.thumb.jpg.63eaa6c4dc18e4fa1497edc68fcfa3c2.jpg)

Jeff,

I am here to help you understand how options work, but am at a loss as to where to begin. I’ll explain in the simplest possible language. I am not talking down to you. I am trying to get you to move past a mental block.

Facts

- Any time that an option is in the money (ITM) at expiration, expect that its owner will exercise. Even when it’s ITM by one penny.

- The option owner must fill out and submit a DO NOT EXERCISE form to prevent the Options Clearing Corporation from exercising ITM options

Many beginners do not know they have the choice to not exercise

Many beginners forget they own the options or forget that expiration has arrived. As a result, they become owners of stock that they do not want, and cannot afford to purchase

Many beginners make mistakes. Let’s minimize yours.

Call strike price + premium paid = break-even

I’ve placed your equation in bold. It is of vital importance that you understand one thing about that equation:

This equation, all by itself, is the cause of your problem.

Forget it. It has no relevance on whether anyone exercises an option. Your formula is fine for keeping records, after the trade is closed. It is unimportant now. More than that. It is currently causing confusion and limits your ability to recognize the truth.

Q: Using such a formula, does it follow that when the stock price is less than the break-even, then the call would not be exercised? For example, if at expiration the stock was $15.05 and one had purchased the $15 strike for a $0.10 premium, it seems one would not exercise the option.

No, it does not follow. If you ignored your break-even equation, you would never ask this question. You believe the owner of your call option would throw away $5, just because it represents a loss! Look at it from the perspective of someone who owns 100 calls. They are worth $500 to the trader.

You are saying that it ‘seems right’ for trader would throw away $500 because he paid $1,000 for that investment. No one in his right mind would do that.

To clarify: Have you ever sold stock at a loss? Did you consider telling your broker to take the shares out of your account and to give them to some randomly chosen person? Instead of taking current value for your stock, you could have chosen to make them worthless to yourself. Surely you know not to do that. When taking a loss, you recover some money. Your money. This situation is no different.

You must not toss cash in the trash just because the trade is at less than break-even.

If you lost a $10 bill and the next day found a $5 bill, would you refuse to pick it up because your loss was a larger sum? This is exactly the same. You must understand this principle. I don’t know how to make it more clear. Those options are worth $5 apiece and only an idiot would elect not to collect cash for them. [Exercise is a different decision and trust me when I tell you that selling is better for you.] Whoever ends up holding those options will exercise at expiration.

There is a tiny [my guess is less than one chance in 10 million] that an option ITM by five cents would not be exercised by its owner. But, it remains a possibility. People do make mistakes.

Q: Yet I have read that options will be exercised if the stock price exceeds the strike price at expiration [MDW: this is only true for calls; for puts the stock must be below the strike], which it does in my example. It makes me wonder if there are other factors being considered by the call buyer. One rule, which I assume is adopted by the industry, is that all options in the money at expiration by $0.05 or more are automatically exercised, unless otherwise directed. What other factors could cause calls to be exercised below the break-even detailed above?

Yes, automatically exercised. The OCC does not care about break-even. Nor should you. Today the number is ITM by $0.01, not $0.05.

You want to know what other factors would make someone exercise when that exercise (or sale) results in a loss. Here’s the answer: MONEY.

When you invest or trade, it is inevitable that you will have losses. When you have a loss, you do not have to lose every penny. The trader is allowed to sell (or exercise) to recover some money. You probably understand that process. However, when expiration comes into the picture, you ignore what you know because you think about that break-even nonsense. When you fail to exercise (or sell), you allow the option to expire WORTHLESS. Why would you take zero for an option that you can sell for $0.05? Answer that one question (correctly) and you will understand.

How can the original cost matter? That’s your hang-up. That break-even is bothering you. Today, right now, you have a choice. Take $5 or take zero. It’s as simple as that.

Q: Perhaps my question was misunderstood. I discussed selling the call rather than at what stock price a call owner will exercise. I understand and agree with you that it is better to sell your call for any amount rather than let it expire. I also understand what you mean by saying the premium paid is meaningless. Yes, if your plan was to sell the call and not exercise it then the premium paid is meaningless in terms of deciding whether you are going to sell the call or let it expire.[MDW: If you understand that, then why are you asking?]

