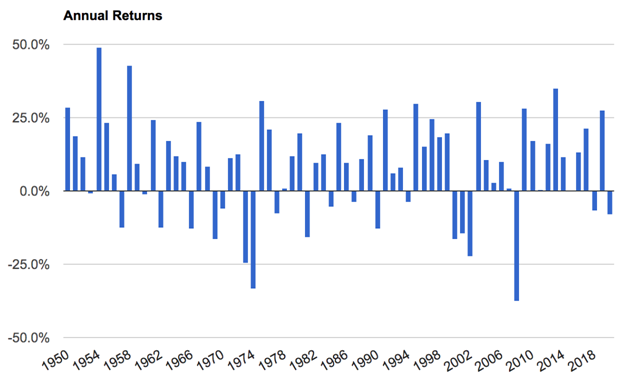

The below chart illustrates the wide range of one-year outcomes. Investors should attempt to truly internalize the emotions they are likely to feel with this type of very normal and expected volatility associated with equity investing. Euphoria when volatility results in above average premiums and despair when volatility results in substantially negative premiums.

There has historically been about one third of all years where the equity premium was negative (the equity market underperformed T-bills), and sometimes by substantial amounts where an investor would have experienced significant short-term capital losses taking several years to recover. Even at a 10-year time horizon, the historical frequency of a market portfolio of US stocks outperforming riskless T-bills has not been guaranteed, with approximately 15% of periods resulting in a negative equity premium. 15% of historical 10-year periods would have resulted in a time of reflection where you realized you took risk for an entire decade without receiving a reward relative to leaving your capital in the safety of T-bills, which are a proxy for cash/money market.

Over time an investment in the total US equity market is expected to provide investors with a return that is many multiples of an investment in risk-free T-bills, otherwise investors would not take on the risk. Diversifying globally further increases these odds, but it’s never a guarantee so investors should come to peace with this uncertainty in order to make better informed investment decisions.

Choice #1: Resist the lessons available within the historical data and endlessly pursue the hope of finding someone or something that can remove the risk of the equity market without also at the same time removing the return.

Choice #2: Come to peace with the historical data, knowing the odds of earning the expected equity premium improve as your time horizon increases, and build a financial plan that accounts for the probabilities.

I believe the second choice is the more likely path towards a long-term successful investment experience as the historical evidence against active portfolio management is overwhelming to the point to where it's imprudent to even try. This is a market-based approach where an investor focuses on what they can control, such as minimizing costs & taxes and thinking through proper asset allocation between stocks, bonds, and cash suitable for their situation. At the same time an informed investor knows how volatile the equity premium can be and is less likely to panic sell when it’s negative for a long period of time. Surprise is often the mother of panic, so it’s best to become a student of history so that you’re not surprised when the risk shows up. Harry Truman said "The only thing new in the world is the history you don’t know.”

In an excellent piece available upon request titled “The Happiness Equation”, Brad Steiman of Dimensional Fund Advisors writes “Ancient wisdom teaches acceptance, as resistance often fuels anxiety. Instead of resisting periods of underperformance, which might cause you to abandon a well-designed investment plan, try to lean into the outcome. Embrace it by considering that if positive premiums were absolutely certain, even over periods of 10 years or longer, you shouldn’t expect those premiums to materialize going forward. Why is this? Because in a well-functioning capital market, competition would drive down expected returns to the levels of other low-risk investments, such as short-term T-Bills. Risk and return are related.”

Would acceptance or resistance better describe your current portfolio and emotional state as an investor? If it’s resistance, what are you going to do to get closer to a state of acceptance to increase your odds of a successful investment experience?

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University.

Related articles:

- Coming To Peace With Market Volatility: Part II

- Should You Care About The Sharpe Ratio?

- Thinking in terms of decades

- The benefits of diversification

- The Importance of Time Horizon When Investing

- How I Invest My Own Money

- Realistic Expectations: Using History as A Guide

- Risk Depends On Your Time Horizon

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now