Because most option traders live in 15-45 days-to-expiration land, there’s a myriad of factors they have to take into account when considering a trade in LEAPS options which aren’t present in short-term options.

Implied Volatility is Higher in LEAPS

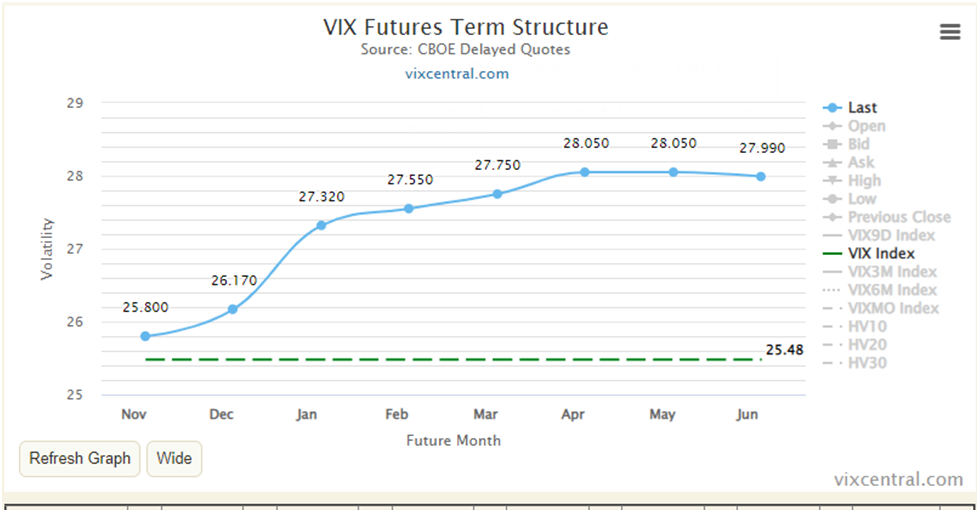

Because of the long time to expiration for LEAPS, they carry higher implied volatility levels. This is intuitive, as in standard times, the VIX term structure is typically in contango, meaning future months get more expensive as you go into the future. Here’s an example of the VIX term structure at the time of writing, which is in contango:

In other words, more can happen in more time. So the price of uncertainty goes up with time and hence the IV on LEAPS is expensive.

Furthermore, there’s less selling pressure in LEAPS from option sellers. Premium sellers tend to pick shorter-dated options (<15 days) so they can quickly recycle their capital quickly. Selling LEAPS ties up your capital for long periods in exchange for a marginal increase in yield. It’s generally a bad trade, at least when it comes to systematic premium selling. They stay out of LEAPS and that keeps the IVs in LEAPS high.

It might be obvious, but the best time to buy LEAPS is when the VIX is below its long-term average, and ideally when the underlying stock has a low IV Rank. The general consensus among academics who study volatility is that it clusters and trends in the short-term and mean-reverts in the long-term.

For this reason, buying LEAPS at a low VIX and IV Rank puts extra wind at your back.

Interest Rates and Dividends Actually Matter

The average options trader lives in 15-45 days-to-expiration land. They seldom need to think hard about how their positions are impacted by the distributions of dividends, or changes in interest rates (Rho).

But when it comes to LEAPS on a stock that pays a dividend, there’s going to be several dividend payments throughout the life of the option, and as we well know, interest rates can change dramatically over the course of 1-3 years.

While these factors are mostly priced into market prices already, future changes in rates or dividends can impact your position in ways you don’t understand if you go into LEAPS blindly.

