.thumb.jpg.c11dd0c1966447e01a4645e5f7cb2d1c.jpg)

This is generally viewed as rational compensation for risk as investors must be enticed with higher expected returns in order to buy smaller companies that are often times in distress. In other words, it’s not a “free lunch,” although there are also behavioral arguments suggesting investors become overly pessimistic about the prospects for value companies and overly optimistic about the prospects for growth companies. When value stocks exceed expectations, and/or growth stocks fail to meet expectations, the value premium emerges.

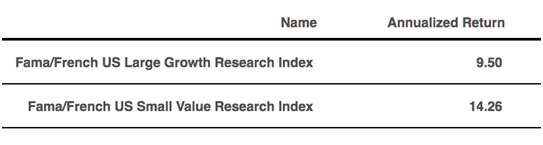

We can observe these relationships in the historical data by reviewing Fama/French and Dimensional Indices. Since 1930, there has been a 4.76% difference in annualized returns.

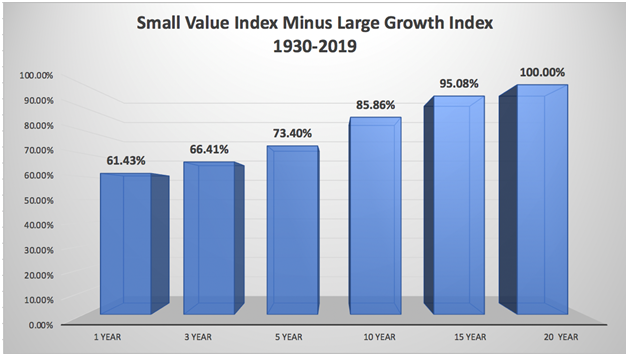

This relationship has also been highly persistent over intermediate and longer-term timeframes. The following chart shows how often the small value index has had higher returns than the large growth index over rolling time periods.

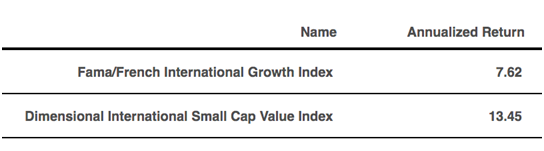

So far, we’ve only looked at US indices, so to give us additional confidence we can also look to historical data in International stock indices with data beginning in 1981.

We see an even larger difference in relative returns with the International index data. This reduces the risk that the spread in returns is random chance in the historical data, along with how the effect has persisted after it was first published by Fama and French in the early 1990’s.

The bar chart with rolling outperformance frequencies showed us that large growth stocks have outperformed small value stocks about a third of the time over 3-year periods. We find this to be the case since 2017, and by an abnormally wide margin.

What you see is not a typo. Since 2017, large growth stocks have beat small value stocks by 26.41% per year. This is the widest margin ever over this timeframe. This massive performance gap has created the largest spreads in valuations in history by many measures, even surpassing the late 90’s technology bubble.

Conclusion

Academic theory and long-term historical data highlights how small value stocks have higher expected returns than large growth stocks. These relationships don’t always materialize over shorter periods of time, such as 3 years, otherwise there would be no risk. Readers who strongly believe in the equity premium should also consider that stocks have underperformed risk-free Treasury Bills more than 20% of the time over 3-year periods, and about 13% of the time over 10 years. Again, risk and return are related and discipline is required.

Since 2017 small value stocks have dramatically underperformed, testing investor discipline, while at the same time creating future opportunity. Spreads in valuation between large growth stocks are at records relative to small value stocks. Since valuations are one of the most reliable indicators of future performance that we have, it may be more likely than usual that small value stocks outperform large growth stocks. When uncertainty is elevated, such as today due to economic pressures from the global pandemic, investors may demand an even larger expected risk premium for small value stocks that are out of favor compared to big glamorous growth companies that are fun to brag to your friends about owning.

So, what should you do? If you currently have little or no exposure to this category of the market, now may be a good time to consider adding it to your portfolio. If you already have greater than market cap weighted exposure like I do, it’s probably a good time to check your portfolio because the spread in recent performance may require you to rebalance back to your target allocation. This would involve trimming large growth exposure and using the proceeds to add to small value. Of course, it’s impossible to predict when things will change, many smart people have been calling for the relative performance bottom in small value stocks for months now, and for this reason you should only consider changing your portfolio if you see the “value” in small value and you’re willing to stick with it for the long run.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles

- Understanding Growth Vs. Value Stocks

- History is a Great Teacher

- The Best Chart I’ve Seen in 2020

- Realistic Expectations: Using History as A Guide

- The Value of Equity Asset Class Diversification

- Total Stock Market Index Funds: A Diversification Illusion?

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now