Now lets go back to the article and to the forecasts in general.

Mark Hulbert tells us about a forecast from Sam Eisenstadt, "who has more successfully called stocks’ direction in recent years than anyone I can think of". He argues that "His previous six-month forecast, for example, was that the S&P 500 by the end of March (this past Tuesday) would be between 2,160 and 2,200 — representing an increase of at least 9.5% over where it stood at the end of last year’s third quarter. As fate would have it, the S&P 500 rose “only” 4.8% over that six-month period. In the inexact world of stock-market predictions, it must be considered a success when a forecasted six-month return is off by just 4.7 percentage points."

Well, Mark Hulbert calls it "off by just 4.7 percentage points." I call it "off by 50%". Matter of perspective I guess. ![]()

Don't get me wrong, I don't know Sam Eisenstadt and have nothing personal against him. I'm just trying to make a point regarding the whole forecast industry.

To see how reliable market forecasts are, lets take a look at http://www.cxoadvisory.com/gurus/. Those guys asked a simple question:

Can equity market experts, whether self-proclaimed or endorsed by others (such as publications), reliably provide stock market timing guidance? Do some experts clearly show better market timing intuition than others?

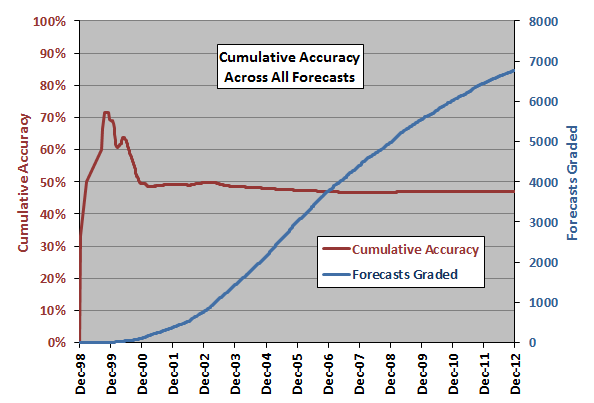

To answer that question, during 2005 through 2012 they collected 6,582 forecasts for the U.S. stock market offered publicly by 68 experts, bulls and bears employing technical, fundamental and sentiment indicators.

Are you ready for the answer?

Terminal accuracy is 46.9%, an aggregate value very steady since the end of 2006.

Did you get it? The average accuracy of the investment gurus is worse than a coin toss!!!

As an example, Bob Prechter from ElliottWave made himself a pretty good name by correctly forecasting the 2008 market crash. What most people don't remember is the fact that Prechter's newsletter had been almost uninterruptedly bearish for the nearly two decades prior to 2008 -- and, as a result, according to the Hulbert Financial Digest, was near the bottom of the rankings for market timing performance over those two decades. A bearish stopped clock even gets to be right occasionally. cxoadvisory's research confirms this - Robert Prechter was ranked the last out of 68 gurus, with only 20.8% accuracy.

The bottom line is that it might be very dangerous to rely on any market forecasts for your investment decisions.

Related articles:

- Can you double your account every six months?

- Can You Really Turn $12,415 Into $4M?

- Performance Reporting: The Myths and The Reality

- Why Retail Investors Lose Money In The Stock Market

- SchoolofTrade: Another Guru Busted

- Are You EMOTIONALLY Ready To Lose?

- Do You Need A Lawyer? I Don't.

- 10 Signs Of A Fake Guru

- 3 Words You Won't Hear On CNBC

- Debunking Options Guru Advice

Subscribe to SteadyOptions now and experience the full power of options trading at your fingertips. Click the button below to get started!

Join SteadyOptions Now!

There are no comments to display.

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account. It's easy and free!

Register a new account

Sign in

Already have an account? Sign in here.

Sign In Now