Red Flags to Watch

First, here are 10 Red Flags to Watch in an Options Alert Service:

-

The service doesn’t have any losing trades. Or doesn’t have very many. Losing on a trade is a natural part of trading options, and if someone doesn’t have any losing trades, that probably means they’re just hiding them from you. Or it could be that all they’re doing is selling put spreads on the SPX that are far out of the money. Eventually, those kinds of trades will blow up in your face.

-

The service won’t show you their closed trades. If you aren’t allowed to see all of the previous trade alerts that they’ve created, then what are they hiding? The service should stand behind all of their trades, both the winners and the losers.

-

The trades have huge risk. Beware of option trades that sell options naked, which means selling the option by itself which gives the trader huge risk. It may look like easy money, but eventually you’ll get burned very badly doing this.

-

The service inflates their ROI numbers. Profits and losses should be calculated against the risk in the trade—not the per share cost of the trade. Using the cost of the trade to figure the return can dramatically inflate the ROI and show returns that wouldn’t pass even the most rudimentary accounting standards.

-

Uses language like “bull call spread” or “bull put spread.” That language was created by the option trading seminar industry for the purpose of confusing the students and then selling them into the next $3,000 class to clear up the confusion. If the person running your trade alert service uses this language, then he most likely learned to trade from a seminar company rather than from a professional trading firm.

-

In-the-money call spreads. If you’re ever shown a trade that’s buying an in-the-money call spread, then 99% of the time the person showing you that trade doesn’t really understand options. Selling the put spread with the same strikes as the call spread is synthetically the same trade in every respect, but it probably gives you a better entry price.

-

Selling credit spreads gives you your money up front. There’s no opening trade that gives you money up front. When you trade a credit spread, you’re actually reducing your option buying power in just the same way that your option buying power is reduced when you trade a debit spread. Again, this is a sign that your trading service doesn’t really understand how options work.

-

Worried about assignment. If your service ever mentions that being assigned on a short option prior to expiration is a bad thing, run in the other direction. Assignment doesn’t increase your risk or cause you to lose money (other than a commission), but can actually give you more profit. Why doesn’t your trading service understand this?

-

Doesn’t give you a trade plan. Every trade should have a detailed exit plan in place before the trade is entered. That’s just standard operating procedure.

- Only trades a bullish market. The idea that the market goes up over time is false. All companies eventually go out of business, or are bought out. The indexes go up over time because they are manipulated, but individual stocks don’t always go up. Just look at a chart of GM. So if your service can’t trade in sideways or down markets, then they’re really just a one-trick pony that’s going to miss a lot of the opportunity in the market.

Performance

Obviously the first thing most traders are looking at is performance. If you cannot find detailed and clear track record, I would definitely stay away.

But even if you do find a track record, you need to know how to read it. Performance data is useless without also analyzing risk. Risk can be measured by Sharpe Ratio which is (Annualized return - risk free rate / annualized volatility). Higher Sharpe Ratio is better (it means higher return with lower volatility).

Click here to read what is Sharpe Ratio and why you should care about it.

Many services report their performance in a completely wrong and misleading way. Please be careful, especially when you see some fantasy land numbers:

(Hint: this service is calculating performance by adding all trades, which means you would need to allocate 100% to each trade to show similar performance. All it takes is one big loser for your account to become toast).

Here are two examples showing how even the most experienced traders can overlook some important facts when evaluating performance.

Princeton Research Ranking

Princeton Research published a list of Top 5 – Best Stock Options Advisory Services.

SteadyOptions had the honor to be ranked second on their list, as "another brilliant service that helps subscribers trade options with high levels of accuracy, without having to know anything more than the basics. It also provides guidelines on risk and financial management, to ensure that the risks you assume don’t destroy your accounts entirely."

First place on their list belongs to service that "claims to have a 77% win rate on 3425 trades over 15 years".

