Think Like a (Professional) Gambler

A good, winning poker player is one of the best models for a trader to imitate.

Half of the battle for a poker player begins before the hand is even dealt. They avoid negative expected value propositions by only playing high-probability starting hands when they’re “in position,” or last to act in the hand.

Poker players understand that while they can meticulously calculate the probabilities of any given situation and memorize all of the essential math of the game, sometimes your opponents get lucky.

Even the best players in the world frequently lose to far worse players because ultimately, they can’t control which hands come out of the deck. They’re trying to exercise a probabilistic edge over a huge number of hands, not ensuring they win every time.

A great way to intuitively grasp this is to watch the video where YouTuber MrBeast, a recreational player, won $400,000 playing poker against professionals.

As a result of this randomness and variance they have to deal with, professionals manage their bankroll conservatively. They’ve done the calculations and know that even if you do everything correctly, you can still have several losing sessions in a row. So they play in stakes where they can manage that sort of losing streak without going broke. Even if they have $1 million, they’re never buying into a game with a $1 million buy-in, as there’s a strong chance they’ll lose it all even if they play well.

Professional poker players understand that every single decision they make within a hand has some sort of probability distribution attached to it. Their long-term winnings are simply a stack of these probability-weighted decisions. If most of these decisions were positive expected value, they make a profit. So they continually study and get better at the game to improve their decision making and hence, profit.

Don’t Just Pay Lip Service to Managing Risk

Trading books for novices pay lip service to risk management and randomness. But they’re too rigid and stick to basic rules like “never risk more than 10% of your account on a trade.”

Great start, but going slightly more granular to get acquainted with concepts like risk of ruin and Kelly betting will give you a far better understanding of the distribution of likely outcomes for your trading account.

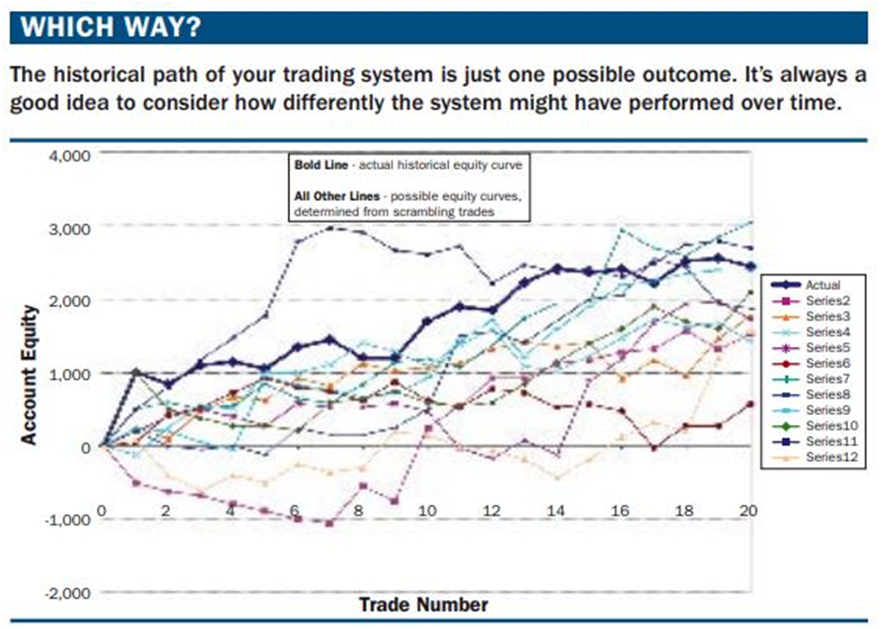

Consider the chart below, which shows the same series of 20 trades scrambled in different orders. Sure, it’s a small sample size, but imagine if the gods of probability gave you the equity curve in red towards the bottom of the chart, which features seven losing trades in a row.

While trading literature pays lip service to the idea that you’ll go on winning and losing streaks that will ultimately average out to your long-term expected value, there’s a difference between doing the work yourself and seeing it in simulations, and reading it in a book or article.

Much of this work just serves to dispose of the notion that markets at all operate deterministically, and instead give you an intuitive grasp for how random they can be.

Understand The Basic, Well-Known Edges

The vast majority of trading strategies aim to exploit one of forces present in markets, those are:

-

Momentum: the tendency for big price moves to continue in the same direction

- Mean reversion: the tendency for big price moves to reverse in the opposite direction

The popular trading and investing strategies they write books about almost all fall into one of these two categories. Value investing--buying cheap beaten down companies is mean reversion. Investing in disruptive growth stocks is momentum. Passively investing in index funds is momentum. Using moving average crossovers is momentum. Using RSI to identify oversold levels is mean reversion. We can go on and on, but you should get the point.

Within these two styles of trading, there are several trading strategies with well-accepted positive return profiles detailed in academic literature. Chances are, the strategy you think is new and unique is already out there and published about.

If your special sauce is special rules for trading or investing, there’s nothing proprietary to what you do. The edge in being a discretionary trader is using the well-established sources of returns and identifying underappreciated methods of applying them, executing well, and perhaps having some good intuition and tape reading abilities.

Going deeply into each of these sources of returns is beyond the scope of this article, but we’ll provide a short list for you to continue your own research if you’re interested.

Mean reversion:

-

Pairs trading: trading the divergences between two closely related securities (Coke and Pepsi is the classic example)

-

Relative value: similar to pairs trading, where you find two similar securities and buy the undervalued one and short the overvalued one. Many hedge funds do this in the credit space, where two bonds are basically the same risk but have different interest rates.

-

Share class arbitrage: some stocks issue multiple classes of stock which all trade on exchanges. Sometimes, the pricing of these get out of whack and it presents an opportunity to sell the expensive class and buy the cheaper class.

