Assumptions:

- $100,000 account.

- Sell SPY 10 delta calls and 10 delta puts.

- Use options expiring in 30 days.

- Base the number of contracts on "notional exposure", not margin.

- Hold till expiration, then open the next trade.

Notional value speaks to how much total value a security theoretically controls. For example, with SPY around $290, that means selling 1 SPY strangle per ~$29,000 of capital.

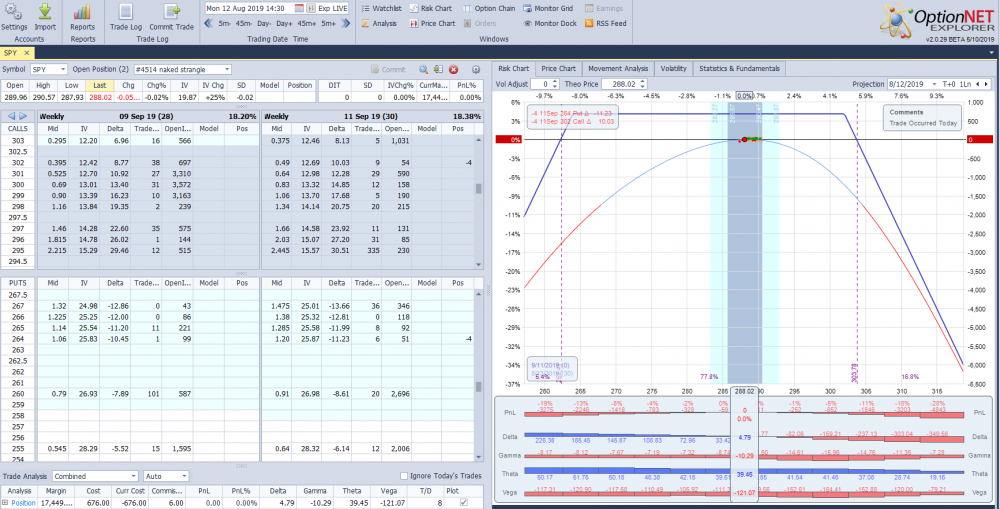

With SPY around $288 on August 12, 2019, we will be selling the following strangle:

- Sell 4 Sep.11 2019 264 put

- Sell 4 Sep.11 2019 302 call

Those strikes are the closest to 10 delta. 4 contracts give us notional exposure of $115,200 ($288*100*4), which means 1.15 leverage. This is fairly conservative exposure.

This is how the P/L chart looks like:

Please note that our total credit is $676 (assuming we can get filled at the midpoint).

Now lets do the math.

If ALL trades expire worthless and we keep all credits, we will collect $676*12=$8,112. This is 8.1% on $100,000 account. But this is the best case scenario. This is probably not going to happen. Based on the deltas of the options, this trade has around 80% probability of winning. Which means that statistically, 2-3 trades per year will be losers.

Now, lets be conservative and assume that 2 trades per year will be losers, and the losing trades will lose the same amount as winners ($676 per trade). In reality, when the markets move against you, even with the best risk management, your losers are usually larger than your winners when you trade a high probability strategy. But again lets be conservative.

Note: The theoretical probability of winning is based on deltas and implied volatility, while the actual win rate is slightly higher because of the volatility risk premium (IV exceeding RV over time). But it doesn't have material impact on the results.

This assumption gives us total P/L of $676*10-$676*2=$5,408. That's total annual return of 5.4%. You can use T-bills as a collateral, which might add 2-4% to the annual return.

In no way this single example can represent the whole strategy, and this calculation might not be very "scientific". Different dates or parameters might provide slightly different results, but this is a ballpark number. We estimate the range to be around 5-7% per annum.

Of course fund managers like Karen Supertrader who use similar strategies realize that those returns probably would not attract too many investors, and also would not get her a spot in tastytrade show. What's their solution to get to the 25-30% annual return they advertise? The answer is: leverage. To get from 5% return to 25%, you need 5x leverage, or 20 contracts.