Their track record is indeed impressive:

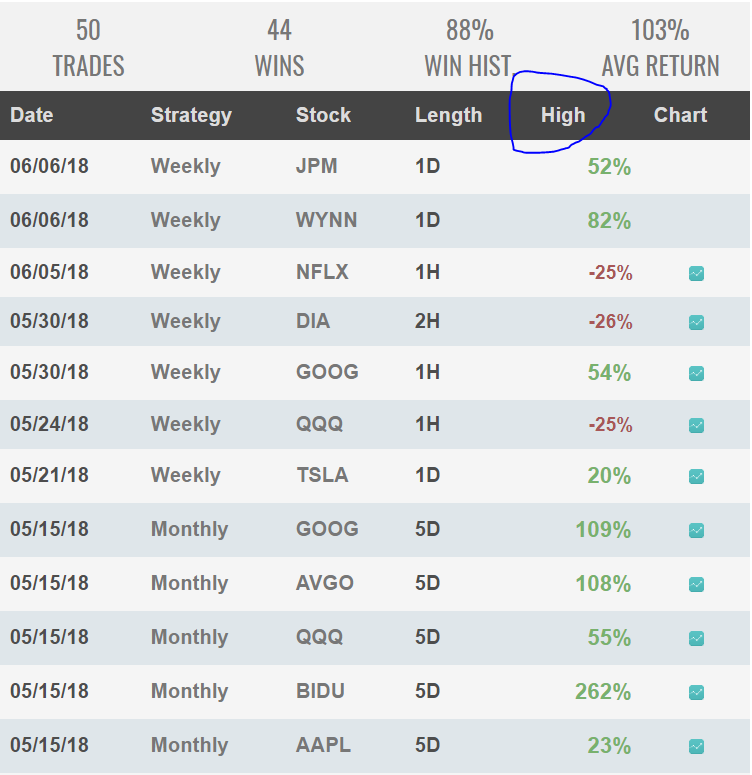

88% winning ratio and 103% average return?? This is beyond impressive.

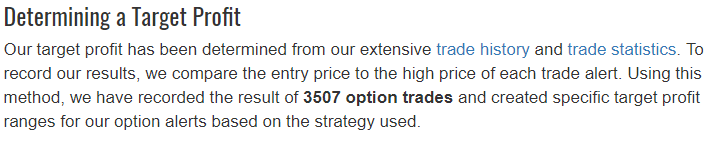

There is only one "small" issue: Those are not real results. You see "High" above the percentage column? The reporting methodology is buried somewhere in the small print:

What it really means is that reported returns are based on the "The highest price the option achieves is recorded as the result since this was historically what the option price reached."

Did you get that? Is anyone really able consistently to sell at the top, or even close?

ToughNickel Rankings

ToughNickel published their research of Best Options Trading Advisory Service.

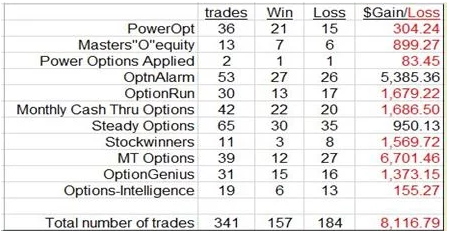

After studying many services they narrowed down the selection to 11 pickers. They then subscribed to the services of these eleven. Shown below are the results of their own trades with these eleven pickers.

"As you can see from the table, except for two pickers, all listed pickers delivered losses. Looking at the numbers, OptionAlarm is the clear winner in the contest with Steady Options coming in second place. Steady Options offers a very conservative and safe trading system but is difficult to follow if you are just following option picks. They require a deep knowledge of the system they use and in most cases leaves it up to the client to decide when and how to enter and exit their selected options."

While we are honored to be among the only two profitable services, there are few things worth mentioning:

First, based on our records, the author of the article was our member for only 3 months. As he mentioned, it takes time to learn our trading system, and members who stick around usually improve their results significantly over time.

Second, it is important to compare apples to apples. The author mentioned that "In order to make the comparisons fair and meaningful I invested the same amount - $1,000 - on each trade." This still doesn't make the comparisons fair. Why? Because the risk is completely different.

Looking at the track record of the first ranker, you can see that around 25% of their trades are 100% losers. In fact, it is not uncommon for them to have five consecutive 100% losers:

Imagine you joined in February 2017 and allocated 10% of your account to each trade. Two months later, your account would lose 50%. While the overall track record is indeed impressive, you just cannot ignore the risk.

Summary

It is important to understand how to evaluate an options advisory service. It is important to understand the strategies they implement and the risks. It is important to understand how they report performance. Some of the questions you should ask:

- Is it based on real trades or hypothetical performance?

- Does it account for position sizing or assumes 100% allocation for each trade?

- Is the P/L calculated based on cash or margin?

And much more.

Related articles:

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now