"Maximum profit potential"

Few days ago one of the options service providers sent a summary of his 2012 performance, bragging about ~42% average return per trade. A quick look on his website reveals how he calculates his returns: "The highest price the option achieves is recorded as the result since this was historically what the option price reached."

Did you get that? Is anyone really able consistently to sell at the top, or even close? Pro-Trading-Options, an independent source which tracks performance of few hundred newsletters, actually stopped tracking this service because they track only profitable services. Turns out that based on real (auto-trading), not hypothetical results, not only the performance was not nowhere near 42% average return, but the service was actually not profitable.

Calculating gains based on cash and not on margin

This is one of the most outrageous frauds. This is how it works:

One of the services makes a lot of risk reversal trades. A risk reversal involves selling a put and using the proceeds to buy a call (or vice versa). The track record includes many 100% losers, but also some ridiculous triple digit returns like 757%, 780% or even 1,150%.You would think that those returns would more than offset the 100% losers.

Out of curiosity, I decided to check how they calculated those returns. The 1,150% trade involved buying a $18 call and selling a $18 put for a net cost of $0.04, and closing the trade for $0.50. 1,150%? Not so fast. What they "forgot" to tell us is that selling naked put involves a margin of ~$450 per spread, so $46 gain is really 10% gain and not 1,150%. No wonder they are able to present "4,344% cumulative return since 2007".

"Cumulative return"

There are a lot of services which make only one trade per month (or per week), yet they present their results as "350% cumulative return since inception". While technically this is correct, does it mean anything? Would you be comfortable placing your whole portfolio (or even half of it) into one weekly Iron Condor?

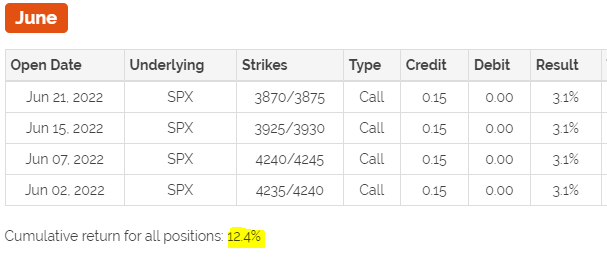

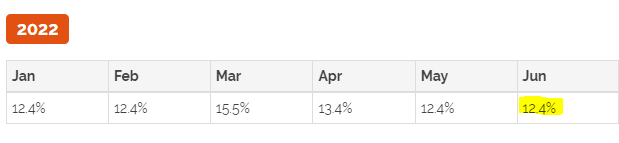

For example, here is a screenshot from one of the services, so you can see how they report returns:

Detailed trades:

Of course most people won't look on detailed trades (they are not easily visible like our trades) so they would think that the service makes 12-15% on a regular basis..

When a newsletter claims a 1,000% return for the year, wouldn't you assume that if you started the year with $10,000 and invested in all the recommendations given on the site, they would now have $100,000? But this is not the case. A lot of services calculate their yearly return by adding together all the individual returns on each trade recommended for the year.

So, for instance, if a website recommended 100 trades for the year and each trade made 10%, they would claim they made 1000% for the year.

The problem is that the returns on trades that overlap cannot be added together. If a service has 5 open positions and each position made 10%, did they make 50%? Of course not, because you could allocate only 20% to each position. So your overall return was 10%, not 50%.

Holding losing positions indefinitely

Many sites claiming unbelievable win ratios hold trades that move against them for many months while new recommendations continue to be given during that time. To you, it really doesn't matter what other trades are recommended during that time or what alleged returns are made because your capital is tied up.

One service that does one trade a month had a losing trade at the beginning of the year that was held the entire year and ultimately closed at the end of the year for a breakeven trade. Yet, during that entire time, new trades were opened each subsequent month. So, they reported a 100% win ratio and a very good return for the year.

The problem is that, realistically, you would not have made a dime since all your capital would have been tied up in the losing trade all year.

Resetting past returns after a large drawdown

One service we know of posts hypothetical results that change each time the service has a bad month. What happens is, when a bad month occurs, they just fix the bad month and post new past performance numbers.

Another service has 10 trading programs. When one of the programs has a large drawdown, they simply close or rename it so new members don't see past results. Needless to say that no track record is posted on the website.

Having too many open trades

Some services claim to have a certain maximum of trades and base the performance on this number. In reality, they open much more trades. There is a service that bases their track record on maximum of 10 open trades and $10,000 portfolio, so members would allocate 10% per trade. In reality, they might have as many as 16-18 trades, with average trade value around $1,400. They have two separate trades in the Open positions section: active trades and "other" open positions. The "other positions are " trades that are still open in the portfolio but are down over 50%. They are on “hold” but are not worth mentioning until they turn around."

Needless to say, most of the time those trades don't turn around and end up being 100% losers. Meanwhile, they tie up the capital, but the service continues opening new trades way beyond the maximum number of 10 positions. In fact, with average value of $1,400 and $10,000 portfolio, they should not open more than 7 trades - in reality, they have double most of the time. This is how they were able to claim 700% return in 2012.

"90% winning ratio"

You will see a lot of services advertising 90% winning ratio. Let me tell you a little secret: some strategies (like selling far OTM credit spreads) have built-in probability of success of 90%. The tradeoff is that the gains are usually very small (3-4%) and you need to hold 3-4 weeks to get that gain. So you win 9 out of 10 trades and lose one time - the big question is how much do you lose on that losing trade. If you made 4% nine times but lost 70% one time, the overall return is negative. Conclusion: winning ratio by itself means nothing. The only thing that matters is the total return.

Annualized return

When used correctly, an annualized return is the average annual return over a period of more than one year.

When used incorrectly, annualized means "we had a good trade so if we continue to make these exact same returns in this same amount of time, we will make X amount by the end of the year."

When someone makes a 10% in one week, they can advertise an annualized return of 500%. To achieve that return, they will have to repeat this 10% return every single week. Does anyone believe this is possible?

How does SteadyOptions present performance?

SteadyOptions does not use any of those dirty tricks. This is how we present our performance:

- The performance numbers are based on real fills, not hypothetical or backtested trades, and definitely not on "profit potential".

- We report returns on the whole portfolio, not on what was on risk.

- We base the model portfolio on 10% allocation per trade which leaves at least 40% of the portfolio in cash.

- All our trades are clearly presented on the performance page.

- We base the returns on the required margin, not on cash.

- We always mention that the returns do not include commissions.

Be aware of those tricks before giving your hard earned money to crooks!

Related Articles:

Why Retail Investors Lose Money In The Stock Market

Are You Ready For The Learning Curve?

Can you double your account every six months?

How to Calculate ROI in Options Trading

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now