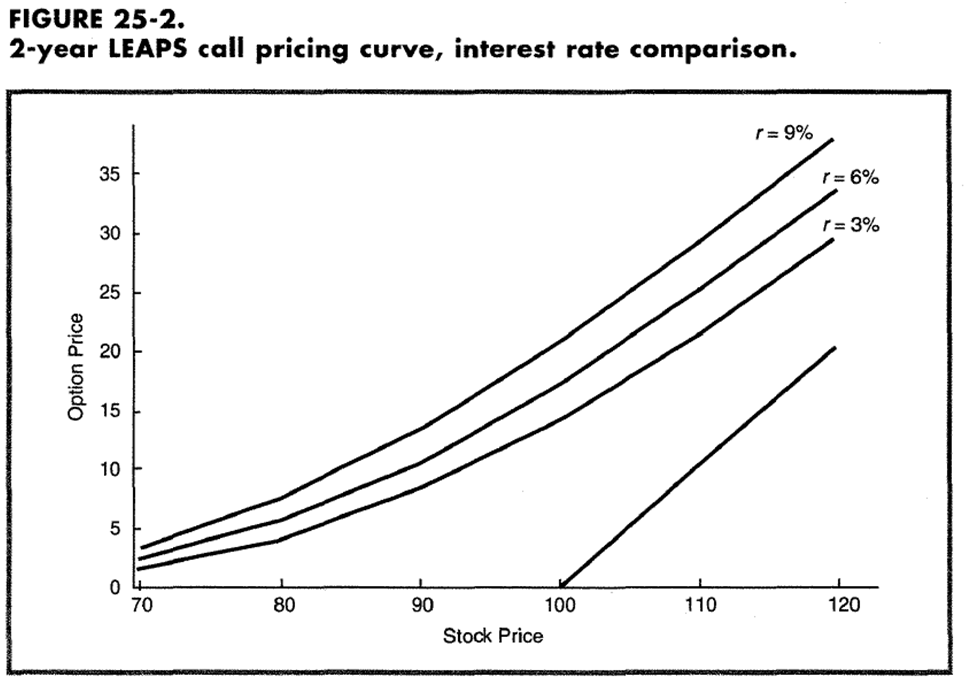

Below is a chart from Lawrence McMillian’s excellent book Options As A Strategic Investment displaying a series of expirations and how their pricing differs with changes in interest rates. Note that the bottom line is value at expiration.

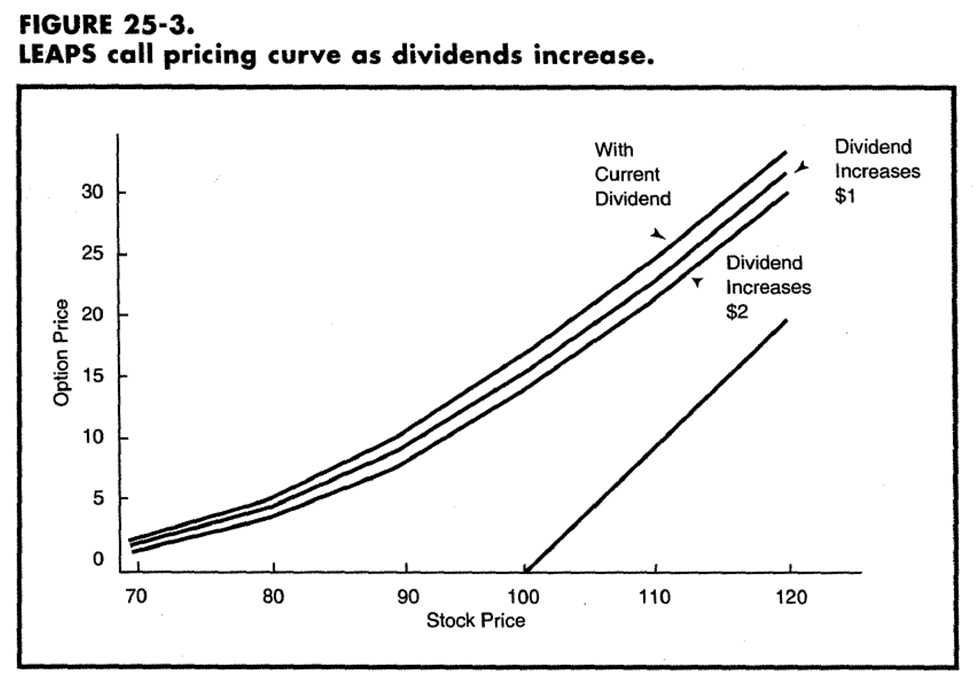

And here’s a chart from the same book displaying how changes in dividends affects call option pricing:

These two factors are of special importance in 2022’s market environment of rising interest rates and energy being the leading sector. Due to a myriad of factors, energy companies often choose to distribute earnings as dividends in lieu of investing in growth as tech companies might. Traders holding LEAPS in energy equities have probably learned a thing or two this year.