(However, the premium is not meaningless if you want to determine if your trading strategy is successful as it represents part of your investment.)

I did not misunderstand. The premium is meaningless, as you admit.

You continue to look at useless items. You think record keeping and evaluating your strategy play a role in this discussion. They play no role when it’s time to make a trade decision. They are used after the fact to see how well you did. [If you disagree, and I have no doubt that you do, that discussion is for another time]

Q: Also, I think you misunderstood my example when I said the stock price was $15.05 and I had a call with a $15 strike for which I paid $0.10. This was interpreted as the stock was trading at $15.10. Perhaps the price relationships I used in my example would not exist in the market. I apologize if I improperly set my example.

When you buy the call at ten cents, and eventually exercise, then you buy the stock at the strike price ($15) per share, but your cost basis is $15.10. You did not improperly set your example. Nor did I misunderstand.

Q: Even so, I am encouraged by how you ended your response: “In this scenario you should almost never want to exercise”. This indicates to me that the risk of owning the stock, plus the additional investment required, must produce a greater return than displayed in the example before exercising the call becomes likely (at least for you).

No, not for me. For everyone. You made an investment. You sought a certain return. You did not earn that return. so what? Today is decision time: You take your $5 or you don’t. ‘Return’ no longer applies.

You are confused because you are looking at too many variables

You are concerned with break-even. You are worried about whether your strategy is working. You think about producing ‘a greater return.’ NONE of that matters at the time when the call owner decides what to do with the options: sell, exercise, discard. You either take the $5 or you don’t. It’s that simple. There is nothing else to consider. The fact that you have irrelevant items on your mind is the reason this is a problem.

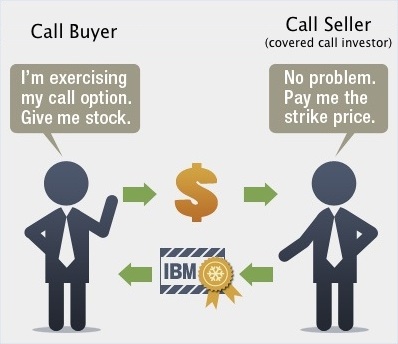

Q: I’m still left not knowing at what stock price / strike price combination calls are usually exercised. [MDW: Of course you know. When the stock is at least one penny in the money options are exercised.] I suppose as a buyer it would be when the stock price is greater than the strike price plus the premium. [MDW: NO]As a covered call seller it probably would be best to assume it would be when the stock price exceeds the strike price.[MDW: YES] Although this is not technically correct since a call’s price must be greater than zero to be sold, it’s probably good enough.

Calls are always exercised when they are in the money at expiration. Period.

There may be the occasional individual investor who correctly (for his/her situation) decides that exercising is too expensive because of commissions (and there were no bids when he/she tried to sell the call), but in general, all ITM options are exercised. That is all you or anyone needs to know.

Over the years, if (and only if) you can overcome your mental block, you may not be assigned a couple of times when the option is ITM by a penny or two. Just don’t expect it to happen.

Q: I appreciate your efforts to help me with my question. I’m sure when my covered calls expire next week I will have an even better understanding that can only come from experience. Thanks again.

You are welcome. However, your entire conversation was from the point of view of the call owner. As the call seller you will learn zero about the mindset of the call owner. ZERO.

You must open your mind, throw out your misconceptions, and the truth will be right there in front of you. This is not difficult. This is the easy part. If you cannot understand this, there is no chance you can ever learn to use options effectively.

Mark Wolfinger has been in the options business since 1977, when he began his career as a floor trader at the Chicago Board Options Exchange (CBOE). Since leaving the Exchange, Mark has been giving trading seminars as well as providing individual mentoring via telephone, email and his premium Options For Rookies blog. Mark has published four books about options. His Options For Rookies book is a classic primer and a must read for every options trader. Mark holds a BS from Brooklyn College and a PhD in chemistry from Northwestern University.

If you liked this article, visit our Options Trading Blog for more educational articles about options trading.

Related articles:

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.