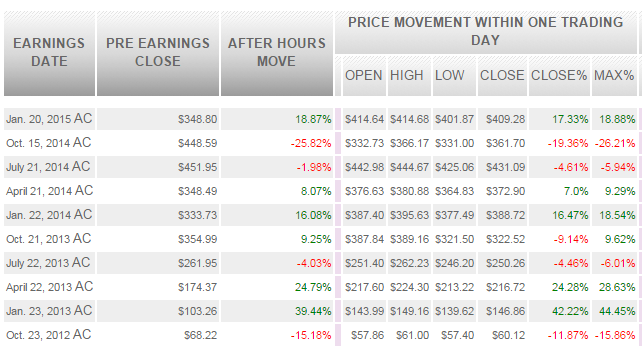

- The short strikes are less than 10% from the stock price, which is not far enough, considering NFLX earnings history.

Now, I want you to take a look at the last 10 cycles of NFLX post-earnings moves:

(This screenshot is taken from OptionSlam.com).

Now, I'm asking you this:

WHO IN HIS RIGHT MIND WOULD TRADE AN IRON CONDOR WITH SHORT STRIKES LESS THAN 10% FROM THE STOCK, ON A STOCK THAT HAS TENDENCY TO MOVE 15-25% AFTER EARNINGS ON A REGULAR BASIS???

The stock is trading above $530 after hours. If it stays this way tomorrow, this trade will be a 100% loser, and there is NOTHING you can do about it. But frankly, the final result doesn't really matter. To me, this trade is simply insane and shows complete lack of basic options understanding.

That said, I'm not completely dismissing trading Iron Condors through earnings. For many stocks, options consistently overestimate the expected move, and for those stocks, this strategy might have an edge (assuming proper position sizing). But NFLX is one of the worst stocks to use for this strategy, considering its earnings history.

Watch the video:

If you want to learn how to trade earnings the right way (we just booked 30% gain in NFLX pre-earnings trade):

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now