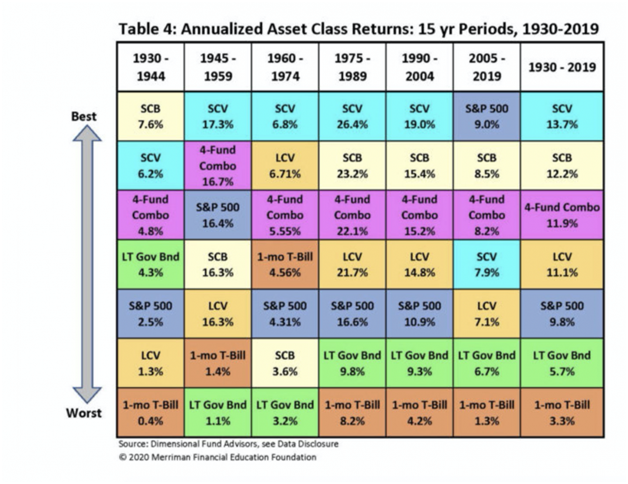

But first, a few definitions:

- “SCB”: Small Cap Blend. This represents an index of US small cap stocks

- “SCV”: Small Cap Value. This represents an index of US small cap value stocks

- “LCV”: Large Cap Value. This represents an index of US large cap value stocks

- “4-Fund Combo”: Equal weight S&P 500, LCV, SCB, and SCV

Academic theory suggests that markets are highly efficient at pricing asset classes so that risk and reward are related. When an asset class has more risk, it should also have a higher expected return. Otherwise why take the risk? Specifically, from lowest risk/reward to highest:

- 1-month T-bills (cash)…lowest risk, lowest expected return

- Long term government bonds

- Large cap stocks (S&P 500)

- Large cap value stocks

- Small cap stocks

- Small cap value stocks…highest risk, highest expected return

We see that the historical data matches the theory over the entire period. But certainly not over every 15-year period, which should be expected…otherwise there wouldn’t be risk if we knew with certainty that holding for 15 years would automatically produce a relative outcome of one asset classes versus another. Therefore, there is no period long enough where we can be certain of any outcome in markets. And for this reason, every investor must consider their own personal ability, willingness, and need to take risk. This is true not only for how much a portfolio should be in stocks vs. bonds, but also how much of that equity allocation should consist of small cap and value stocks. The right portfolio is the one that has the highest probability of meeting your long-term return objectives(one that is well diversified) and is also one that you can stick with.

The diversification of the 4-fund combo never gives you the best outcome, which is a price to pay for also avoiding the worst outcome that you’re more likely concerned about. The period of 1960-1974 stands out, a period of 15 years when the popular S&P 500 index underperformed totally riskless 1-month T-bills (along with SCB & LT Gov Bonds). The 4-fund combo, due to the performance of value stocks, still produced a risk premium over T-bills.

Over the long-term, which is the only period an equity investor should care about, diversification can reduce worst case scenarios. Yet it’s interesting that when I review the portfolios of new clients and prospects, it’s extremely rare to find any allocation at all to small cap value stocks. Whether that portfolio was built with the help of an advisor or not hasn’t seemed to matter, indicating that lack of awareness of the historical data is the likely explanation. I’ve written extensively in other articles about the higher expected returns of small and value stocks, as this has been known for at least 30 years.

The last point I’ll make is that the same chart created with shorter periods, such as 1/5/10 year periods, has much more random outcomes. Again, this would be expected, and it’s why increasing your awareness of the range of potential outcomes over various time periods is one of the best things you can do to have proper expectations. My recent articles on market volatility digs deeper into this topic.

Conclusion

We should all attempt to judge the quality of every decision we make in our lives not solely based upon the after the fact outcome but based on the information we had available at the time of making the decision. With investments, this is especially true as we can only have historical data and academic theory to guide us. The science of investing is not like other forms of science where laws exist creating certainty of cause and effect outcomes. This means we should focus our attention on the things we can control such as diversification, asset allocation, and rebalancing. Once we’ve built our portfolios according to these principles, we can relax knowing that we’ve maximized our probability of having a successful investment experience.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service.

Related articles

- Investment Ideas for Conservative Investors

- Building A Diversified Equity Portfolio?

- Understanding Growth Vs. Value Stocks

- 3 Principles to a Successful Investment Experience

- Financial Planning Lessons From the Pandemic

- Risk Depends On Your Time Horizon

- Buy When You Have the Money, Sell When You Need the Money

- Cash is (no longer) Trash

- What’s Wrong With Your 401(k)? (If anything)

- The Magic of Compounding, and the Tyranny of Taxes

- Coming To Peace With Market Volatility

- Coming To Peace With Market Volatility: Part II

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now