LEAPS Have Far Less Liquidity

Besides having less interest from option traders, market makers are generally less active in LEAPS and tend to quote very wide spreads. This can make establishing a position of any reasonable size a pain.

Because option prices have definitive and knowable characteristics allowing you to ascribe a theoretical fair value to them, it’s far easier to get someone to trade with you if you’re will to pay a premium to the theoretical value.

However, as good traders often say, getting into a trade is seldom a problem, getting out when out when you need to is the issue.

How Traders and Investors Use LEAPS?

Position Trades

Many short-term traders who are used to holding their positions in the area of hours or days don’t like to/aren’t experienced at managing a longer-term delta-one position.

Instead, they’ll often use LEAPS to express these longer-term views. Whatever their initial risk (perhaps 1% of their trading equity) would have been on the trade, they’ll use that to buy LEAPS, which they can kind of “set and forget” and not fiddle with stop losses and gap risk.

This has the added benefits of providing leverage to their positions as well as not tying up much of their capital for long periods.

An Alternative to Index Investing

Whatever you think of the Boglehead philosophy of index investing being nearly the only way to invest smartly, they’ve had a pretty good track record for the last few decades when compared to actively managed fund options.

But skeptics of passive investing still have a problem with blind faith in long-term return averages continuing into the future, but don’t want to miss out on potentially amazing yield.

One way to replicate a return profile similar to that of passive index investing is to use LEAPS on index ETFs like SPY by periodically rolling at-the-money calls forward and funding the negative carry with the dividends supplied by a modestly sized high-yield dividend portfolio.

Enhancing Returns of Long-Term Holdings

Many hedge fund managers for whom their largest position is asymmetrically larger than the rest of their positions are presented with a problem. They’re loaded up to full size and then the position declines in value, creating an excellent opportunity to buy more at a great price.

But they don’t have the capital or simply can’t risk more on what is already their largest position.

In this case, they might use LEAPS to increase their upside for a small relative cost.

Betting Against a Short Seller’s Nightmare

Tesla (TSLA) is the perfect example of a stock that many traders desperately want to short exposure to, but the volatility is simply too high. There’s a whole graveyard of long/short managers who got taken to the cleaners shorting Tesla (TSLA).

This is where buying LEAP puts would be a viable alternative. You still get the upside if your thesis is correct

In the situation of Tesla, the bet was binary in nature for many of the company’s skeptics. They’re sure that the company is an eventual zero and if not unless they can find a strategic buyer like Volkswagen before the worst happens. Do note that this isn’t our view, instead, we’re just explaining the thinking of many Tesla shorts.

In a binary situation like the one above, the put premium paid isn’t even of much concern if you expect such a dramatic move to the downside. The only concern is timing, of which LEAPS provides plenty.

There’s a number of stocks in the same camp as Tesla in that the volatility is too difficult to deal with.

Protecting Long-Term Positions

Just as the Tesla bear might opt to use LEAPS calls to express their bearish view in a risk-defined manner, the Tesla bull might, too.

With a stock like Tesla being such a high-risk, high-reward bet, even the bulls are aware of the significant risks to their thesis. For them, the trade is semi-binary in nature as it is for the shorts, at least far more so than buying the S&P 500 is.

This is where they might use out-of-the-money LEAPS to protect their worst case downside while still benefiting from the same upside.

Bottom Line

While LEAPS aren’t very popular among traders due to opportunity cost on capital, they provide an excellent avenue for traders to limit their risk while making long-term leveraged bets. It’s for this reason that LEAPS are frequently overpriced, because there are few natural sellers.

If you dip your toe into LEAPS, make sure you take heed of the differences between LEAPS and short-term options:

-

Lower liquidity

-

Higher IV

- Dividends and interest rates actually have a significant impact on LEAPS positions.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now