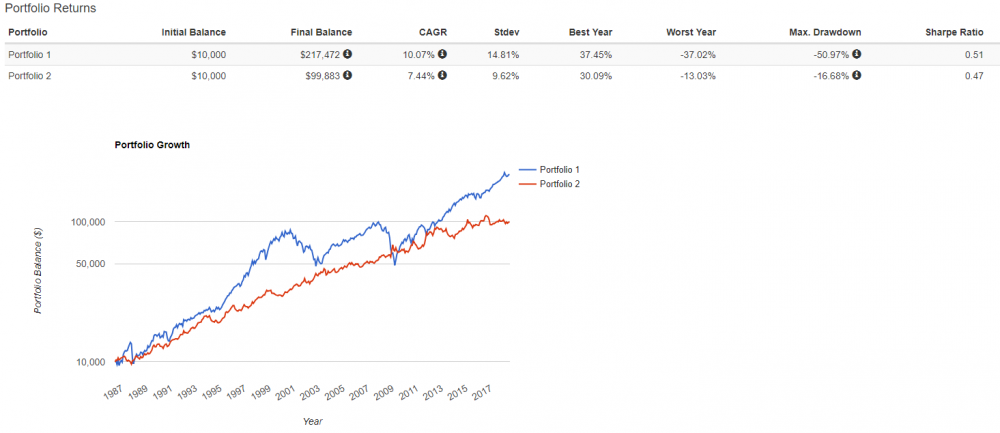

Since June of 1986, they've both carried Sharpe Ratio's of approximately 0.5. Sharpe Ratio measures excess annualized return / annualized volatility. Excess return is the annualized return of the mutual fund minus the risk free return of T-bills.

Portfolio 1 = VFINX

Portfolio 2 = VUSTX

We see that VFINX had a higher return, but also higher volatility. This is what we would expect over a long period of time from relatively efficient markets. And we'd also expect similar Sharpe Ratio's like we see.

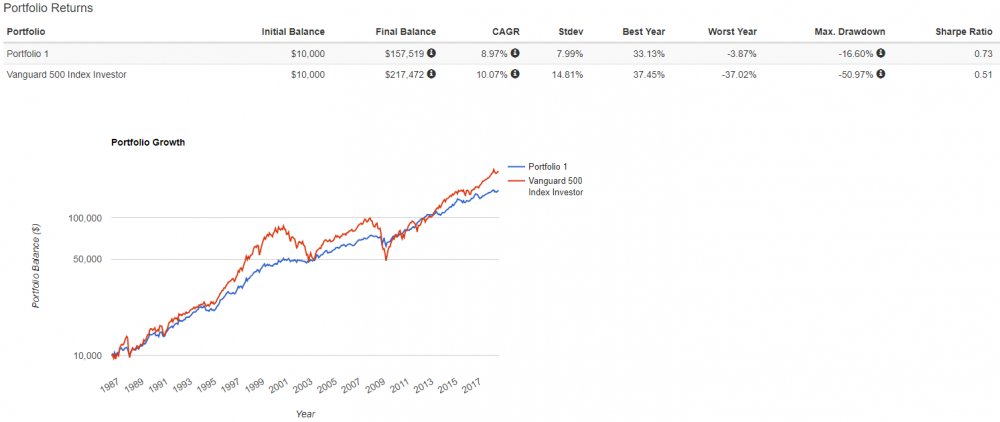

So what's the benefit of diversification? Well, a risk parity portfolio, where both assets contribute about the same amount of volatility, would mean we need about 40% in VFINX, and 60% VUSTX.

Portfolio 1 = 40% VFINX, 60% VUSTX

We immediately see the benefits of diversification where the 40/60 portfolio Sharpe Ratio shoots up to 0.73. That's substantially higher than either mutual fund itself, and even higher than Warren Buffett during this same period where BRK/A produced a Sharpe of 0.64. This means the benefits of diversification are making a portfolio more efficient by offering higher returns per unit of risk.

Are you thinking right now, "yeah, but the return is still less!". That's true, and it's why I often find investors believe that diversification lowers returns. This ignores the ability to use leverage.