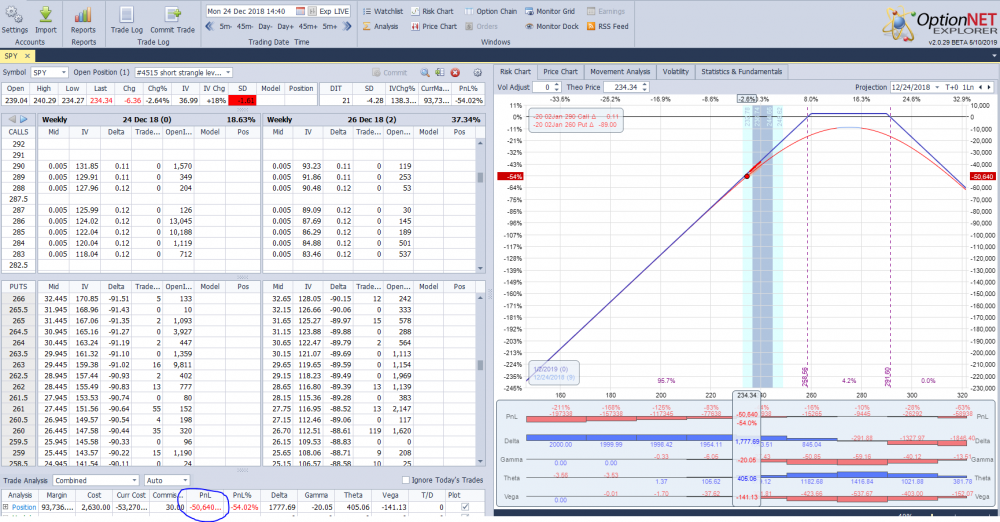

To see how the leveraged trade would perform during market meltdown, lets assume it was initiated on Dec.3, 2018, with SPY at 280. Three weeks later, SPY was around 234, 16% down. This is how the trade would look like:

That's right, the $100k portfolio would be down 50%. This is how you blow up your account.

In this case, the 16% market decline took 3 weeks. What if it was 25% decline happening in one week? You can only imagine the results.

Of course we could change the parameters, use 20 delta options, different time to expiration etc. This would not change the results dramatically. With 20 delta options, you would get more credit, but also higher number of losers per year.

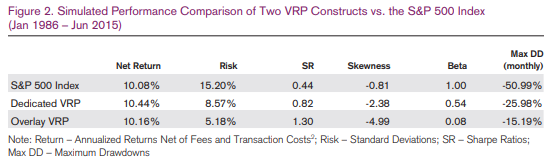

Does it mean the selling naked strangles is a bad strategy? Not necessarily. In fact, according to CBOE Volatility Risk Premium and Financial Distress, 1x notional strangle on SPX has historically returned about the same as SPX with 3x the Sharpe Ratio:

But the strangle itself produced around 6% annualized return, which is pretty close to the performance we calculated. Rest of the return came from the collateral.

The bottom line is: selling naked strangles on indexes is a good strategy if used with a sensible amount of leverage. But you should set your expectations correctly. I suspect that most traders would probably base their position sizing on margin, not notional exposure, which is like driving a Ferrari 190 MPH down a busy street...just because you can. This would increase the return, but also the risk. If you base your position sizing on notional exposure, the risk is pretty low, but so is the potential return.

Naked options by themselves are not necessarily a bad thing. The problem is leverage and position sizing. If implemented correctly, naked options can make money in the long term. But if you overleverage, you just cannot recover from the inevitable big losses. We warned our readers about the dangers of naked options and leverage on several occasions. It's not the strategy that killed Karen Supertrader, James Cordier, Victor Niederhoffer and others. It's the leverage and lack of risk management.

What about selling naked strangles on individual stocks? Personally, I would never do it, especially not before earnings. The risk is just too high. But lets leave something for the next article..

“The problem with experts is that they do not know what they do not know.”

― Nassim Nicholas Taleb.

Related article:

- Do 80% Of Options Expire Worthless?

- Selling Options Premium: Myths Vs. Reality

- Karen The Supertrader: Myth Or Reality?

- Karen Supertrader: Too Good To Be True?

- How Victor Niederhoffer Blew Up - Twice

- The Spectacular Fall Of LJM Preservation And Growth

-

James Cordier: Another Options Selling Firm Goes Bust

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.