-

Volatility arbitrage: like relative value, but for options. Two similar options that should be pierced near identically, but have a considerable divergence in pricing.

- Shorting pump and dumps and parabolic micro-cap stocks: almost everyday there are small stocks that day traders pump up 50%+ for little reason. This provides an opportunity to short them for a huge, albeit highly risky return.

Momentum:

-

Classic futures trend following: many of the famous traders in the Market Wizards books got rich buying the futures contracts going up the most and holding them until they broke below some sort of trendline or moving average. The 1980s were the heyday for trading but there’s plenty of hedge funds and CTAs still applying basically the same strategy.

-

Post-earnings announcement drift: academics figured out that investors systematically underreact to positive earnings surprises which creates intermediate-term trends in earnings winners.

- Cross-sectional momentum: this involves ranking stocks based on their momentum (often some combination of returns and slope of ascent) and buying the top-ranked stocks and shorting the worst-ranked stocks. It’s kind of like relative value but for momentum traders

Nobody is recommending you go and trade these strategies “out of the box,” but understanding what drives their return profiles dramatically improves your understanding of how markets work, and what type of trading the market rewards.

Many traders have their own hybrid style where they stack several of these edges combined with their own tape reading abilities.

Understand Basic Correlations

In today’s highly passive market environment, understanding how the movement of stocks is interrelated is more important than ever.

When the S&P 500 goes up, the majority of stocks go up and vice versa. The correlation gets stronger as you get down into sector, industry, and sub-industry pairs. Visa and MasterCard, or Coke and Pepsi are highly correlated and likely to move together.

It can get far deeper too. Some stocks are highly sensitive to the movement of the US dollar, others to the price of oil or interest rates. Some obsessive quants attempt to quantify every factor affecting the price of a stock and make it an engineering problem.

The point isn’t that you need to understand the global economy on such a micro level that you become this guy:

https://www.youtube.com/watch?v=kxh2X6NjuhY

However, it's to understand that stocks generally follow the movement of the broad market and their sector. For a stock to break that correlation in the short-term, it needs a significant catalyst.

So often when you’re trading a setup in a stock, you’re simply trading a higher or lower version of the stock market or the stock’s broad sector. Or you’ll see a setup in say, Capital One (COF), but the underlying move was driven by a great earnings report in Discover (DFS).

With this basic understanding, it allows you to structure your trades better.

Buying Outright Options Is Often a Bad Trade (For Beginners)

Beginners typically get into trading to make thematic trades. Cannabis is becoming far more socially accepted in the US and looks to be on the cusp for federal legalization in the next decade. So novices think they can’t lose buying cannabis stocks. It’s after a loss in trades like these that they learn about the market’s discounting mechanism and how the stock price isn’t important, but the valuation.

But the same is true for the options market. Novices get drawn in by the hot media frenzy of the day like GameStop or AMC and buy calls. They’re often right on the direction and befuddled when they actually lose money on the trade. It’s here where many quit, calling the market a scam, but those that stick around learn about the basics of option pricing, and that it’s not just the strike price that’s important, but the implied volatility they’re paying for when buying options.

Unfortunately, most get drawn in at precisely the wrong time, when the frenzy is at a fever pitch, implied volatility is sky high from retail call buying, and there are few left buying to support current prices.

Understand How Scalability Relates to Returns

In general, the more scalable a trading strategy is, the smaller its potential returns. There are certainly strategies out there which you can make 100%+ a year if you’re really skilled, but not with any scalability.

To understand why, imagine the guy trading the above strategy went to Jeff Bezos and told him “we can probably double your money each. I want 20% of the upside.” If we compounded Bezos’ $139B net worth just five years forward, his net worth would exceed the GDP of the United States by year five.

The reverse is also true. Typically, the less scalable a strategy, the higher its potential returns. If you find an arbitrage that only works in stocks that trade less than $100K in volume per day, you’ll be too big for that market pretty soon and now you can’t do your trade. Plus, your trading has an effect on the market and you’d likely end up closing the arbitrage with your own trading activity.

As a new trader, this is an advantage. While the largest and most liquid markets like the S&P 500 have low transaction costs and trade cleanly, it never hurts to explore areas where only people with your account size can afford to explore.

This is one of the most underrated advantages that undercapitalized traders have. Warren Buffett is famous for saying that if he restarted with a small amount of capital, he’s confident he could deliver 50%+ returns by investing in smaller opportunities.

Selling Options Is Not Always “Being the House”

Promoters love selling the idea that selling options is similar to being the house at a casino. Because most options expire worthless, so the thinking goes, an option seller should win most of their trades.

But this angle reeks of truthiness. In reality, according to the CBOE, only 30-35% of options expire worthless.

Without a doubt, there’s an edge to selling premium if applied correctly. Benefiting from time decay and the fact that options volatility is frequently overpriced is great, but it doesn't mean that blindly selling options is likely to bring you riches. Far from it.

A premium seller, at the core, is a mean reversion trader. They’re identifying that volatility has gotten too high in a certain option series and fading it, hoping to trade it back to fair value. The real edge is in identifying those dislocations, where someone was forced to pay too much for protection, or when the market is overestimating the impact of an upcoming catalyst.

And these aren’t trivial problems to solve. The reason selling options can be a great strategy is that the market can often overvalue insurance. Much of the institutional demand has historically been long options but selling puts became a crowded trade among hedge funds in recent years, making this “volatility is overstated” phenomenon less systemic. As always, picking your spots is paramount.

There are no comments to display.

Join the conversation

You can post now and register later. If you have an account, sign in now to post with your account.

Note: Your post will require moderator approval before it will be visible.