.thumb.jpg.b73ee2bea73e184d31c722134c0a9d41.jpg)

The investor then sells a call option over those shares in exchange for collecting a premium.

One call option contract represents 100 shares, so investors can sell multiple call options if they have a particularly large stock holding.

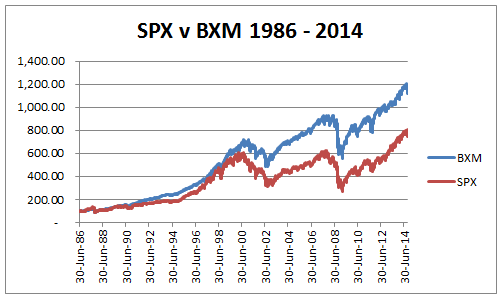

Covered calls have been shown to outperform pure stock ownership over the long term while also decreasing volatility.

Based on data provided by the CBOE, we can see that BXM (CBOE S&P 500 Buy Write Index) has significantly outperformed the S&P 500 over the tracking period of 1986 to 2014.

Covered calls work well on blue chip, low volatile stocks. This way you can generate a tidy sum from selling the call options and also receive a healthy dividend while you own the stock.

Here are two stocks that meet that criteria:

INTC

Intel has had a tough run of it lately with the trade war having a big impact on the stock price. There are still risk ahead for the chip maker but it seems to have put in a short-term bottom for now.

After dropping 27% in April and May, the stock has recovered and is now above a rising 20-day moving average.

Conservative traders may want to wait for a successful retest of the 20-day line before making a trade.

Volatility isn’t as high as it has been recently, but at 25% for a Dow stock, there is some value there for option sellers.

The stock also pays a nice 2.66% dividend so investors can achieve some nice income while they hold the stock.

By combining stock ownership with covered call trading, investors can further boost the income potential from this semiconductor stock.

With the stock currently trading at $47.21, traders could sell an August 21st $49 Call for $1.27.

Such a trade would forego any capital gains above $49, but would increase the income potential by another 15.90% per annum.

MMM

3M Corporation is another stock that’s had a tough run lately.

This Dow component is another stock that dropped around 27% in the April-May period.

Like INTC, the stock has bounced off the low and is holding above a now rising 20-day moving average.

MMM pays a very healthy dividend around 3.37% and is a Dividend King, having raised dividends for more than 50 consecutive years.

Implied volatility is currently around 25%, having been as low as 15% and as high as 35% in the last year.

Traders wanting to increase the yield from their portfolio could sell an August 21st $180 call for $3.85 which would add another 13.1% per annum income potential to the holding.

Join me for a webinar on Saturday, where I’ll be sharing my market analysis and also looking at more trade ideas such as this.

As always, do your own due diligence and trade safe!

Gavin McMaster has a Masters in Applied Finance and Investment. He specializes in income trading using options, is very conservative in his style and believes patience in waiting for the best setups is the key to successful trading. He likes to focus on short volatility strategies. Gavin has written 5 books on options trading, 3 of which were bestsellers. He launched Options Trading IQ in 2010 to teach people how to trade options and eliminate all the Bullsh*t that’s out there. You can follow Gavin on Twitter.

Related Articles:

- Uncovering The Covered Call

- Covered Calls –Does Rolling Forward Mean Higher Risk?

- Leverage With A Poor Man’s Covered Call

- 2 Tweaks To Covered Calls And Naked Calls

- Dangers Of The Covered Call

- Exercise Risk Of Uncovered Calls

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now