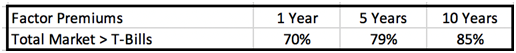

The bad news is that the annualized volatility of the market premium has been almost twice as large as the premium itself at 15%, and therefore has had a wide range of approximately -40% to +50%. Many are not fully aware of the implications volatility has on the probability of a positive outcome over meaningful periods of time. For example, below are the historical frequencies at which the US equity market premium has been positive since 1927:

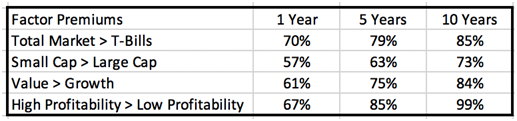

As investors, our goal should be to maximize the odds that our investments meet our long-term financial goals. In order to achieve this objective, we could attempt to time the market premium (get out/in of the equity market when we think it will underperform/outperform T-Bills), but this is so difficult to do consistently that it may be imprudent to try. Alternatively, we can diversify within the equity market by giving greater than market cap weight to stocks with certain characteristics, or factors, that academic research has found to have higher expected returns and diversification benefits. This includes the higher historical average returns of Small Cap stocks vs. Large Cap stocks, Value stocks vs. Growth stocks, and stocks with high relative Profitability vs. stocks with low relative Profitability. Below are the historical frequencies of outperformance since 1926 for each factor. Note that due to data limitations, profitability is measured since 1963. All data is from Dimensional Fund Advisors.

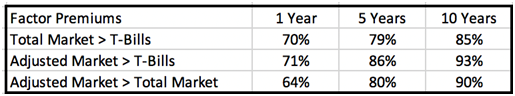

There are many ways investors can use this information. For the purpose of this article I’m focused on how we can use it to build a portfolio with a higher frequency of beating T-Bills than a market portfolio, as well as the frequency of a “factor tilted” portfolio beating a market portfolio. In the below chart, the factor tilted portfolio that gives slightly greater than market weighting to Small Cap, Value, and high relative Profitability stocks is referred to as “Adjusted Market”.

There are mutual funds and ETF’s available that investors could purchase that would provide similar expected returns to what is displayed in this chart. Not only would this factor tilted adjusted US equity portfolio historically have higher than market returns (average premium over T-Bills of 9.95% annually since 1950 vs. 8.37%), the data shows it would have also provided a slightly more consistent premium over 5- and 10-year rolling periods.

Conclusion

Our goal as investors should be to build portfolios that can most reliably meet the required rate of return that it will take to reach our long-term financial goals. In order to know this, a financial plan with clearly described goals is required. We should focus on only taking risks that cannot be easily diversified away, and therefore the market provides compensation for bearing. These risks include the factors mentioned in this article, including the risks of the Market as a whole and of Small Cap and Value stocks. Investors may consider adding greater than market cap weighting to these known sources of expected return for their equity portfolios.This can easily be done today at low costs with certain mutual funds and ETF’s. By simply “tilting” a portfolio to these risk factors, diversification is still maintained across roughly 3,000 stocks that make up the total market. Similar to an investors decision of how much to hold in stocks vs. bonds, an investor must consider how much they include factors in their equity allocation.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady Momentum service, and regularly incorporates options into client portfolios.

Related articles

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.