This is a critical issue that many traders don't fully understand.

To understand the real risk this lady is taking, I would like you to take a look at Victor Niederhoffer. This guy had one of the best track records in the hedge fund industry, compounding 30% gains for 20 years. Yet, he blew up spectacularly in 1997 and 2007. Not once but twice.

Are you Aware of Black Swan Risk?

This is how Malcolm Gladwell describes what happened in 1997:

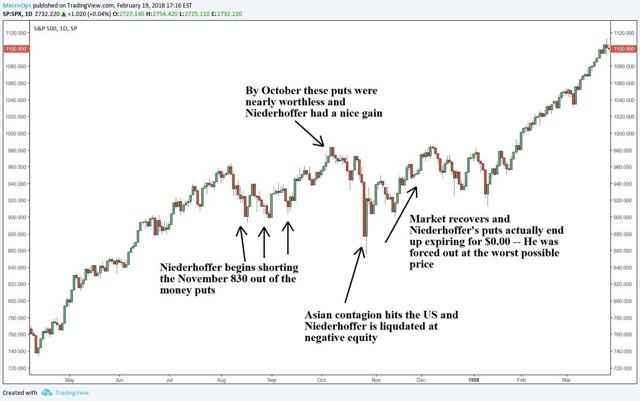

"A year after Nassim Taleb came to visit him, Victor Niederhoffer blew up. He sold a very large number of options on the S. & P. index, taking millions of dollars from other traders in exchange for promising to buy a basket of stocks from them at current prices, if the market ever fell. It was an unhedged bet, or what was called on Wall Street a “naked put,” meaning that he bet everyone on one outcome: he bet in favor of the large probability of making a small amount of money, and against the small probability of losing a large amount of money-and he lost. On October 27, 1997, the market plummeted eight per cent, and all of the many, many people who had bought those options from Niederhoffer came calling all at once, demanding that he buy back their stocks at pre-crash prices. He ran through a hundred and thirty million dollars — his cash reserves, his savings, his other stocks — and when his broker came and asked for still more he didn’t have it. In a day, one of the most successful hedge funds in America was wiped out. Niederhoffer had to shut down his firm. He had to mortgage his house. He had to borrow money from his children. He had to call Sotheby’s and sell his prized silver collection.

A month or so before he blew up, Taleb had dinner with Niederhoffer at a restaurant in Westport, and Niederhoffer told him that he had been selling naked puts. You can imagine the two of them across the table from each other, Niederhoffer explaining that his bet was an acceptable risk, that the odds of the market going down so heavily that he would be wiped out were minuscule, and Taleb listening and shaking his head, and thinking about black swans. “I was depressed when I left him,” Taleb said. “Here is a guy who, whatever he wants to do when he wakes up in the morning, he ends up better than anyone else. Whatever he wakes up in the morning and decides to do, he did better than anyone else. I was talking to my hero . . .” This was the reason Taleb didn’t want to be Niederhoffer when Niederhoffer was at his height — the reason he didn’t want the silver and the house and the tennis matches with George Soros. He could see all too clearly where it all might end up. In his mind’s eye, he could envision Niederhoffer borrowing money from his children, and selling off his silver, and talking in a hollow voice about letting down his friends, and Taleb did not know if he had the strength to live with that possibility. Unlike Niederhoffer, Taleb never thought he was invincible. You couldn’t if you had watched your homeland blow up, and had been the one person in a hundred thousand who gets throat cancer, and so for Taleb there was never any alternative to the painful process of insuring himself against catastrophe.

Last fall, Niederhoffer sold a large number of options, betting that the markets would be quiet, and they were, until out of nowhere two planes crashed into the World Trade Center. “I was exposed. It was nip and tuck.” Niederhoffer shook his head, because there was no way to have anticipated September 11th. “That was a totally unexpected event.”

Well, guess what - unexpected events happen. More often than you can imagine.

The market bottomed right after Niederhoffer was margin called. By November, the market was back near highs. His 830 puts went on to expire worthless - meaning his trade, had he been able to hold on, turned out to be profitable.

But his leverage forced his liquidation. He was oversized and couldn't ride the trade out.

Niederhoffer had shorted so many puts that a run-of-the-mill two-day market selloff sent him out on a stretcher.

If he had sized the trade correctly, he would have survived the ride and took home a small profit. But the guy was playing on tilt, got greedy, maybe a bit arrogant, and lost all of his client's money.

Karen is managing over 300 million dollars now. Her annual returns are in a 25-30% range. Are those good returns, based on the risk she takes?

Not in my opinion. I believe that betting 300 million dollars on naked options is a disaster waiting to happen. I'm sure that most of her investors are not aware of the huge risks she is taking. Niederhoffer's story should be a good lesson, but for most people, it isn't. Unfortunately, people desperately want to believe there is a way to make money with no or little risk.

Personally, I have hard time to understand why Sosnoff is promoting those strategies. But this is a different story.

As a side note, this article is not an attempt to bash tastytrade. It is an attempt to show a different side of the coin and point out some historical cases. If we don't learn from history, we are doomed to repeat it. tastytrade advocates selling premium based on "high IV percentile". They ignore the fact that IV is usually high for a reason. Personally, I consider selling naked options before earnings on a high flying stocks like NFLX, AMZN, ULTA, TSLA etc. as a very high risk trading. tastytrade followers consider those trades safe and conservative. Matter of point of view I guess.

Some tastytrade followers argued that PUT Write index performed better than SPX. And it is true. But those are completely different strategies. The original purpose of PUT Write index (or any naked put strategy) is to buy stock at a discount and reduce risk. As long as you sell the same number of contracts as the number of shares you are willing to own, you should be fine, and in many cases to outperform the underlying stock or index. The problem with Karen Supertrader and Niederhoffer was that they used too much leverage. They sold those naked options just to collect premium. Same is true when you sell strangles before earnings.

Related articles:

- Karen SuperTrader: Myth Or Reality?

- Karen Supertrader: Too Good To Be True?

- Do You Still Believe in Fairy Tales?

- Selling Naked Put Options

- The Spectacular Fall Of LJM Preservation And Growth

- James Cordier: Another Options Selling Firm Goes Bust

June 2016 update: Turns out Karen is under investigation by the SEC. Read the details here and here.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now