My investment philosophy is built upon harvesting risk premiums with positive expected returns. Examples of risk premiums that meet my personal criteria for inclusion in a portfolio include the equity, size, value, and volatility risk premiums. The volatility premium is the persistent tendency in the options markets for implied volatility to exceed realized volatility. This should not be perceived as market mispricing, but instead, rational compensation for risk to the seller of option contracts.This is similar to how insurance companies are profitable over the long term by collecting more in premiums than paying out in claims and other expenses. Buyers of insurance are willing to lose a relatively small amount of money in the form of recurring premiums in order to transfer the risk of a large loss. Sellers of insurance need a profit incentive in order to take on this risk.

A bullish strangle is a way to gain some exposure to the equity premium with reduced downside risk. Every option strategy includes tradeoffs, and the bullish strangle tradeoff is less upside capture in a rising market…and even potential losses. I’ve used the ORATS Wheel to complete backtests from 2007-current on 3 different equity index ETF’s…SPY, IWM, and EFA. The trading parameters used were:

- DTE: 30

- Short Put Delta: 40

- Short Call Delta: 16

- Exit: 80% of credit received, or 5 DTE, whichever occurs first

- Collateral yield: None

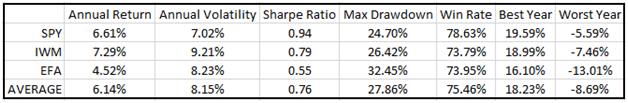

Results:

This is impressive considering that no collateral yield is included. For example, US Treasury Bills are conventionally used as a risk-free form of collateral for option selling, and would have added just under 1% per year to the total returns during this period. Adding some term risk to the equation with 5 Year Treasuries, similar to what we do in Steady PutWrite, would have added almost 4% per year during this period along with diversification benefits that would have increased the overall Sharpe Ratio.

Conclusion

Options are a great addition to a portfolio for the disciplined and well-informed trader/investor. They don’t have to be used as a speculative tool, nor do they have to be used in a high-risk manner. The bullish strangle is potentially a great strategy for an investor with a more guarded outlook on the equity markets or who simply lacks the courage to buy traditional index funds.

Jesse Blom is a licensed investment advisor and Vice President of Lorintine Capital, LP. He provides investment advice to clients all over the United States and around the world. Jesse has been in financial services since 2008 and is a CERTIFIED FINANCIAL PLANNER™ professional. Working with a CFP® professional represents the highest standard of financial planning advice. Jesse has a Bachelor of Science in Finance from Oral Roberts University. Jesse manages the Steady PutWrite service, and regularly incorporates options into client portfolios.

Related articles:

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.