Well, every trade should be put in context. Before evaluating a trade (or an options strategy), the following questions should be asked and answered:

- What is the holding period of the strategy?

- What is the maximum risk?

- What is the profit potential?

- What is the average return?

- What is the winning ratio?

Why holding period is important? Well, making 5% in one week is not the same as making 5% in six months. In the first case we are talking about 250% annualized return. In the second case, 10%. See the difference.

Maximum risk is important because it doesn't make sense to aim for 5% gain if your strategy can lose 50-100%. For example, when you are trading a directional strategy, and the stock gaps against you, the losses can be catastrophic. Since the risk is high, you should aim for higher return to compensate for the risk.

However, if your maximum risk is limited, you can aim for lower return and still get excellent overall performance.

Lets examine our pre-earnings straddles as an example.

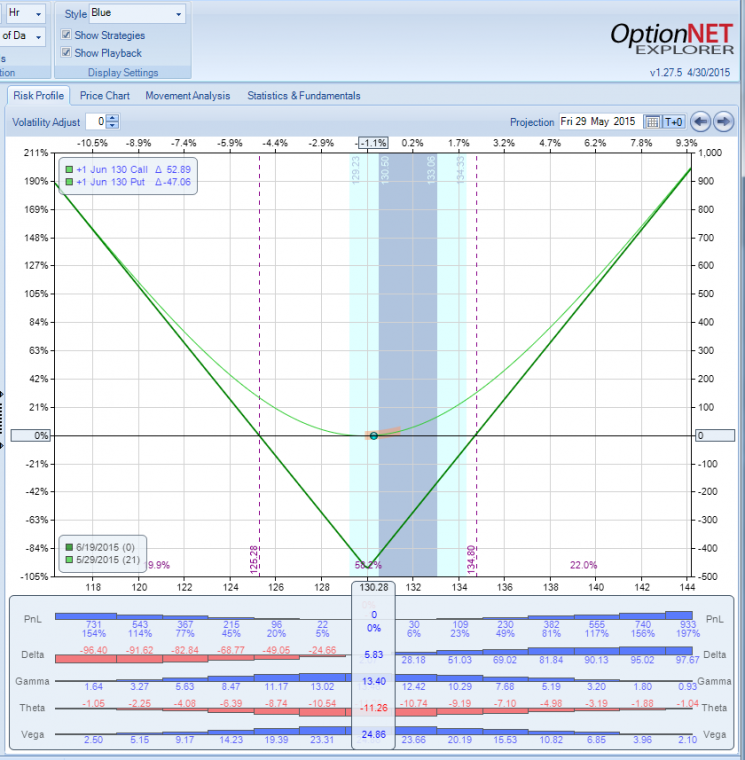

As a reminder, a long straddle option strategy is vega positive, gamma positive and theta negative trade. It works based on the premise that both call and put options have unlimited profit potential but limited loss.

Straddles are a good strategy to pursue if you believe that a stock's price will move significantly, but unsure as to which direction. Another case is if you believe that Implied Volatility of the options will increase - for example, before a significant event like earnings. I explained the latter strategy in my Seeking Alpha article Exploiting Earnings Associated Rising Volatility. IV usually increases sharply a few days before earnings, and the increase should compensate for the negative theta. If the stock moves before earnings, the position can be sold for a profit or rolled to new strikes. This is one of my favorite strategies that we use in our SteadyOptions model portfolio.

This is how the P/L chart looks like:

How We Trade Straddle Option Strategy provides a full explanation of the strategy.

Lets take a look at 2022 statistics for this strategy:

- Number of trades: 148

- Number of winners: 103

- Number of losers: 40

- Winning ratio: 72.5%

- Average return per trade: 4.9%

- Average return per winning trade: 8.7%

- Average return per losing trade: -10.2%

- Average holding period: 7.2 days

Lets do a quick math. If you can do 10 trades per month, each trade producing 5% gain on average and 10% allocation per trade, your monthly return is 5% on the whole portfolio. That's 60% non compounded annual return, with minimal risk.

To answer the original question: for a strategy that has 70%+ winning ratio and loses on average 10% on losing trades, with average holding period of one week, 5% is an EXCELLENT return. In fact, I would consider it as Close to the Holy Grail as You Can Get.

Related Articles:

- How We Trade Straddle Option Strategy

- Buying Premium Prior to Earnings

- Can We Profit From Volatility Expansion into Earnings

- Long Straddle: A Guaranteed Win?

- Why We Sell Our Straddles Before Earnings

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now