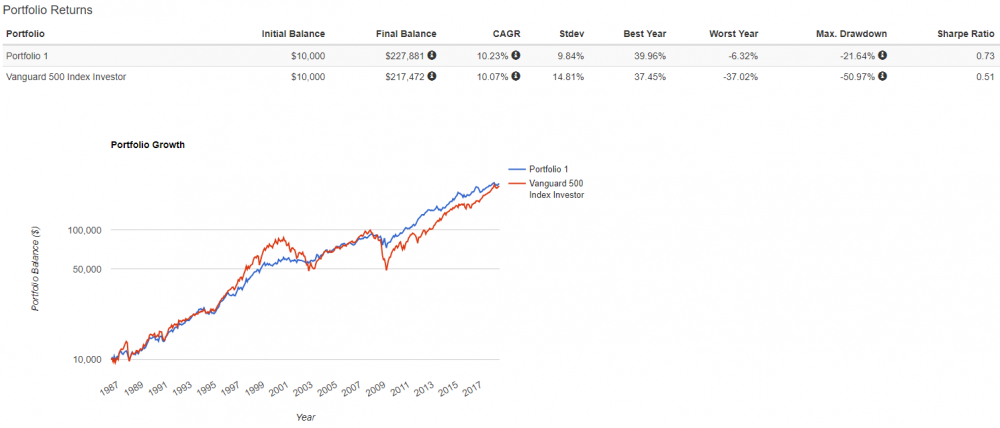

Let's assume in the following examples that we can borrow at the risk free T-bill rate. This is unrealistic, but the futures market does provide implied financing rates relatively close to this over time. With the ability to use leverage, either by borrowing funds directly through a source of financing such as a bank or a margin loan from a broker (i.e., Interactive Brokers), or indirectly through derivatives like futures and options contracts, we are no longer constrained to investing a maximum of 100%. This means we can use the benefits of diversification to either A. produce similar returns with less risk or B. produce higher returns with similar risk.

A. Similar returns (as 100% VFINX) with less risk by investing 25% more in each fund (50% VFINX, 75% VUSTX). Financed at the T-bill rate.

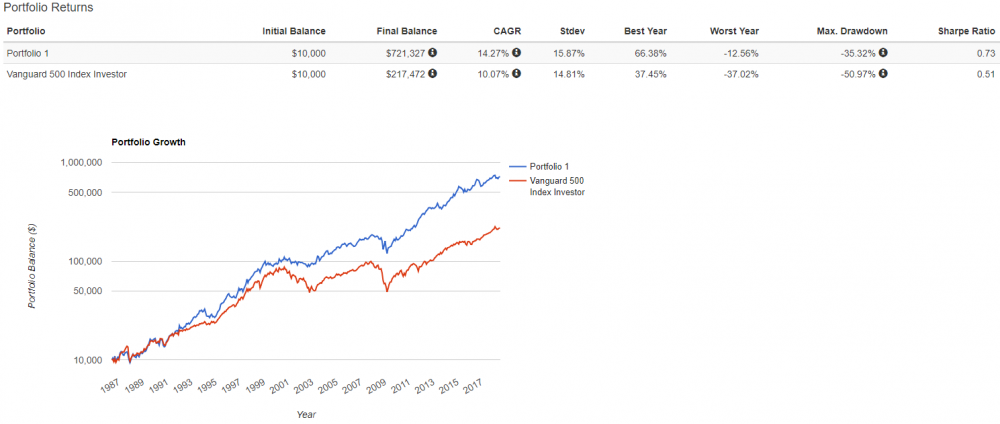

B. Higher returns (than 100% VFINX) with similar risk (defined as "Stdev", or annualized volatility) by investing 100% more in each fund (80% VFINX, 120% VUSTX). Financed at the T-bill rate.

These examples are meant to be just that...examples. Leverage creates risks of its own that investors should be aware of, but I personally like the benefits of using moderate amounts of leverage applied to a diversified portfolio to increase expected returns, vs. the more conventional method of simply investing more in stocks. To each his own. I mentioned that we'd compare the results of our leveraged portfolio to that of Warren Buffett's (via BRK/A). So let's take a moment to do just that...interestingly enough, academic research has concluded that a material amount of Buffett's outperformance was due to just that...leverage...1.6X on average.

"Further, we estimate that Buffett’s leverage is about 1.6-to-1 on average. Buffett’s returns appear to be neither luck nor magic, but, rather, reward for the use of leverage combined with a focus on cheap, safe, quality stocks."

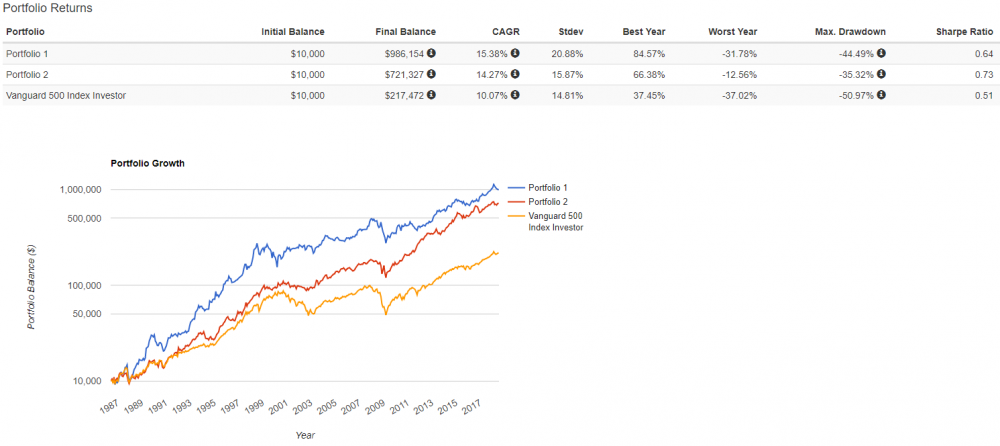

Portfolio 1 =BRK/A

Portfolio 2 =80% VFINX, 120% VUSTX

Our 2x levered portfolio slightly underperformed BRK/A on an absolute return basis, but slightly outperformed on a risk adjusted return basis due to having approximately 30% less volatility.

The risk here for retail investors is when the thought crosses their mind "well, if I can lever up to 200%, why not MORE ![]() ?" Hopefully I don't have to explain the risks of leverage...just because you can drive a Ferrari 200 mph doesn't mean you should! A rule of thumb is that if you model your portfolio annualized volatility to be more than ~20%, you're probably driving too fast and eventually you're going to crash. For this reason, only highly sophisticated and highly disciplined investors with a strong understanding of modern portfolio theory, statistical probabilities, and quantitative finance should attempt to create portfolios like this on their own. There are many variables to consider, and it's never as obvious as it looks.

?" Hopefully I don't have to explain the risks of leverage...just because you can drive a Ferrari 200 mph doesn't mean you should! A rule of thumb is that if you model your portfolio annualized volatility to be more than ~20%, you're probably driving too fast and eventually you're going to crash. For this reason, only highly sophisticated and highly disciplined investors with a strong understanding of modern portfolio theory, statistical probabilities, and quantitative finance should attempt to create portfolios like this on their own. There are many variables to consider, and it's never as obvious as it looks.

"You've got to guess at worst cases; no model will tell you that. My rule of thumb is double the worst you have ever seen" - Cliff Asness, AQR

"Well the single biggest difference between the real world and academia is — this sounds overly scientific — time dilation. I’ll explain what I mean. This is not relativistic time dilation as the only time I move at speeds near light is when there is pizza involved. But to borrow the term, your sense of time does change when you are running real money. Suppose you look at a cumulative return of a strategy with a Sharpe Ratio of 0.7 and see a three year period with poor performance. It does not phase you one drop. You go: “Oh, look, that happened in 1973, but it came back by 1976, and that’s what a 0.7 Sharpe Ratio does.” But living through those periods takes — subjectively, and in wear and tear on your internal organs — many times the actual time it really lasts. If you have a three year period where something doesn’t work, it ages you a decade. You face an immense pressure to change your models, you have bosses and clients who lose faith, and I cannot explain the amount of discipline you need." - Cliff Asness

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse oversees the LC Diversified forum and contributes to the Steady Condors newsletter.

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now